As an analyst with over two decades of experience in financial markets under my belt, I’ve seen my fair share of bull runs and bear markets. The surge we’re witnessing in Bitcoin right now is truly remarkable, especially when compared to traditional safe havens like gold. To see one Bitcoin equivalent to approximately 39 troy ounces of gold is a sight I never thought I’d behold during my career.

The recent increase in Bitcoin‘s value has significantly boosted its buying potential compared to gold. Currently, one Bitcoin is worth roughly 39 troy ounces of gold, which represents a record high.

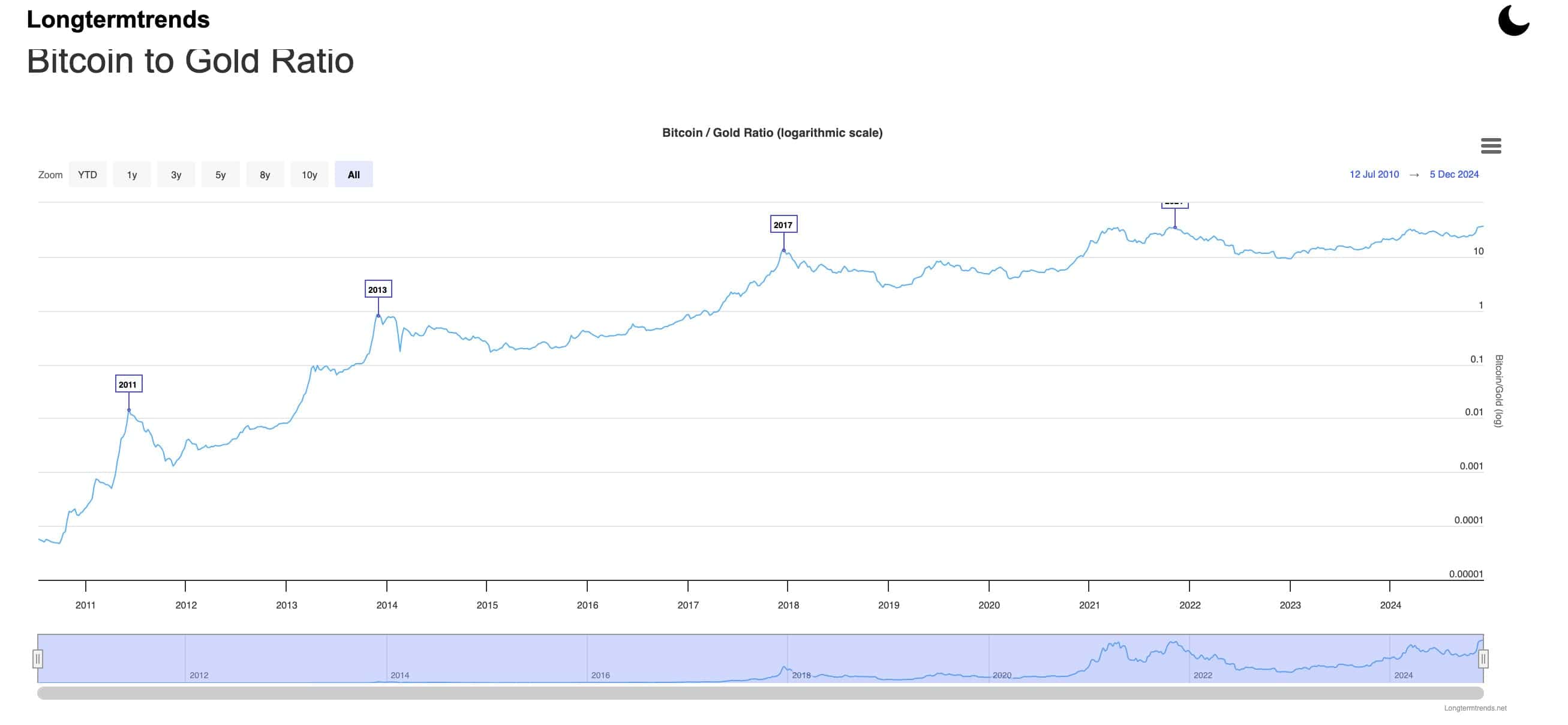

The graph you see shows the comparison between the number of ounces of gold needed to buy one Bitcoin. An increasing value in this ratio suggests that Bitcoin is performing better than gold, while a decreasing ratio implies the opposite. The graph uses a logarithmic scale on the y-axis to clearly show the significant price growth of Bitcoin over time.

Bitcoin, first introduced in 2009 by an anonymous creator known as Satoshi Nakamoto, brought a groundbreaking concept to the table: a decentralized, peer-to-peer digital payment system. Unlike conventional currencies that require intermediaries, Bitcoin operates independently. Similar to gold, the total supply of Bitcoin is capped at 21 million coins, with no more ever being created after approximately 2140. This cap is built into its code. Regular “halving” events occur every few years, reducing the rate at which new Bitcoins are issued by half, thereby maintaining scarcity and ensuring that all coins will be mined by around 2140. Miners, who maintain the network and verify transactions by solving complex mathematical puzzles, are incentivized by receiving Bitcoin rewards for their efforts.

In terms of investment options, Bitcoin and gold are frequently compared due to their functions in shielding against economic instability and inflation. Historically, gold has been a reliable choice for safeguarding wealth because of its long-standing reputation as a stable store of value. Bitcoin, on the other hand, has become increasingly popular as a digital alternative, recognized for its limited supply, decentralized structure, and technological superiority. Unlike gold’s physical durability and dependability, Bitcoin provides easier division, transportability, and transparency through blockchain technology. Essentially, both assets are utilized to diversify portfolios and safeguard against the devaluation of paper currency.

The $100,000 Milestone

This significant achievement can be attributed to various elements, among them being the re-election of President Donald Trump, who has shown a supportive stance towards cryptocurrencies. The possible policy changes under his administration, such as appointing individuals like Paul Atkins, known for their crypto-friendly views, to lead regulatory bodies like the SEC, have increased investor confidence.

The approval of Bitcoin Spot ETFs has significantly boosted institutional investments, with notable examples like BlackRock’s iShares Bitcoin Trust experiencing increased inflows. This trend suggests a growing mainstream acknowledgment and adoption of digital currencies.

Experts are confident that the future direction of Bitcoin looks promising, as predictions estimate it might hit $120,000 by the beginning of 2025. This optimism stems from anticipation for wider public acceptance and positive regulatory advancements.

Nevertheless, the market continues to be unpredictable. Latest figures suggest an uptick in the use of protective put options, implying that certain investors are readying themselves for possible declines following Bitcoin’s swift rise.

In summary, Bitcoin’s recent performance underscores its growing prominence as a digital asset, increasingly viewed as “digital gold.” While the current trends are encouraging, investors should remain vigilant and consider the inherent volatility of the cryptocurrency market.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2024-12-06 16:48