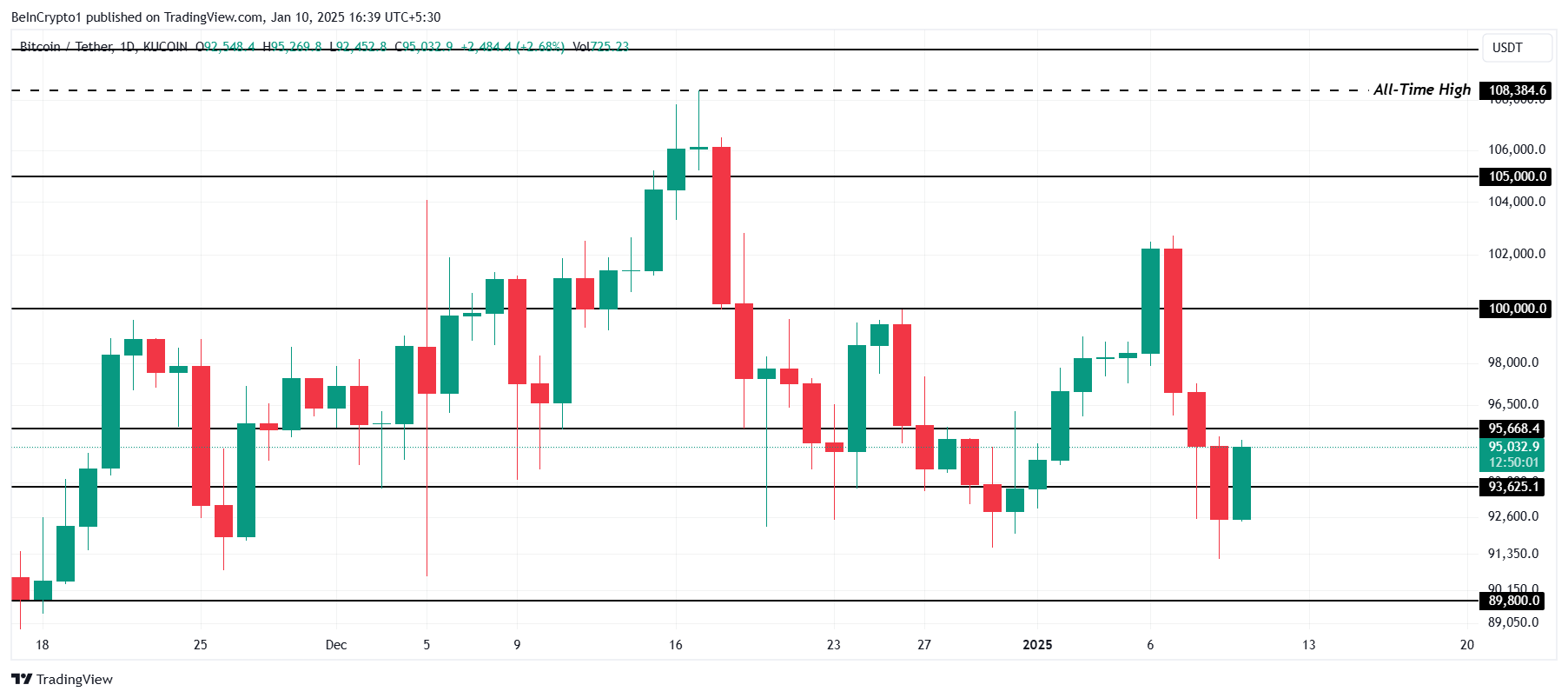

The price movement of Bitcoin has been volatile, as it plunged from its peak of $108,384 to a recent trough of $91,350 after reaching its all-time high.

The major decrease is primarily due to a prominent group of investors pulling back, leading to less immediate demand and putting downward pressure on the market.

