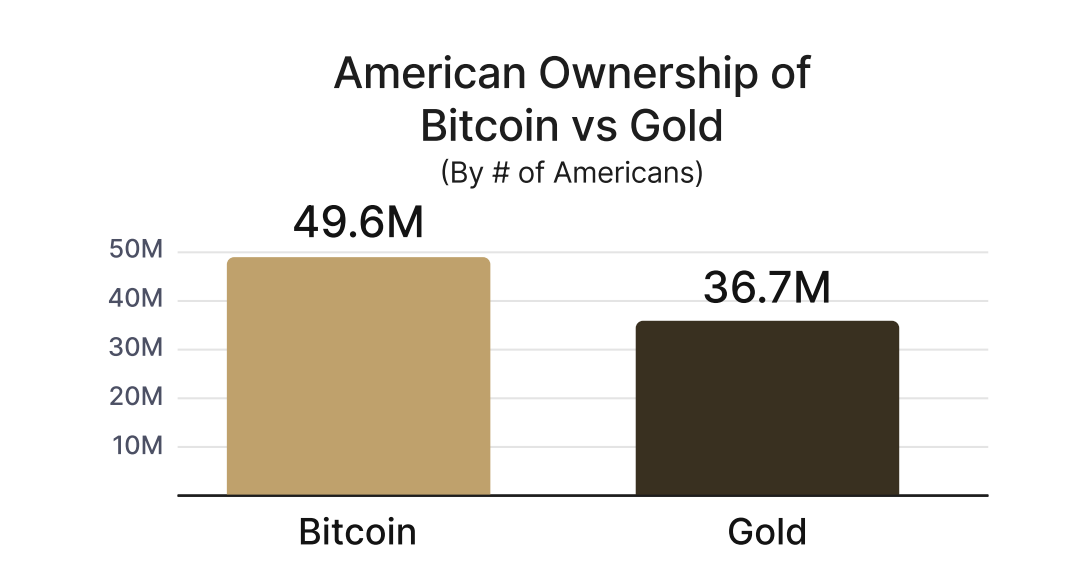

In a plot twist worthy of a Hollywood reboot, more Americans now own Bitcoin than gold—about 50 million have hopped aboard the Bitcoin bandwagon, while a mere 37 million are still clutching their gold coins like pirates in denial.

Once upon a time, gold was the go-to “just in case” asset, but now Bitcoin is muscling in, becoming a key player in America’s economic playbook, purchasing policies, and financial systems. If gold had feelings, it might be feeling a bit obsolete right now.

