As a seasoned analyst with years of experience in the volatile world of cryptocurrencies, I find myself intrigued by the latest developments in the Bitcoin market. The recent dip and subsequent recovery, coupled with the analysis suggesting reduced selling pressure from short-term holders, paints an interesting picture.

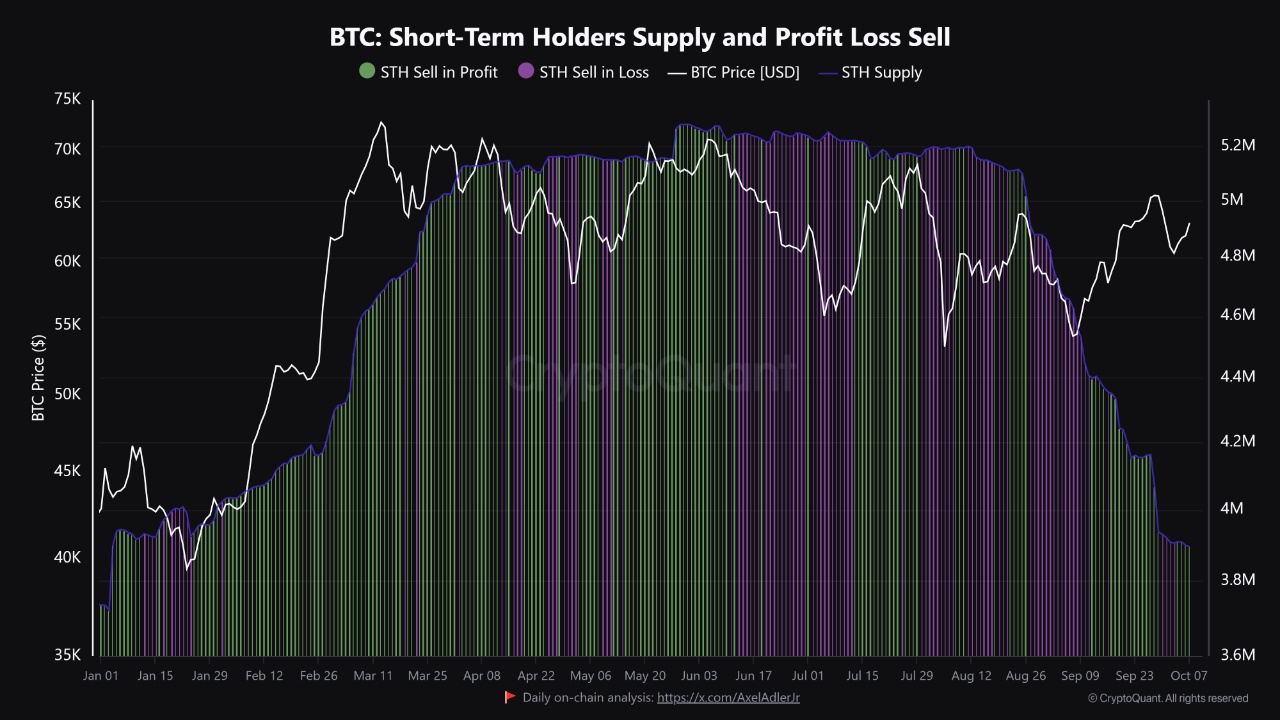

With Bitcoin‘s price bouncing back slightly over $60,000 after a recent downturn, some recent studies indicate that short-term Bitcoin owners are progressively leaving the market. This trend results in less pressure to sell.

Based on research by CryptoQuant analyst IT Tech, there’s been a significant decrease in the amount of Bitcoin held by short-term investors, particularly following substantial sell-offs. This reduction in selling pressure offers chances for accumulation and could indicate a potential price bottom.

As short-term investors unload their cryptocurrencies, they may be transferred to more robust investors, which could help maintain market stability.

In my experience as a crypto investor, it appears that significant players (whales) are aggressively amassing Bitcoin in this current market trend, which seems unprecedented. These whales, who entered the market during the recent bull run, seem to be actively seeking profits by continually adding BTC to their holdings.

As stated by the CEO of a well-known cryptocurrency analytics company named CryptoQuant, the newly established whale wallets, primarily those linked to custodial wallets and spot Bitcoin exchange-traded funds (ETFs) that began trading in the U.S. this year, have not yet made enough profit to convert their earnings into cash.

According to Ki Young Ju, the recent fluctuations in the cryptocurrency market can be likened to a game within the futures trading arena. Just last month, Bitcoin’s price peaked at approximately $66,000, only to dip down to around $60,000 at the start of October. Since then, its value has rebounded and is currently being traded above $61,000.

In simpler terms, the leader of CryptoQuant stated that significant investors, often referred to as ‘whales’, influence the market by buying and selling cryptocurrencies both on traditional exchanges (spot trading) and private deals (OTC markets). However, he noted that the older whales have not experienced substantial gains, whereas the newcomers in the market have barely made any profits.

Additionally, he pointed out that the latest data on whale holdings shows minimal connection with Exchange-Traded Funds (ETFs), implying that the whales joining the market are not solely investors who buy Bitcoin via spot ETFs.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-10-09 01:55