Bitcoin Investors Are Pulling Back

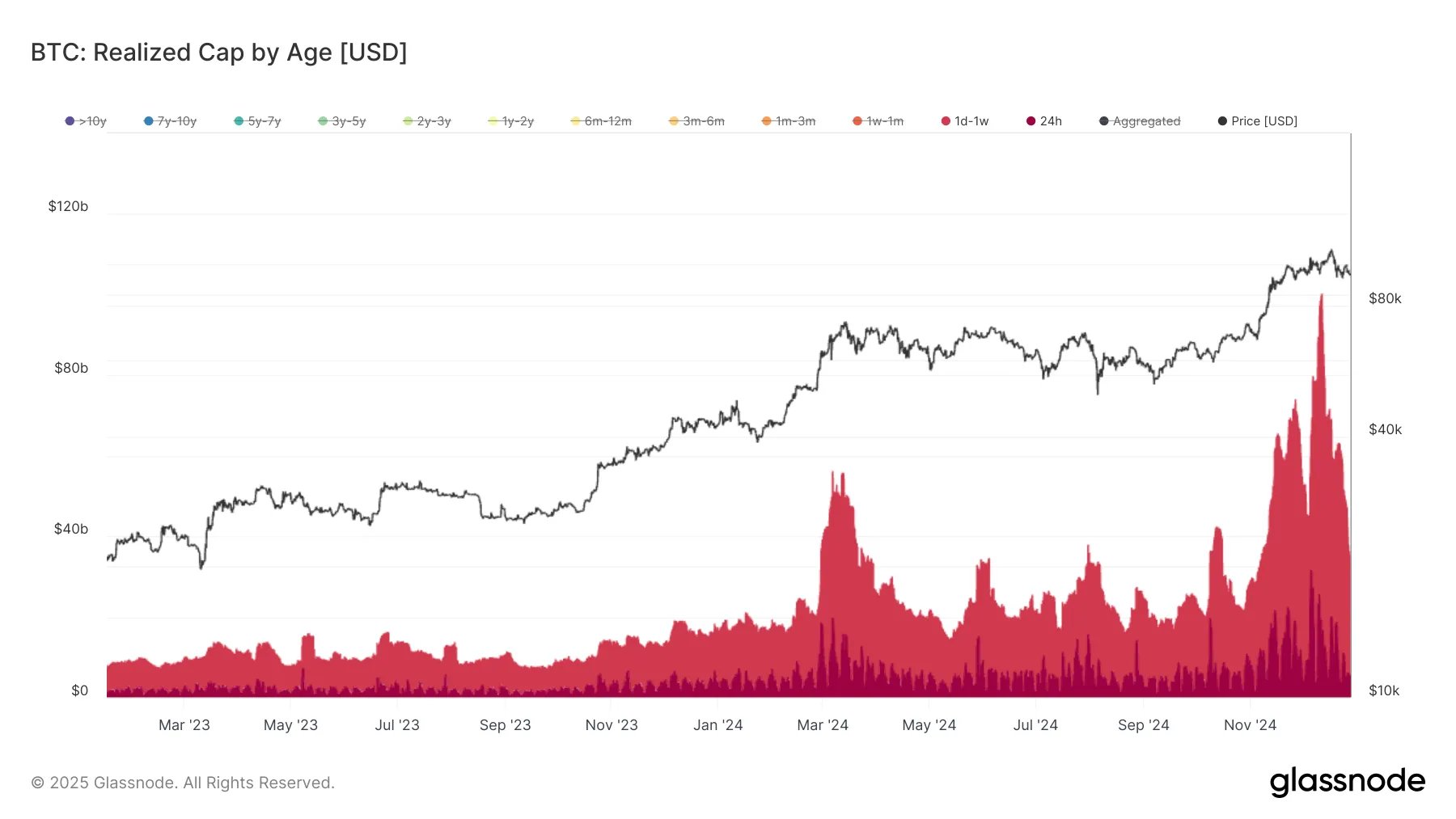

The “Realized Cap by Age” indicator suggests a troubling pattern in Bitcoin’s popularity. In the last seven days, the amount of money poured into the market for short-term purposes has dropped drastically by 66% within the past month. At present, this swiftly moving capital amounts to around $32 billion, indicating a significant decrease in short-term investments being funneled into the market.

This decrease is crucial because it underscores the waning trust among short-term investors, who typically propel Bitcoin’s progress. The absence of fresh investment from these players indicates increasing doubt and adds to Bitcoin’s challenge in holding its ground above significant thresholds.

