As a seasoned analyst with over two decades of market experience under my belt, I have witnessed countless market cycles and patterns that seem to repeat themselves like clockwork – albeit never exactly the same way twice. The similarities between Bitcoin‘s current trajectory and the 2018 BHLD pattern, as highlighted by veteran trader Peter Brandt, is a fascinating development that warrants closer scrutiny.

While history doesn’t always repeat itself, it often rhymes, and if Bitcoin follows this path, we could be in for an exciting ride. The Hump-Slump-Pump-Dump pattern has proven to be a reliable indicator in the past, so it’s essential to keep a close eye on BTC‘s progression.

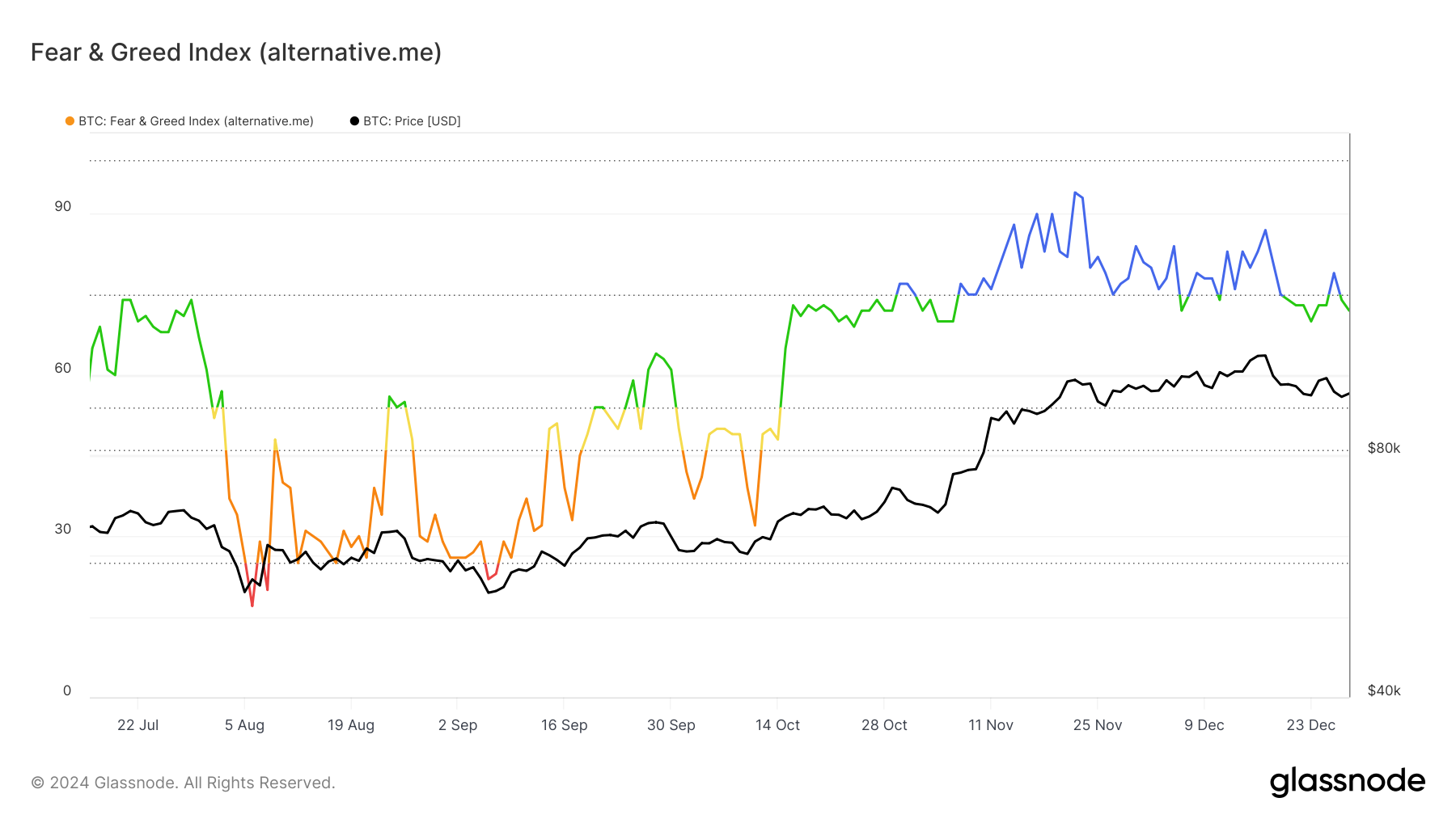

One thing that I have learned over my years of analyzing markets is never to underestimate the power of human emotions, especially greed and fear. The current shift from Extreme Greed to lower Greed levels in Bitcoin’s Fear and Greed Index could be a positive sign for stabilizing its price, but we mustn’t ignore the potential for excessive selling pressure if greed escalates further.