Bitcoin Surpasses Gold in US Ownership

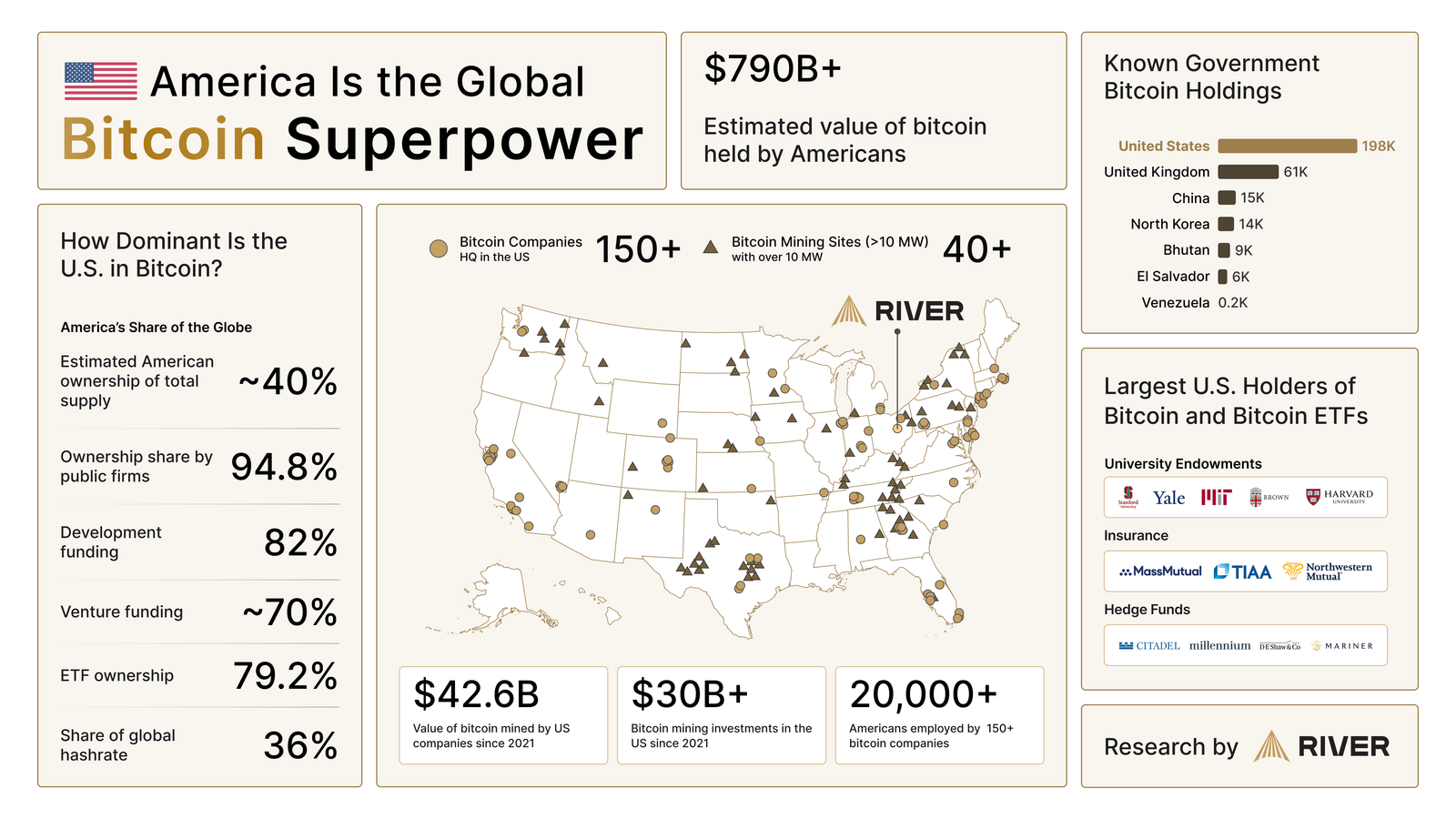

According to a May 20 report from River (a Bitcoin investment firm that probably has more digital wallets than you have socks), the US is leading the global charge in Bitcoin adoption. With serious investments and infrastructure, America’s love affair with Bitcoin is official. The fact that Bitcoin now outshines gold in American portfolios is less a blip and more a seismic shift—like swapping your grandma’s fruitcake for a shiny new air fryer.

