As a seasoned analyst with over two decades of experience in financial markets, I’ve seen my fair share of bubbles and corrections. The recent surge of Bitcoin past $100,000 has certainly caught my attention, but it also sets off a few alarm bells.

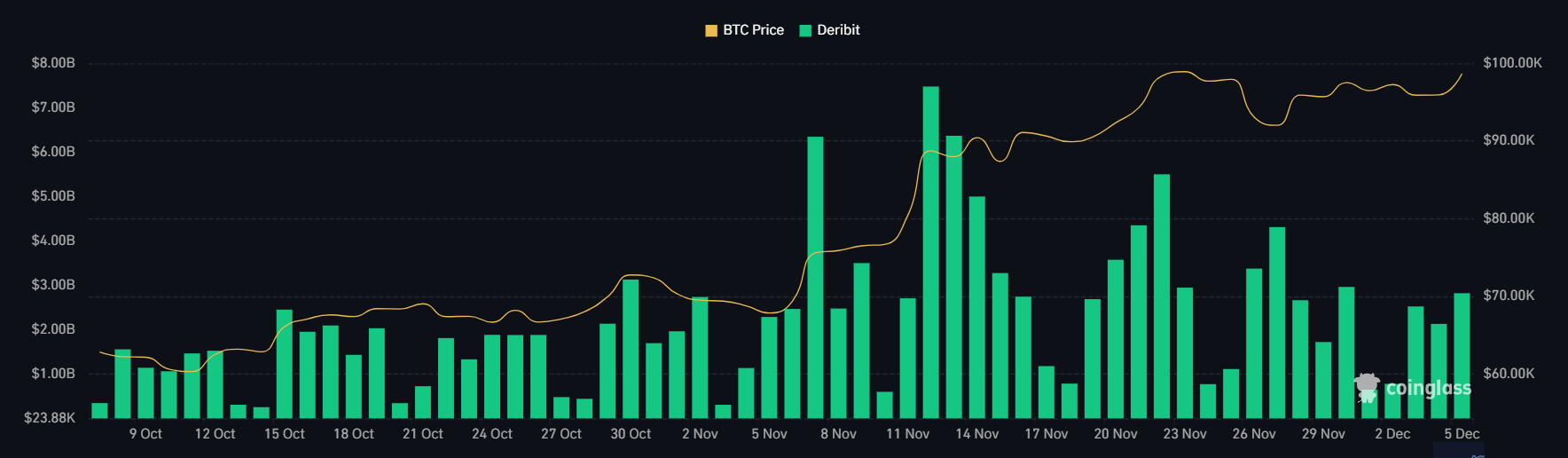

The spike of Bitcoin above $100,000 has caused some options traders to protect themselves from possible losses. There’s been an increase in the interest for put options, which enable holders to sell at a predetermined price within a defined period.

This signals a cautious sentiment despite the cryptocurrency’s recent rally.