In terms of BTC price prediction, I believe Bitcoin is attempting to secure $95,668 as a support level, with investors playing a crucial role in either stabilizing the price or pushing it lower. If Bitcoin can reclaim $100,000 as support, it could signal a short-term bullish trend, helping BTC recover its recent losses and potentially resume its upward trajectory.

However, if we fail to hold $95,668, Bitcoin could drop further, testing support at $89,800. Such a decline would be a setback for the bulls but not an insurmountable obstacle – after all, even the mighty phoenix must occasionally endure the flames before rising again from its ashes.

Lastly, let me leave you with a little humor: Remember, Bitcoin is like a rollercoaster – it’s all about the ups and downs, but in the end, it always comes back around for another ride!

Bitcoin (BTC) is finding it tough to move beyond its current range, preventing it from establishing the $100,000 mark as a strong support point again.

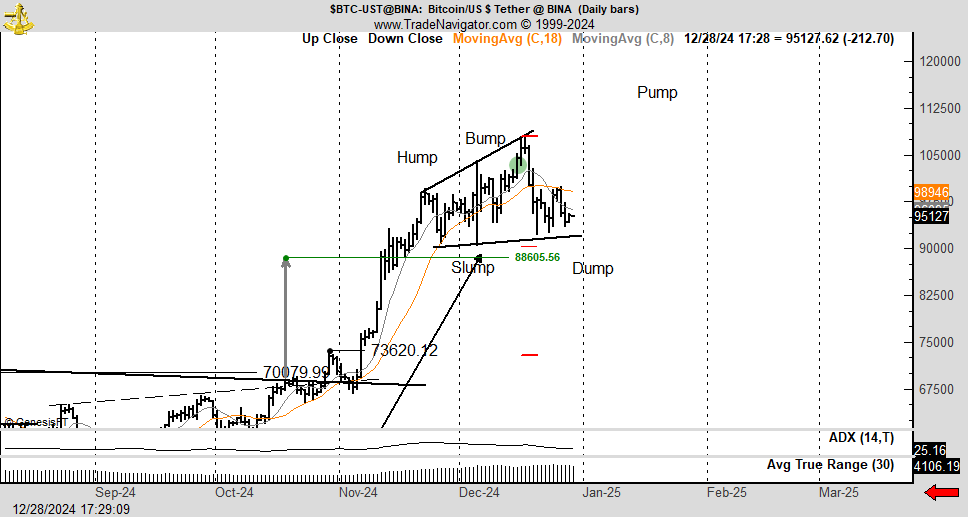

During these current market fluctuations, seasoned trader Peter Brandt has pointed out a resemblance between Bitcoin’s price trend in 2018 and the present situation, fueling discussions about what could be Bitcoin’s next step as the undisputed leader of cryptocurrencies.

Bitcoin Strategy Reinvented

Peter Brandt observed that Bitcoin seems to mirror an old pattern from 2018, prior to BTC breaking its Parabolic Advance. This pattern is called the BHLD (Bump, Lump, Hump, Dump), which has a variation known as the Hump-Slump-Pump-Dump. This pattern appears to correspond with Bitcoin’s current trend and could potentially predict its future trajectory.

As a seasoned cryptocurrency investor with years of experience in the volatile world of Bitcoin (BTC), I would advise fellow enthusiasts to revisit this post from several years ago. It presents the intriguing Hump Slump Bump Dump Pump chart construction, which holds a fascinating resemblance to current market trends. Just as we’ve seen cycles repeat in the past, it’s essential for us to keep an eye on these patterns and adjust our strategies accordingly.

The overall trend of Bitcoin, as indicated by the Fear and Greed Index, appears to be moving from an extremely greedy phase towards a less intense level of greed. Historically, Bitcoin has experienced significant corrections during periods of extreme enthusiasm or greed. Therefore, this transition could potentially mean that the price of Bitcoin is becoming more stable.

The present degree of greed suggests a chance for Bitcoin to recover, provided it doesn’t lead to intense selling. Although selling may occur, the tempering of market feelings might offer Bitcoin an opportunity for temporary profits.

BTC Price Prediction: Securing Support

Currently, Bitcoin is being traded around $94,224, aiming to establish $95,668 as a stable support point. For this to occur, investors need to hold off on cashing out their gains, allowing Bitcoin to regain its pace and recover the lost momentum.

If Bitcoin manages to regain the $100,000 level as a support point, this might indicate a temporary optimistic market condition. Recapturing this level could aid in reversing recent losses for BTC and may encourage it to continue its positive trend, boosting investor trust and confidence.

Instead of maintaining the current value of $95,668, letting it go could cause Bitcoin to fall even more, challenging its support at around $89,800. This potential drop would undermine the positive perspective and move Bitcoin’s recovery plan to January 2025, extending the period of uncertainty for investors.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Gold Rate Forecast

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Every Minecraft update ranked from worst to best

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2024-12-30 00:47