10x Research analysts and other industry experts caution that Federal Reserve policies might dampen market excitement, despite the potential for substantial expansion in the cryptocurrency sector.

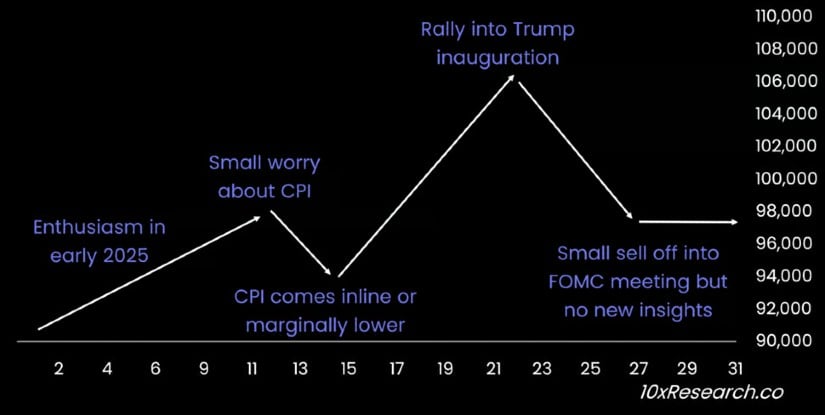

As a researcher, I’m eagerly anticipating a robust commencement to January, with a sense of optimism swelling in the air ahead of the Consumer Price Index (CPI) inflation data unveiling slated for the 15th. A favorable CPI could potentially fortify the escalating Bitcoin rally, propelling it further towards the Trump inauguration on the 20th of January.

Thielen anticipates that the current momentum won’t last long as the Federal Open Market Committee (FOMC) meeting scheduled for January 29 approaches. He predicts that Bitcoin’s value will fall within the range of $97,000 to $98,000 by the end of the month.

Federal Reserve Policies Remain a Key Risk

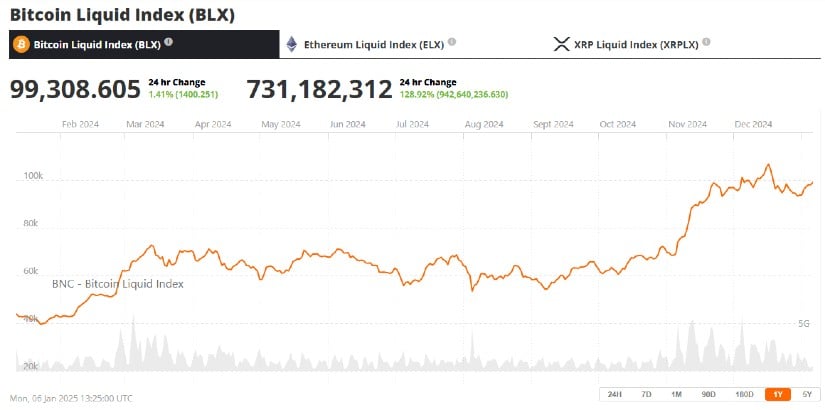

The primary threat to Bitcoin’s ongoing surge is the potential impact of communications from the Federal Reserve. As of now, it’s predicted that federal rates will stay within a range of 4.25% to 4.50% post the FOMC meeting, with an 88.8% probability according to FedWatch, a tool by CME Group. It’s important to note that Bitcoin has shown significant volatility in response to decisions made by the Federal Reserve in the past. For instance, in December 2024, the value of Bitcoin dropped by as much as 15% to $92,800 following a decision by the Fed to reduce its anticipated 2025 rate cuts.

Thielen notes that although inflation could decrease in 2025, it’s expected that the Federal Reserve might act gradually when altering its monetary strategies. Moreover, he underlined the significance of institutional investors re-entering the crypto market, which could significantly influence the trend. He mentioned factors like stablecoin production and Bitcoin ETF investments as crucial signs to monitor.

Long-Term Projections and Bitcoin Dominance

As an analyst, I remain hopeful for the future prospects of Bitcoin, despite any short-term fluctuations. John Glover, the chief investment officer at Ledn, predicts that by Q1 2025, Bitcoin could surge to $125,000 and potentially peak at an even higher level of $160,000 later in the year. Additionally, asset management companies like Bitwise and VanEck are aiming for Bitcoin to reach heights of $200,000 before the end of this year.

By the end of 2024, Bitcoin’s dominance decreased to approximately 57%, demonstrating the significant impact it holds over the crypto market. As Thielen explained, “This shrinkage underscores Bitcoin’s prominent position as a key player within the cryptocurrency sector.

In recent times, altcoins have found it hard to match Bitcoin’s progress, and Ethereum specifically may encounter a tough year ahead. Thielen characterized Ethereum as a less promising medium-term investment in his December 30 report, pointing out its dwindling active validator growth and lack of demand beyond staking as key concerns.

Outlook for the Crypto Market

In the coming years up to 2025, the mix of political occurrences and economic strategies will dictate Bitcoin’s trends. The arrival of Trump in office could boost market confidence, but Federal Reserve decisions might balance this out, adding uncertainty to the market. It’s crucial for investors to keep a close eye on inflation figures, FOMC results, and institutional actions, as these elements will significantly impact Bitcoin’s direction.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-01-08 13:53