As a seasoned crypto investor with a knack for interpreting economic data, I found November’s Employment Situation report to be a fascinating piece of information that sent ripples through the financial markets and, more specifically, Bitcoin’s price movements.

On Friday morning at 8:30 a.m. Eastern Time, the U.S. Bureau of Labor Statistics (BLS) published their Employment Situation report for November.

As a researcher, I’m sharing an update based on the latest report from the BLS. They’ve announced a surprising increase of 227,000 jobs in total nonfarm payroll employment. The unemployment rate, however, stayed relatively steady at 4.2%. This growth was particularly notable in sectors like healthcare, leisure and hospitality, government, and social assistance. Regrettably, retail trade saw a decrease in employment numbers.

The workforce was consistently engaged at approximately 62.5%, and there was a slight uptick in the average workweek to about 34.3 hours. Furthermore, hourly wages climbed by 0.4% to $35.61, preserving an annual growth of 4%. This suggests a labor market that, though strong in certain aspects, exhibits indications of inflationary pressure due to wage increases.

The publication of the Employment Situation report caused a swift impact on financial markets, particularly affecting Bitcoin‘s price fluctuations. At exactly 8:30 a.m. ET, the Bitcoin-to-U.S. Dollar price graph showed a significant surge, as demonstrated by the BTC-USD price chart from TradingView.

Prior to the news release, Bitcoin had been holding steady within the $97,000 vicinity. Yet, by 9:18 a.m. Eastern Time, it spiked to roughly $98,718 – a 0.8% jump in an hour post-announcement. Despite this rise, it was still down by 4% compared to the previous day. This abrupt increase seems to coincide with the publication of employment data, implying that traders might have predicted or responded to potential impacts on Federal Reserve policy. This pattern is consistent with Bitcoin’s characteristic as a risk-hedging or speculative asset influenced by macroeconomic indicators.

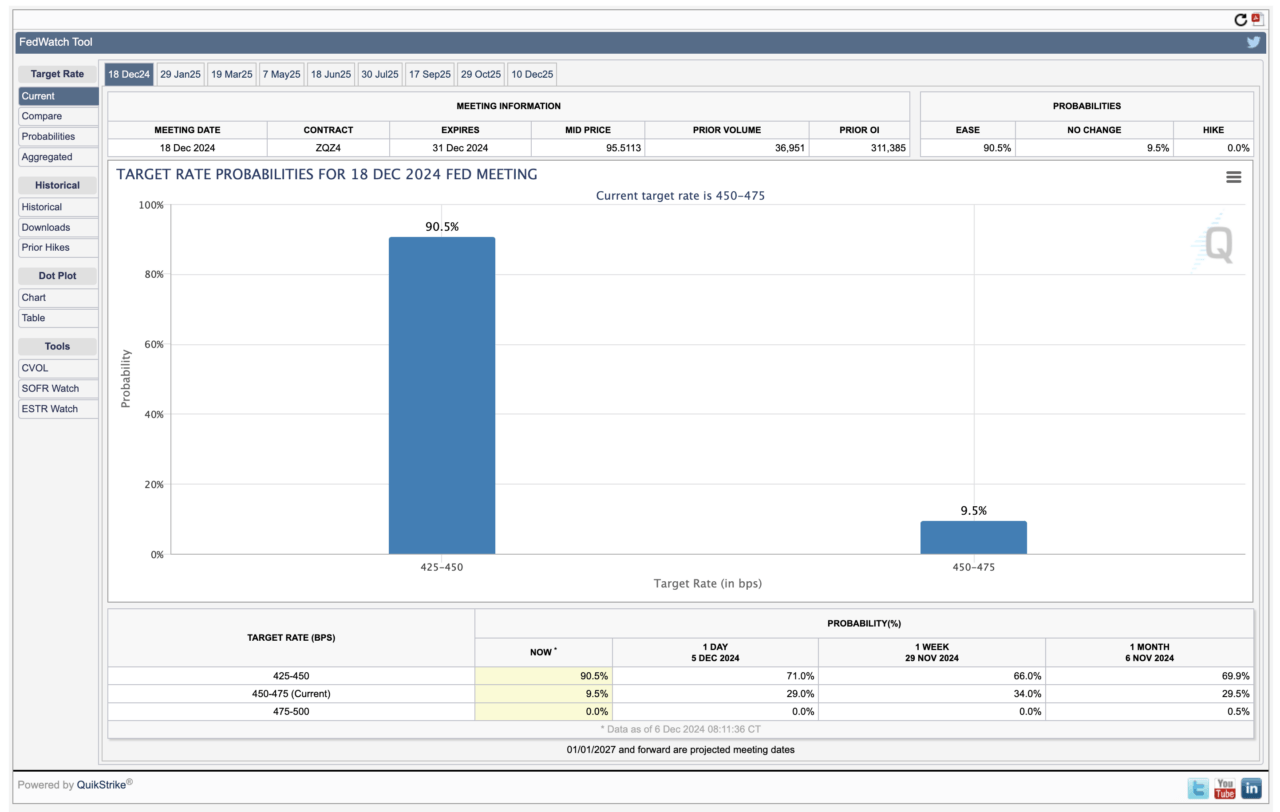

Simultaneously, the CME Group’s FedWatch Tool offers valuable perspectives on how the financial markets anticipate the Federal Open Market Committee (FOMC) meeting slated for December 18. As per the tool, the likelihood of a rate cut within the 4.25% to 4.50% range has soared to 90.5%, marking a substantial increase from earlier predictions of 71% (December 5) and 66% (November 29). The tool further demonstrates a notable decrease in the probability of keeping the existing 4.50% to 4.75% range, falling to 9.5% from almost 29% the previous day.

In November, the number of total nonfarm jobs exceeded October’s figure by a considerable margin, as predicted, after October’s job market disruptions due to major storms and a dockworkers’ strike. The unemployment rate stayed relatively stable, and the 4% yearly increase in average hourly wages indicates a low risk of inflation escalation. These findings make it more probable that the Federal Reserve will implement the anticipated 25 basis point interest rate reduction.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Summer Game Fest 2025 schedule and streams: all event start times

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2024-12-06 17:55