In the grand theater of finance, Bitcoin (BTC) and its motley crew of cryptocurrencies find themselves in a precarious dance, as the specter of recession looms large, all thanks to the musings of none other than President Donald Trump.

His recent soliloquy on Fox News, where he tiptoed around the notion of an economic downturn, sent shivers down the spines of investors, igniting a sell-off that could make even the most seasoned trader weep into their coffee.

Bitcoin Takes a Nosedive as Recession Fears Spark a Frenzy

In a March 10 interview, the inquisitive folks at Fox News posed a question to President Trump about the likelihood of a recession. While he artfully dodged a clear answer, he did acknowledge that “disruption” was as inevitable as a cat chasing its own tail in a room full of rocking chairs.

His words, like a pebble tossed into a still pond, rippled through the markets, hinting that the US economy might face a few bumps in the road before it finds its footing again.

Trump’s remarks seemed to suggest a willingness to brave the storm of recession if it meant fixing the economic ship that’s been sailing a bit too close to the iceberg.

“So, why did the decline accelerate today? We think markets are reacting to President Trump’s willingness to weather an economic downturn to ‘fix’ issues the US faces,” noted The Kobeissi Letter, with a hint of sarcasm that could cut through steel.

While this perspective might be a silver lining for the long haul, it has only served to heighten the jitters among Wall Street’s finest and the crypto cowboys alike.

In the immediate aftermath, Bitcoin prices plummeted below the psychological barrier of $80,000. As of this moment, BTC was trading at a meager $79,856, down nearly 3% since the opening bell rang on Tuesday. Ouch!

Not to be outdone, Trump’s comments echoed the recent warnings from the Federal Reserve, which has been whispering sweet nothings about the possibility of a recession, further stoking the fires of market anxiety. The Fed’s cautious tone has turned the crypto landscape into a veritable minefield of bearish sentiment.

A potential economic slowdown could lead to lower interest rates, which might be the lifeline that stimulates growth. But alas, investors seem to be bracing for more pain than a cat in a bathtub.

Bitcoin and Stocks: A Love-Hate Relationship with Economic Anxiety

Like a well-rehearsed duet, the traditional financial markets responded with a swift kick to the gut. The S&P 500 has shed a staggering $5 trillion in market value over a mere 13 trading days. Meanwhile, the crypto markets have seen a loss of approximately $1.3 trillion since their peak in December 2024. Talk about a bad hair day!

Bitcoin, that fickle barometer of risk appetite, has taken a nosedive of 35% in just three months. It’s like watching a soap opera where the plot twists just keep coming.

This, coupled with the ever-looming inflationary concerns and the uncertainty surrounding Federal Reserve policy, has sent investors running for the hills. The downturn in Bitcoin mirrors a broader shift in investment strategies, as institutional investors pull out of high-risk assets faster than a kid at a haunted house.

The so-called “Magnificent Seven” stocks, which include the tech titans of our time, have seen their exposure levels plummet to the lowest since April 2023. Tesla, that rollercoaster of a stock, experienced its seventh-largest single-day drop, plummeting 15.4%. It’s as if investor confidence in speculative assets has taken a long walk off a short pier.

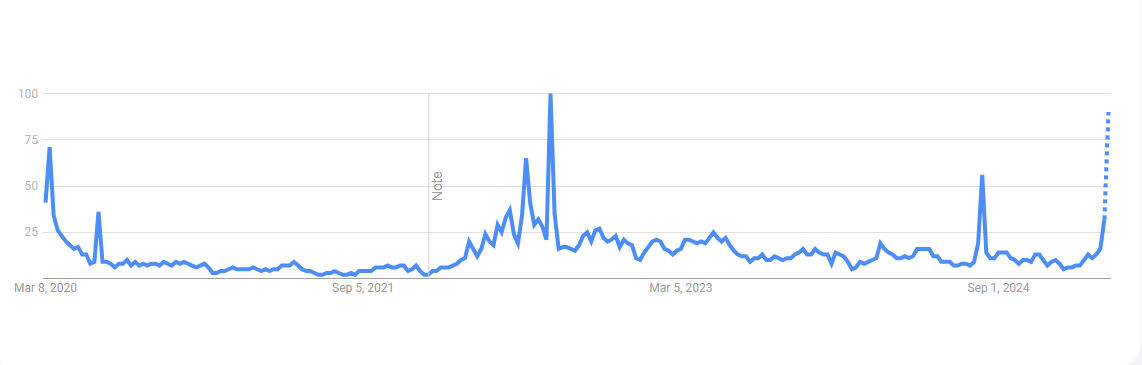

Meanwhile, Bitcoin’s price movements have been as closely tied to macroeconomic uncertainty as a dog to its owner. Google Trends data reveals that searches for “US recession” have skyrocketed to their highest levels since August 2024—historically a harbinger of market volatility. Similar spikes in searches in mid-2022 and late 2024 coincided with sharp declines in Bitcoin’s price. Coincidence? I think not!

Adding to the cacophony of concerns, prediction markets like Kalshi have upped the ante, increasing the probability of a US recession to a staggering 40%. These markets, which aggregate real-time investor sentiment, are often seen as more accurate than traditional economic models in forecasting downturns. Who knew a bunch of traders could be so insightful?

“The prediction markets can often be more accurate than traditional economic models, reflecting real-time sentiments and information from traders,” remarked startup investor Rushabh Shah, likely with a smirk.

While some analysts believe a recession could lead to looser monetary policy, which might give Bitcoin a much-needed boost, the immediate outlook remains as clear as mud. For now, traders and investors should strap in and prepare for a bumpy ride ahead.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-03-11 09:54