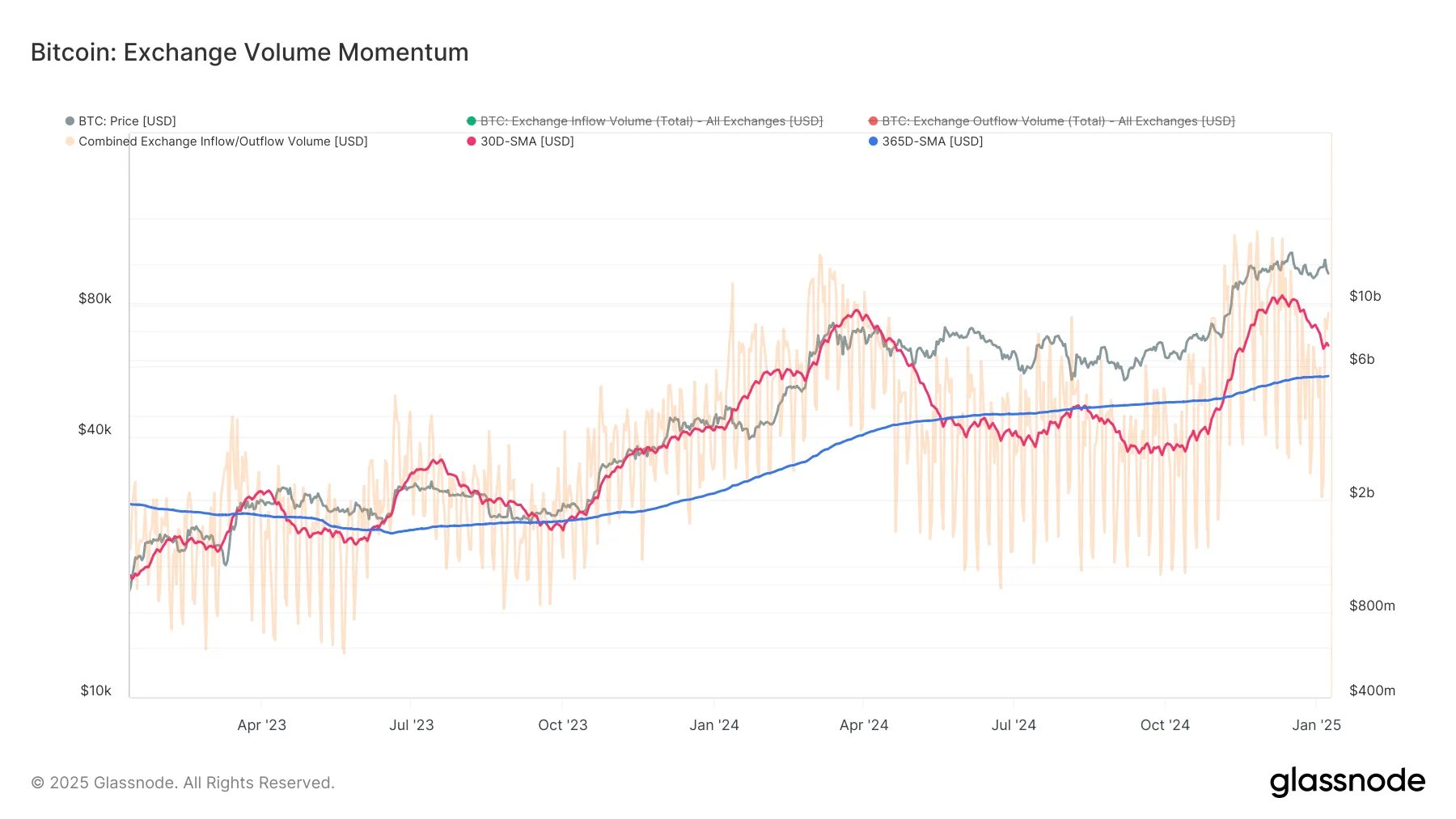

The strong overall trend of Bitcoin seems to align with a negative perspective, as trading volume trends are approaching a significant bearish cross-over point. In simpler terms, the 30-day average is about to dip below the 365-day average, suggesting prolonged weakness in investments flowing into Bitcoin.

As a researcher studying market trends, I’ve noticed a shift in behavior from short-term holders, who are known for their rapid buying and selling strategies. Currently, their activity seems to be decreasing, which aligns with the observed slowdown in overall demand. This reduced involvement raises worries about Bitcoin’s potential short-term recovery. If this cautious approach persists, it could potentially impede Bitcoin’s journey towards reclaiming higher price levels.

BTC Price Prediction: Charting A Path To $100,000

At the moment, Bitcoin is hovering around $95,000, having rebounded from $92,600 and establishing $93,625 as a significant support point. Nevertheless, this digital currency is encountering difficulties in maintaining its upward trajectory due to dwindling short-term interest and unfavorable long-term economic signs.

If these conditions continue, there’s a possibility that Bitcoin might break its current support at $93,625, causing a potential fall to around $89,800. This drop could intensify the ongoing downtrend, challenging the patience of long-term investors.

Instead, let’s focus on Bitcoin aiming to surpass the $95,668 barrier as its next objective. Once it does, this level could serve as a foundation for further growth, potentially allowing Bitcoin to regain the $100,000 mark. Hitting this significant figure would contradict the current pessimistic forecast and revive investor enthusiasm.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-01-10 18:52