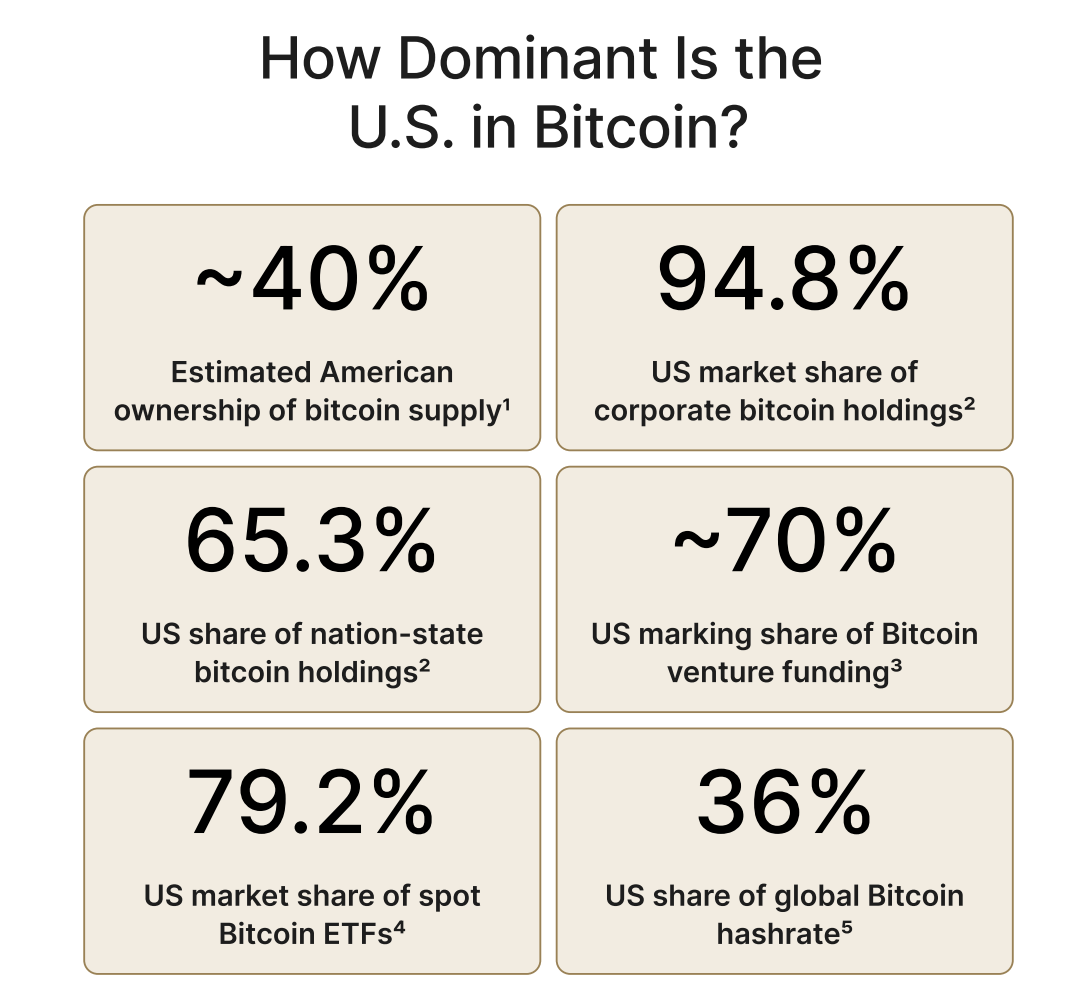

The report also points out that the US isn’t just keeping up—it’s sprinting ahead. Forty percent of all global Bitcoin companies call the US home, and American firms hold a whopping 94.8% of all Bitcoin owned by publicly traded companies worldwide. That’s not just dominance; that’s showing up to the gold rush with a spaceship.

This all reflects America’s full-throttle investment in Bitcoin infrastructure, from scrappy startups and ETFs to policies that make cryptocurrency feel less like the Wild West and more like Wall Street with better Wi-Fi.

Another eyebrow-raising tidbit: Bitcoin is now being considered as the modern reserve asset, elbowing gold out of its comfy seat. River’s report calls Bitcoin an “underestimated pillar” of American economic muscle—imagine Arnold Schwarzenegger in digital form, flexing on Wall Street.

With Americans holding $790 billion worth of Bitcoin, it’s no longer just an investment—it’s woven into the nation’s economic plans and financial systems like avocado in a Californian’s breakfast.

“Bitcoin is an underestimated pillar of American dominance. Americans have a larger estimated share of the bitcoin supply than of global wealth, GDP, or gold reserves.” River stated

Confidence in Bitcoin keeps growing, thanks to perks like easy digital storage (no need for a vault or a pirate map) and the tantalizing idea that the US might one day create its own strategic Bitcoin reserve—because nothing says “future-proof” like a digital piggy bank endorsed by politicians.

Moody’s recent downgrade of US credit ended a century-long streak of top ratings, making Bitcoin look even shinier as a hedge against fiscal wobbles. Gold, meanwhile, is probably polishing itself and muttering about “the good old days.”

Of course, this digital gold rush isn’t without its quirks. Bitcoin’s price can swing faster than a caffeinated squirrel, so some investors are understandably cautious. But with heavyweights like BlackRock backing it and regulations getting clearer by the day, Bitcoin is settling into its role as America’s favorite new asset—at least until someone invents quantum money or time-travel stocks. 🕰️🚀

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- All 6 ‘Final Destination’ Movies in Order

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- 30 Best Couple/Wife Swap Movies You Need to See

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

2025-05-21 17:15