Bitcoin (BTC) has had its moments of glory, having surged higher following the recent FOMC meeting, but now it’s looking a little worse for wear. It’s dropped nearly 3% in the past 24 hours. The price seems to be under a bit of a struggle, unable to break past that pesky resistance level. Short-term momentum? Well, let’s just say it’s starting to take a nap. 💤

Technical indicators, including the trusty Ichimoku Cloud and EMA lines, are sending us not-so-encouraging postcards suggesting that BTC might have a few challenges ahead. Meanwhile, the whales have stopped their feeding frenzy and are now simply lounging about, having accumulated a healthy amount of BTC. This raises the burning question: Can BTC muster enough strength to rise above its current price range this month, or will it just keep moping along? 🤔

BTC Ichimoku Cloud Shows Some Clouds on the Horizon 🌩️

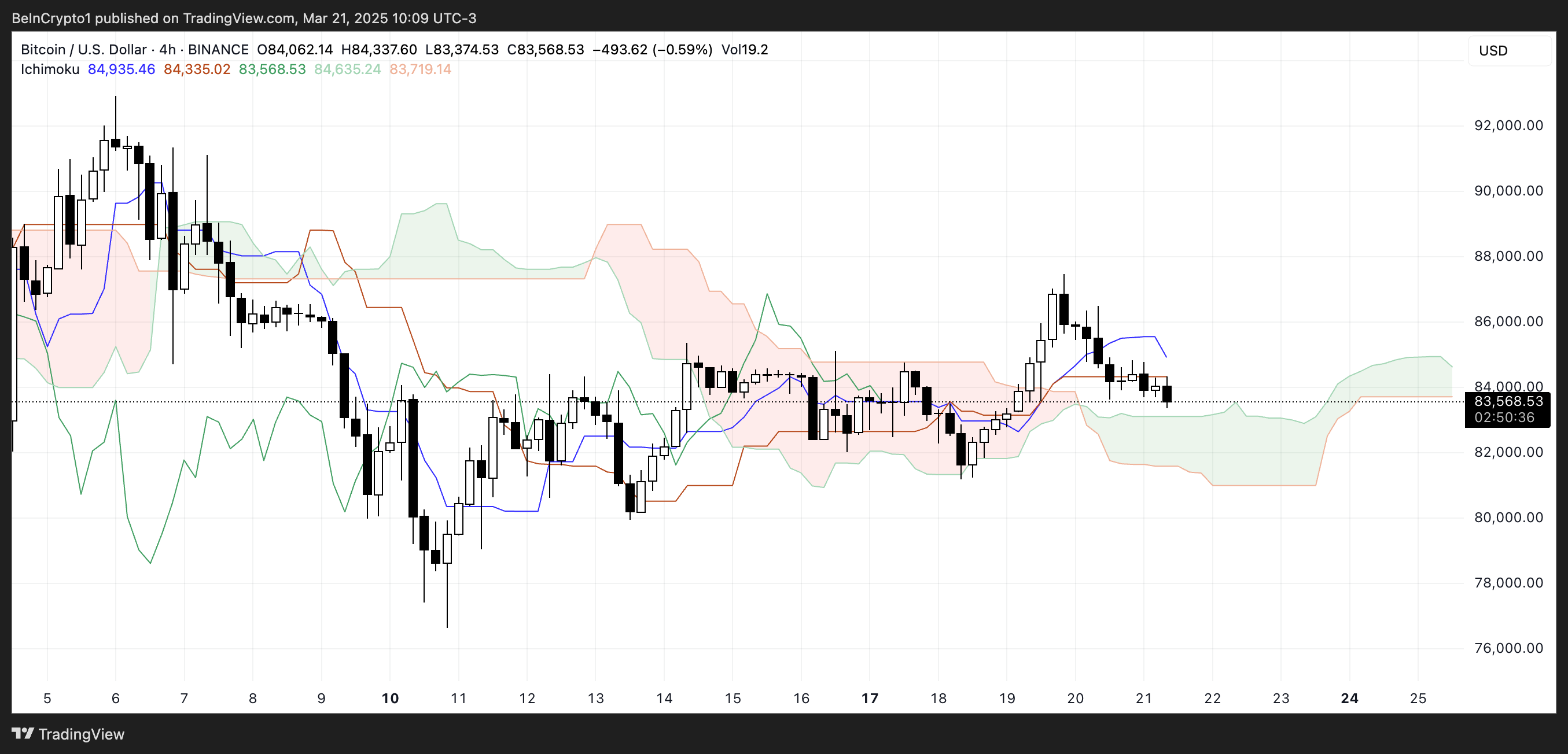

Currently, Bitcoin is flirting with the depths below the Ichimoku Cloud, a bearish move, if there ever was one. The price has dipped beneath the Tenkan-sen (that’s the blue line, in case you were wondering) and Kijun-sen (the red one), which only adds more weight to the downside pressure. It’s like watching a balloon slowly deflate—hopeful, but not promising. 🎈

The cloud ahead looks about as inviting as a soggy blanket—thin and flat, suggesting we’re in for either a slow drift sideways or a further dip into bearish territory unless the price can somehow gather enough gumption to rise again. But honestly, don’t hold your breath. 😬

Even the Lagging Span (that’s the green line, for those keeping track) is hanging out below the price action and the cloud, confirming that bearish sentiment is firmly in the driver’s seat. However, there’s a sliver of hope: the price is approaching the cloud’s lower boundary, which could act as a makeshift support. 🛑

If buyers don’t show up to defend this level, it’s downhill from here. But if they somehow manage to push the price back above the Tenkan-sen and Kijun-sen, we might just be looking at an early sign of recovery. Don’t get too excited though, because that cloud resistance above is one serious hurdle. 🚧

