Well, if it isn’t dear old Bitcoin, prancing about like the eager debutante at the ball, having just pirouetted past a modest intraday high of $94,320. After languishing in the dull drawing room of $80,000 to $85,000 for what felt like an age, our crypto hero has finally decided to upend the tea service and break free from April’s humdrum consolidation. Splendid stuff!

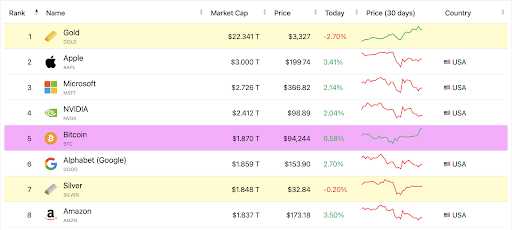

What’s gotten the digital dandified chap all riled up, you ask? Institutional chaps and dames, dressed to the nines, have been pouring moolah into Spot Bitcoin ETFs with the enthusiasm of a butler spotting a silver platter. Indeed, inflows have hit heights not seen since January, propelling Bitcoin into the top five assets globally — cheekily elbowing aside the likes of Alphabet, Silver, and Amazon. You can almost hear the posh money chuckle, “You shall not pass… without a Bitcoin pass, that is.”

Spot Bitcoin ETFs: The Money Floodgates Swing Wide Open

According to the wizards at SoSoValue — who keep a keen eye on such affairs — the US Spot Bitcoin ETFs scooped up a princely $936.43 million on Tuesday, April 22, performing almost as robustly as that January 17 spree when $1.08 billion waltzed in. And not to be outdone, Wednesday continued the binge with $916.91 million. Jolly good show!

Leading this charge is BlackRock’s iShares Bitcoin Trust (IBIT), waving its flag with a knockout $643.16 million inflow, while Ark & 21 Shares’ ARKB follows like an eager page boy with $129.5 million. For four days running, these Spot ETFs have been attracting over $100 million daily. That’s a streak that last turned heads back when January was still fresh-faced and new.

After weeks of ETF activity resembling a drought-stricken garden, these downpours of investor enthusiasm have timed their arrival just right, pushing Bitcoin’s price skyward like a champagne cork at a raucous soirée. This coordination between ETF inflows and Mr. Bitcoin’s ascending value is one heck of a showstopper.

Bitcoin Overtakes Amazon and Google—What’ll They Think of Next?

Thanks to this ETF-fuelled pep talk, Bitcoin has sashayed up the global asset rankings, now dazzling with a market value towering over $1.87 trillion. The giant tech behemoths Google (Alphabet) and Amazon have been left gobsmacked in the corner, their stock prices slipping as if they’d misplaced their monocles in the last 30 days.

Our friend Bitcoin is no longer merely a sprightly cryptocurrency but has now sashayed onto the macroeconomic stage, hobnobbing with traditional tech kings and commodity titans alike. It’s even now outpacing the NASDAQ 100, hinting at its own brand of rebelliousness — a proper gentleman not wishing to be tied down by conventional stock indices.

With Bitcoin holding court a smidge north of $90,000 once again, all eyes turn to whether it will charge boldly toward the $100,000 mark — a princely sum indeed. Yet beware, for the $94,000 plateau acts as a rather stout hedge, tempting some traders to take profits and send Bitcoin on a brief but polite retreat. Nothing says “party’s over” like a few liquidated buy orders, eh?

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- All 6 ‘Final Destination’ Movies in Order

- Every Minecraft update ranked from worst to best

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

2025-04-24 19:22