Demand for Hedging Bitcoin Options Has Increased over 24 Hours

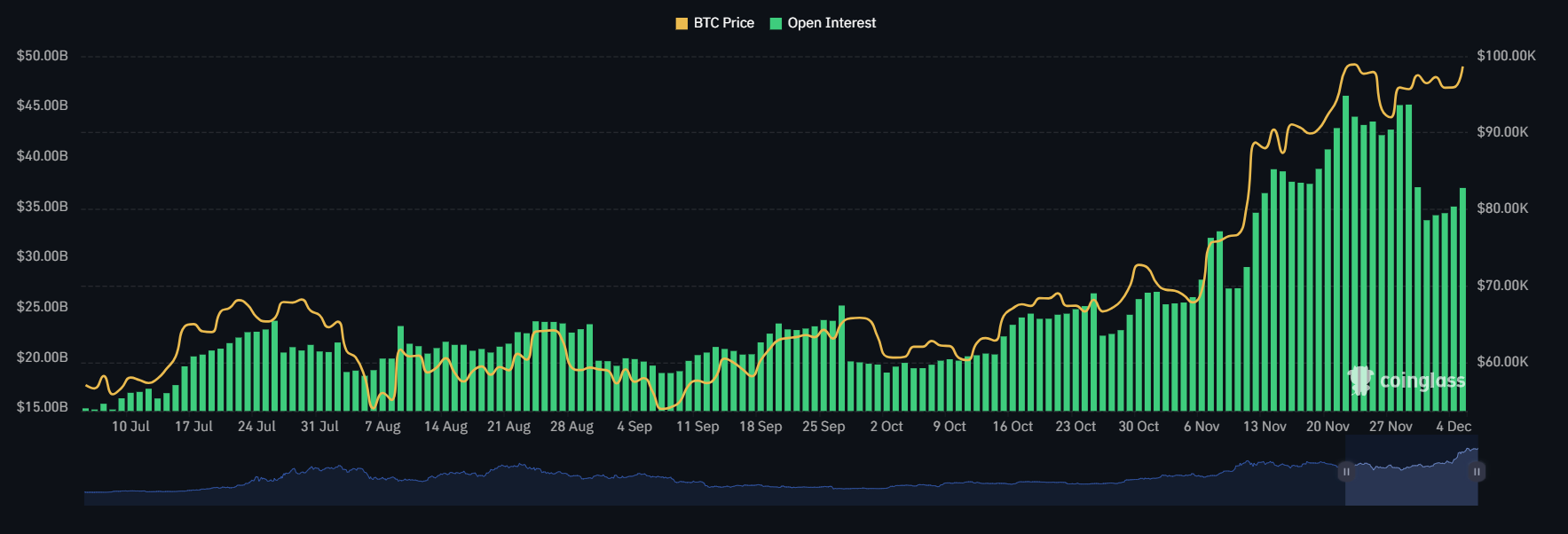

In the last 24 hours, data from Coinglass shows that the options with a strike price of either $95,000 or $100,000 have garnered the most activity in terms of open positions.

Moreover, there’s been a rise in requests for options with lower exercise thresholds, such as $75,000 and $70,000. A significant number of these contracts are focused on maturities around early 2025.

On the other hand, the overall put open interest on the Bitcoin options exchange Deibiti is noticeably less compared to the call options with the same expiration date.

On Wednesday, Bitcoin reached an all-time high of $100,000, propelled by enthusiasm stemming from President-elect Donald Trump’s choice for a pro-cryptocurrency SEC chair and Russian president Vladimir Putin’s backing of the digital currency. This recent increase in value builds upon Bitcoin’s approximately 50% growth since the election and continuous inflows into Bitcoin ETFs, further strengthening its position in the market.

Currently, traders are seizing the opportunity provided by Bitcoin’s upward trend by increasing their optimistic bets using leveraged positions. Notably, the funding rate, which gauges leverage in the cryptocurrency market, is approaching a record peak.

This rate indicates the price premium that traders are ready to accept when investing in continuous future contracts about Bitcoin’s price movement, which is a widely-used strategy for boosting directional wagers on Bitcoin’s price changes.

A Short-Term Pullback?

Historically, it’s common for market corrections to follow periods of increased funding rates. Bitcoin has begun to show signs of weakening, with its price dropping by 3% within the past hour and currently trading above $98,000. This trend resembles past bull markets, where significant growth was followed by phases of consolidation or retreat.

As I analyze the current market trends, I’ve noticed that the relative strength index (RSI) of Bitcoin has dipped to around 53. This RSI, which gauges the rate and amplitude of price fluctuations, suggests that despite recent price movements, Bitcoin might be experiencing a slight downtrend.

As a crypto investor, I’m observing that the reading of 53 suggests a neutral stance for Bitcoin right now. It’s neither in an overbought state (above 70) where the price is excessively high due to excessive buying pressure, nor oversold (below 30) where it’s undervalued because of excessive selling pressure. This level of 53 indicates a balanced market sentiment, meaning there’s no strong push in either direction for buying or selling.

Based on other market influences, traders could view this as a temporary halt in progression, possibly indicating a period of lateral movement or uncertainty about the immediate future direction.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2024-12-06 00:27