As a seasoned researcher with a keen eye for market trends and a knack for deciphering their implications, I must admit that the meteoric rise of Bitcoin has left me both astounded and intrigued. The rapidity at which this digital currency is outpacing traditional financial giants like Saudi Aramco is nothing short of breathtaking.

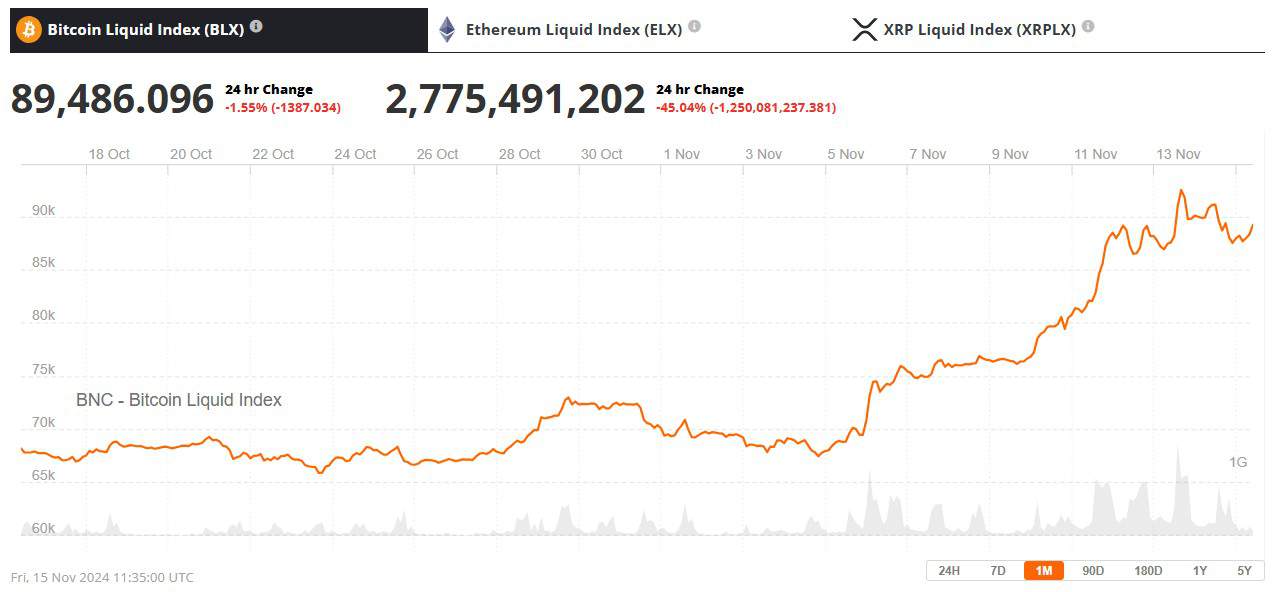

The unprecedented surge in the value of this digital currency has surpassed Saudi Aramco, the world’s leading oil producer, in market capitalization. On November 13, 2024, Bitcoin achieved a never-before-seen peak price of $93,434.36 and daily trading volumes reached an impressive $118.32 billion.

The global cryptocurrency sector has experienced remarkable expansion, currently boasting a total worth of approximately $3.02 trillion. This makes it the eighth-largest economy in terms of GDP, outranked only by the United States, China, Germany, Japan, India, the United Kingdom, and France, as indicated by data from the International Monetary Fund.

As a crypto investor, I’ve noticed that Bitcoin’s surge has been parallel to an increase in institutional trading activity. To put it into perspective, Binance, the leading cryptocurrency exchange, has handled over $7.4 billion worth of Bitcoin/USDT trades within just 24 hours. Meanwhile, Coinbase, a prominent U.S. exchange, has facilitated over $3.4 billion in Bitcoin transactions during the same timeframe. This indicates a growing interest and activity in the Bitcoin market from both individual and institutional investors.

Standard Chartered Investment Bank has dared to forecast a significant expansion for the cryptocurrency market based on recent political shifts. The bank anticipates that the overall value of the crypto market could surge to an impressive $10 trillion by 2026, in the wake of the Republican victory in the U.S. elections.

Given the increasing likelihood of a Republican victory in the upcoming U.S. election, Geoff Kendrick, Head of Digital Assets Research at Standard Chartered, predicts we’ve stepped into a ‘crypto summer.’ The bank proposes that favorable government actions could potentially quadruple the market value over the next few years.

Should Bitcoin attain its predicted values, its overall worth could soar beyond a staggering $4.3 trillion, surpassing the British pound‘s total money supply in circulation. As of now, Bitcoin trails behind gold ($17.1 trillion), Nvidia ($3.5 trillion), Apple ($3.4 trillion), Microsoft ($3.1 trillion), and Amazon ($2.25 trillion) in terms of market capitalization.

As an analyst, I’m observing that the current circulating supply of Bitcoin stands at approximately 19.78 million, nearing its maximum cap of 21 million coins. The market data suggests robust liquidity across prominent exchanges, with significant trading depth on both buy and sell sides, indicating a vibrant and active market.

In his current role as the 47th President of the United States, Donald Trump has become a vocal advocate for cryptocurrencies. During his campaign, he expressed intentions to establish a “strategic national Bitcoin reserve.” This represents a notable change from his earlier views on digital assets, where he cautioned that if the U.S. fails to adopt cryptocurrency and blockchain technology, other nations, particularly China, might take the lead, potentially dominating the global landscape.

The overall value of the cryptocurrency market has surged past $650 billion and reached an impressive $3.2 trillion since the election, mainly due to investor optimism about potential supportive crypto regulations from the newly elected administration.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2024-11-15 14:48