Bitcoin Whales: The Calm After the Feeding Frenzy 🐋

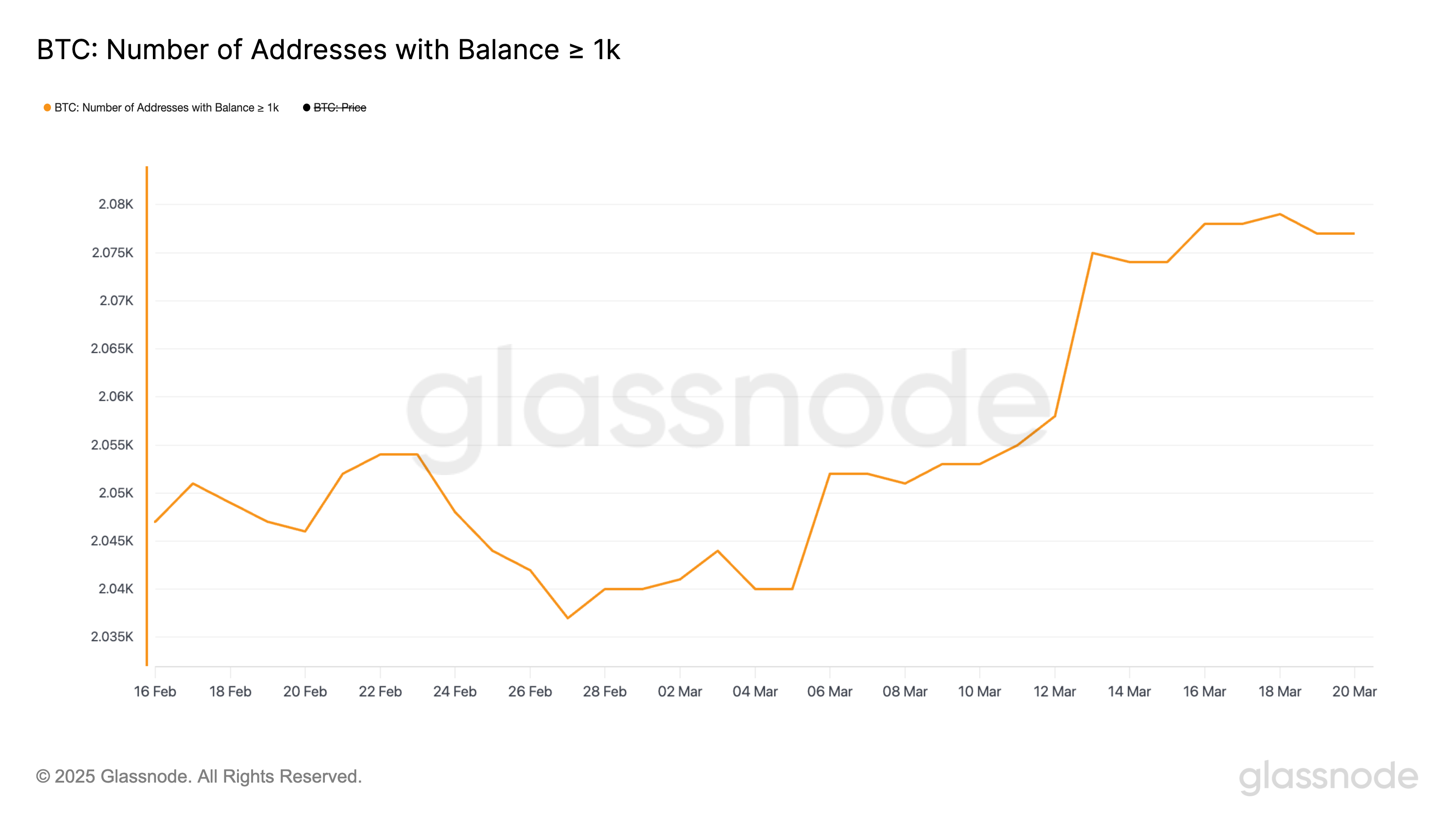

The number of Bitcoin whales has surged, with wallets holding at least 1,000 BTC climbing from 2,040 on March 5 to 2,079 by March 18—basically the highest point since mid-December 2024. It’s like a bunch of rich folks suddenly realized they were on the right yacht and decided to throw a party. 🎉

But now, the party’s over. The number has stabilized at 2,077, suggesting that the feeding frenzy has slowed down. The whales are lounging now, but don’t let that fool you. When they move, things move—dramatically. 🚀

Whale activity is worth keeping an eye on, as these massive holders can influence Bitcoin’s price more than a tea kettle on a hot stove. A rising number of whales could point to increasing confidence among major investors, which, in turn, might lead to a price surge. 🤑

The recent uptick in whale addresses might mean that institutional or high-net-worth investors are quietly getting ready for the next big move, whether that’s a price rally or just a pause to stock up during dips. We’ve seen a bit of both in recent weeks, haven’t we? 😏

Can Bitcoin Break $90,000 In March? Or Is It Just a Dream? 💭

Bitcoin’s price is currently stuck between a rock and a hard place—resistance at $85,124 and support at $81,187. The EMA lines are so close together they might as well be holding hands, making it hard to predict the next move. The FOMC-induced price spike has already started to lose steam, aligning with Nic Puckrin’s rather pessimistic prediction: this rally may not have legs. 👀

“The slight ‘Powell pump’ we saw in crypto markets after the FOMC meeting has brought Bitcoin back above its 200-day moving average, which is certainly a bullish sign. Whether it can continue on this trajectory, however, is another question. If BTC does continue its current surge, a key resistance level to watch will be around $92,000-$93,000. If it manages to break out above this, we could see it extend the rally toward its previous all-time high. However, there is likely too much uncertainty in markets to provide the necessary support for such a move,” Puckrin told BeInCrypto.

If Bitcoin manages to break above the $85,000 resistance, it could surge toward $92,920 or even $96,484, should bullish momentum come roaring back. But if the $81,187 support crumbles, brace yourselves for a descent to $79,955, with the possibility of sliding all the way down to $76,642 if the bears take over. 🐻

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-03-21 18:12