As a long-time crypto investor and follower of the industry, I find myself deeply concerned about the legal battle between Roger Ver and the U.S. government. Having witnessed Ver’s significant contributions to the crypto world as “Bitcoin Jesus” and his role in promoting Bitcoin Cash, it is disheartening to see him facing such severe charges, especially when he has been a vocal critic of U.S. crypto rules.

As a crypto investor, I’ve found myself closely following the legal case of an individual who renounced his U.S. citizenship in 2014, and it has sparked some intense discussions regarding the constitutionality of the Internal Revenue Service’s (IRS) “exit tax.” This ongoing battle serves to highlight broader worries about regulatory clarity within our industry.

As a researcher, I’m shedding light on a recent claim made by the US government. They allege that an individual named Ver, aged 45, failed to pay taxes on approximately $240 million worth of Bitcoin he liquidated in the year 2017. The prosecution posits that this individual understated his Bitcoin holdings and provided misleading asset valuations when submitting his exit tax declaration – a document required for US citizens who renounce their citizenship and possess assets exceeding $2 million.

The allegations encompass tax evasion, submitting false tax documents, and mail fraud, any conviction of which could potentially lead to a 30-year prison sentence for Ver. Additionally, the indictment claims that Ver intentionally understated the value of his assets to minimize his tax obligations.

Defense Arguments

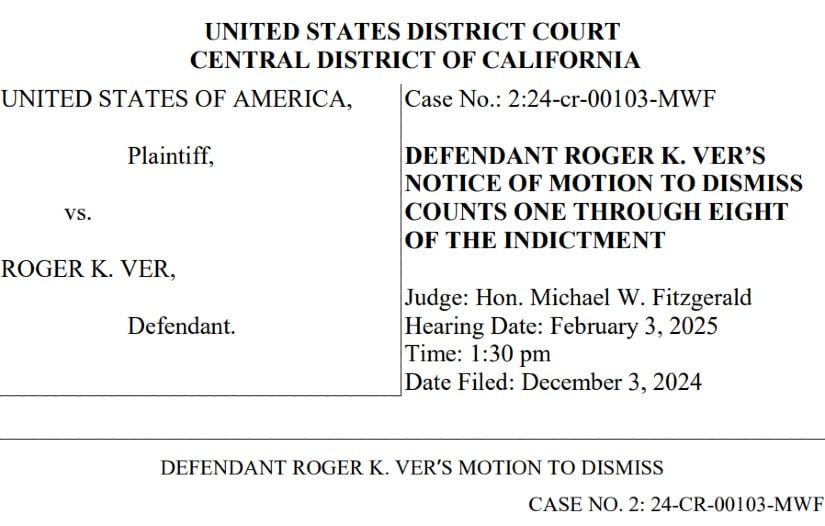

Ver’s legal team has characterized the accusations as unlawful and influenced by politics. In a document submitted to the court on December 3rd, they argued that the Exit Tax imposed by the IRS infringes upon the Apportionment and Due Process Clauses of the United States Constitution.

The statement at hand argues that the ‘exit tax’ in question infringes upon both the Apportionment Clause and the Due Process Clause of the Constitution, as mentioned in the filing. Furthermore, it was asserted that Ver acted based on professional legal counsel and in good faith. The lawyers representing him also voiced concerns about the prosecution potentially withholding evidence that could clear Ver (exculpatory evidence) and engaging in questionable practices during the interrogation of one of his attorneys.

Extradition and Political Context

Earlier this year, Ver found himself in deeper legal issues when he was apprehended in Spain during a cryptocurrency conference. Currently, he remains in Spain as the local courts deliberate over the possibility of sending him back to the United States. His legal team is optimistic that shifting political conditions within the U.S. might lead to a more lenient stance on cryptocurrency regulations, potentially influencing his case.

Robert Barnes, Ver’s civil rights attorney, has described the charge as an example of “selective harassment” of important players in the cryptocurrency business. “This case represents government overreach and a lack of clear regulatory guidelines,” Barnes said in a statement.

Roger Ver is a highly recognized individual in the world of cryptocurrency. As an early investor in Bitcoin when its value was under $1, his advocacy work earned him the moniker “Bitcoin Jesus.” In 2017, he became a vocal proponent of Bitcoin Cash – a version of Bitcoin designed to provide quicker transaction times and improved scalability, which is a fork (a split) of the original Bitcoin.

Ver has encountered legal difficulties before, and one of his previous brushes with controversy was a lawsuit filed against him by platforms like CoinFLEX in 2022. They accused him of owing $47 million in USD Coin. Despite these financial setbacks, Ver continues to be an influential figure in the crypto sphere, championing the concept of decentralized finance systems.

Regulatory Implications

Ver’s situation highlights the ongoing disputes between the crypto industry and government authorities. Critics argue that the U.S. government’s strategy, centered around enforcement instead of clearly outlined policies, creates an uncertain atmosphere for industry players.

Onlookers are wondering if Ver’s intense criticism towards US crypto regulations might have led him to be scrutinized. This situation could establish a crucial precedent regarding how digital assets are handled under U.S. tax law. As the cryptocurrency market grows more complex, it’s evident that clearer regulatory guidelines are necessary and time-sensitive.

Ver’s subsequent actions hinge on the outcomes of his extradition trials and ongoing legal disputes in American courts. His legal representatives remain hopeful that the charges will be dropped, pointing to technicalities and constitutional issues as their basis. In the interim, this situation offers a warning tale for cryptocurrency investors who grapple with the intricacies of tax regulations and governmental oversight.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-12-05 12:34