As a seasoned researcher with over two decades of experience studying financial markets and political dynamics, I can confidently say that navigating the intricacies of Polymarket data has become akin to deciphering ancient hieroglyphics for me. The recent drop in confidence regarding the prospect of a US Bitcoin reserve under Trump’s leadership is indeed striking, but not entirely surprising given his past rhetoric and the industry’s high-stakes nature.

I remember the early days of Bitcoin when I first started following its development, and the fervor it generated among investors was palpable. But over time, I’ve learned that the crypto market is as much about sentiment and speculation as it is about technology and innovation. The current 27% probability suggests a cautious approach from traders, who are likely weighing political signals, macroeconomic trends, and regulatory uncertainties.

The $1.5 million betting volume underscores just how polarizing this prediction has become, not unlike the election cycle itself. It’s like playing a game of chess where the pieces have minds of their own, each with its own set of motives and agendas. I find myself constantly reminded of the old joke: “How do you make a small fortune in crypto? Start with a large one!”

In this ever-evolving landscape, only time will tell whether Trump’s stance on Bitcoin will shift or if the current skepticism is warranted. As we inch closer to 2025, I can’t help but wonder: Will Trump embrace Bitcoin, or will it remain a mirage for crypto optimists? Only time and the market will tell. But one thing’s for sure – I’ll be here, watching the charts, and ready to adjust my strategy when the pieces on the board start moving again!

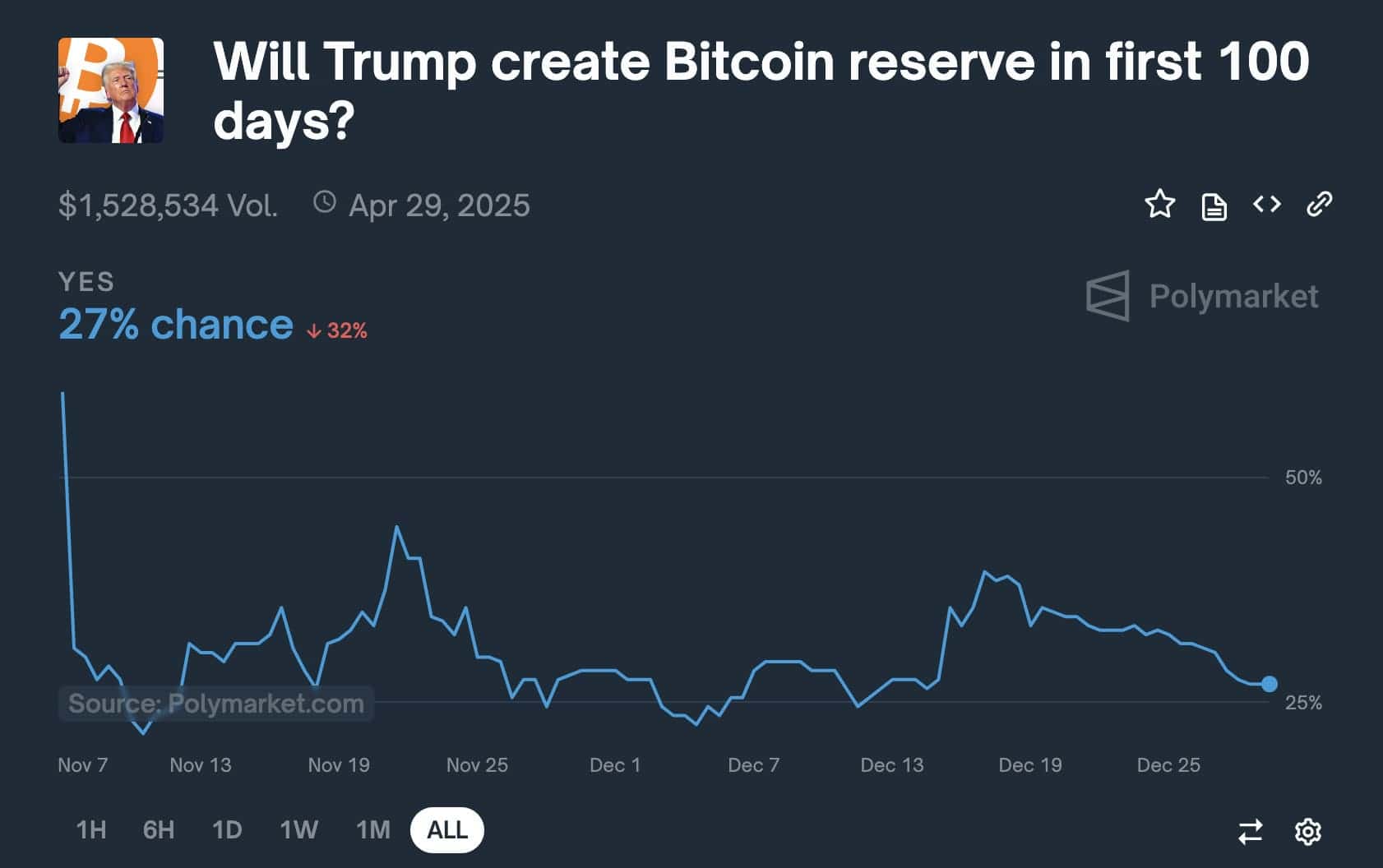

The graph indicates a significant decrease in market confidence, as the “Yes” side now has only a modest 27% likelihood – a substantial drop of 32% within the past few days.

Volatility in the Numbers

The data from Polymarket, showing predictions about whether Trump will establish a U.S. Bitcoin reserve, shows a volatile public opinion. In early November, the market was mostly optimistic with predictions hovering around 50%, largely due to speculation and notable endorsements of cryptocurrency policies. However, the continuous drop below 30% suggests growing skepticism, which could be influenced by Trump’s mixed history with cryptocurrencies.

A Tale of Conflicting Narratives

As a crypto investor, I’ve witnessed the growing acceptance of Bitcoin worldwide, yet its relationship with political figures like Trump has been complex. Throughout his presidency, he referred to Bitcoin as a “scam” and championed a robust dollar over decentralized alternatives. However, whispers circulated within the crypto community about a potential shift in his perspective when influential Republican figures, some of whom are pro-Bitcoin advocates, rose through the party ranks.

Moreover, fueling the suspense is the $1.5 million in total wagers placed—a clear demonstration of the intense interest and high-risk nature this forecast has garnered. The changing line on the graph implies that traders are maneuvering through a complex maze of political indicators, economic patterns, and the possibility of regulatory interventions.

Crypto Markets React

As a researcher, I’ve observed that the Polymarket trend mirrors the recent downward trends in my Bitcoin price analysis. This could indicate that speculators are taking precautions against the potential of significant federal adoption of Bitcoin under President Trump’s leadership. Despite Trump expressing interest in Bitcoin, analysts caution that the intricate bureaucratic and legislative barriers would likely prolong any such initiative far beyond the initial 100-day term.

What Could Swing the Odds?

Multiple elements might spark renewed optimism. For instance, a high-profile endorsement of Bitcoin by a prominent Trump associate, or clearer legislation regarding digital assets, could potentially increase the likelihood again. On the contrary, negative crypto talk or focusing on other economic matters could potentially diminish trust even more.

At present, the Polymarket chart indicates a cautious stance, symbolic of the ambiguity surrounding Trump’s intentions regarding Bitcoin. As we move closer to 2025, the question lingers: Will Trump adopt Bitcoin, or is this simply a false hope for crypto enthusiasts?

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-12-29 14:48