Glassnode, the analytics firm that probably has more charts than a cartographer on a caffeine binge, has suggested that Bitcoin sellers might be running out of steam. Or, as they put it, “seller exhaustion.” Because apparently, even digital currency traders need a nap sometimes. 🛌

Bitcoin Realized Loss: The Drama Continues

In a post on X (formerly known as Twitter, but let’s not get into that), Glassnode delved into the thrilling world of Bitcoin capitulation. The star of the show? The “Realized Loss” metric. This little gem measures how much loss Bitcoin investors are collectively realizing. Because nothing says “fun” like quantifying despair. 😅

Here’s how it works: the metric digs through the transaction history of each Bitcoin to see what price it was last sold at. If that price is higher than the current spot price, congratulations! You’ve just contributed to the Realized Loss. The amount of loss is, of course, the difference between the two prices. It’s like a math problem, but with more existential dread. 🧮

And just to keep things balanced, there’s also a “Realized Profit” metric. Because sometimes, people actually make money. Shocking, I know. 💰

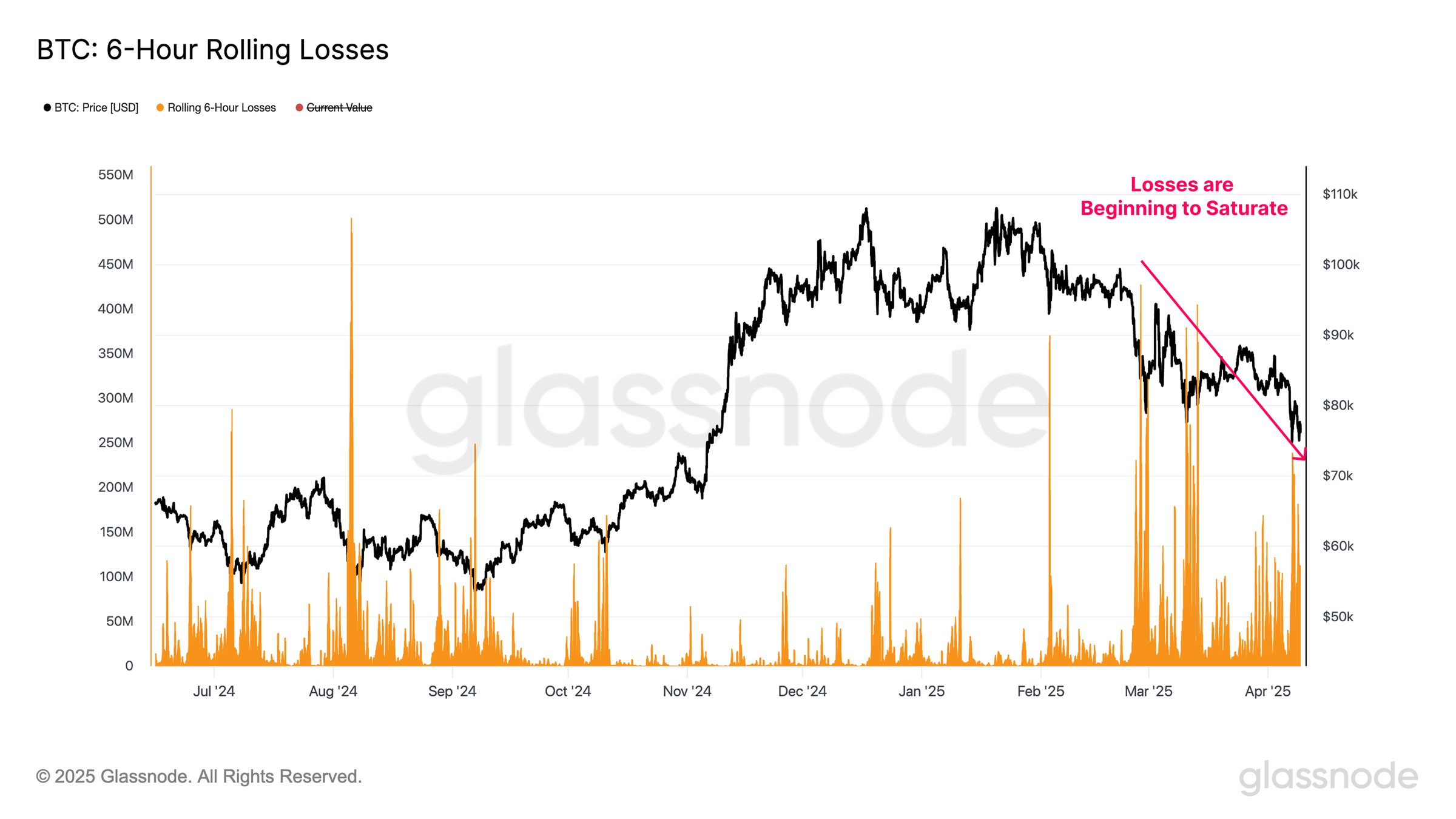

Here’s a chart from Glassnode showing the 6-hour rolling value of the Bitcoin Realized Loss over the past year:

