On April 9, 2024, in an interview with Sonali Basak from Bloomberg TV, Marathon Digital CEO Fred Thiel discussed his comprehensive understanding of Bitcoin mining’s changing terrain and predicted consequences of the approaching Bitcoin halving, estimated to occur around April 20.

Impact of Bitcoin ETFs and Price: Thiel is convinced that the United States Securities and Exchange Commission (SEC) giving the green light to Bitcoin spot ETFs in January has had a substantial impact on the cryptocurrency market. In his opinion, this approval has drawn substantial investment into the market, possibly advancing the price increase usually observed around six months after a halving event. He stated, “The approval of these ETFs, which has proven to be highly successful, has attracted investments and essentially brought forward the anticipated price surge that typically occurs three to six months following a halving.”

Marathon’s Strategic Shifts: In preparation for the upcoming Bitcoin halving, Marathon Digital has made some strategic changes to enhance operational control. Previously, the company relied heavily on external infrastructure services. However, Marathon is now taking ownership of over 53% of its mining facilities, marking a shift towards a more hands-on approach. By doing so, they aim to cut costs and boost efficiency by eliminating intermediaries from the equation.

Mining Costs and Productivity: According to Thiel, Marathon’s expense for mining a single Bitcoin hovers around the lower end of $20,000, considering both energy costs and other operational expenses. After the halving event, he expects this cost to roughly double as a result of heightened energy consumption needed for each new Bitcoin creation. However, the unaltered personnel-related operational costs remain in place.

Moving forward, Thiel announced Marathon’s intentions to broaden its horizons through international expansion. This strategic move aims to add diversity to Marathon’s operational landscape and minimize reliance on any specific geopolitical region. Moreover, Thiel highlighted the significance of Marathon’s investment in a comprehensive technology infrastructure and advanced cooling technologies. These investments could potentially yield benefits beyond cryptocurrency mining.

Sustainability and Long-Term Perspective: During the interview, there was a considerable discussion about the sustainability aspect of mining activities. Thiel proposed an innovative idea called “energy harvesting.” This method taps methane gas from landfills, biomass from diverse industrial processes, and other resources to fuel mining operations. The benefits are twofold: not only does it decrease energy expenses but also utilizes the heat produced during mining for industrial purposes. As a result, crypto mining and various industries can coexist harmoniously, fostering mutual advantages.

Effects of the Bitcoin Halving: The Bitcoin halving will decrease the daily production of new coins, posing both threats and chances for the mining community. According to Thiel, this event will decrease the number of newly minted Bitcoins by approximately 450 per day, which could cause minor price fluctuations. However, Thiel expressed optimism among miners, as the price has risen prior to the halving instead of declining, a rare occurrence. Inefficient miners might face challenges and potential acquisitions or mergers within the industry, leading to further consolidation. Additionally, surviving firms are expected to invest in technological advancements and operational optimizations to stay competitive.

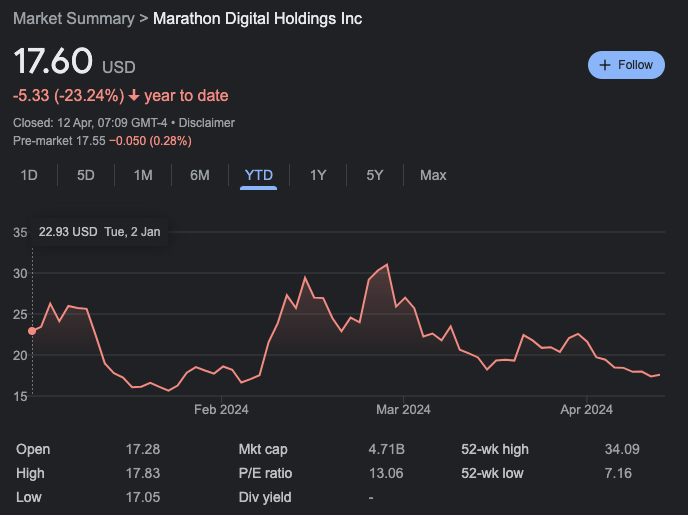

April 11, 2024: The price of Marathon Digital’s shares finished at $17.60, marking a 23.24% decrease from the beginning of the year.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- All 6 ‘Final Destination’ Movies in Order

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2024-04-12 14:30