As you can see, there were some pretty dramatic spikes during the February and March price drops. Investors were panic-selling like it was Black Friday at a mattress store. But recently, the scale of the Realized Loss has been smaller. Glassnode thinks this might mean sellers are getting tired. Or maybe they’re just bored. Either way, it could be a sign that Bitcoin is nearing a bottom. Or not. Who knows? 🤷♂️

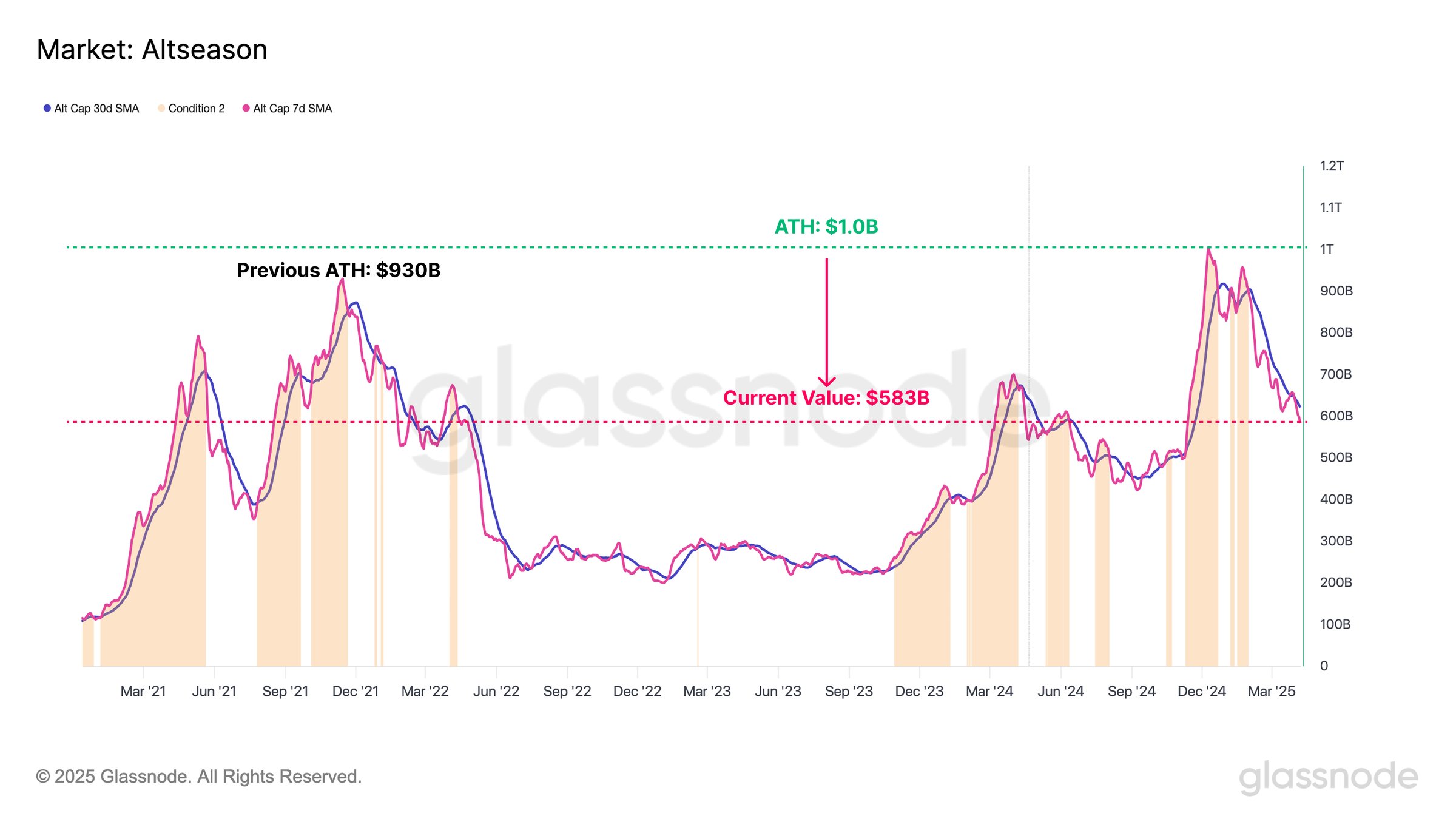

In the same thread, Glassnode also took a look at the altcoin market cap. Because why stop at Bitcoin when you can also analyze the chaos of everything else?

Back in December 2024, the altcoin market cap was sitting pretty at $1 trillion. Today? It’s shrunk to $583 billion. Glassnode notes that “assets further out on the risk curve have shown heightened sensitivity to liquidity shocks.” Translation: altcoins are like that one friend who panics at the slightest hint of trouble. 😬

BTC Price: The Comeback Kid?

Meanwhile, Bitcoin has been trying to stage a comeback. Over the last couple of days, its price has climbed back to $81,900. Because even digital gold needs a little pick-me-up now and then. 📈

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-04-12 11:12