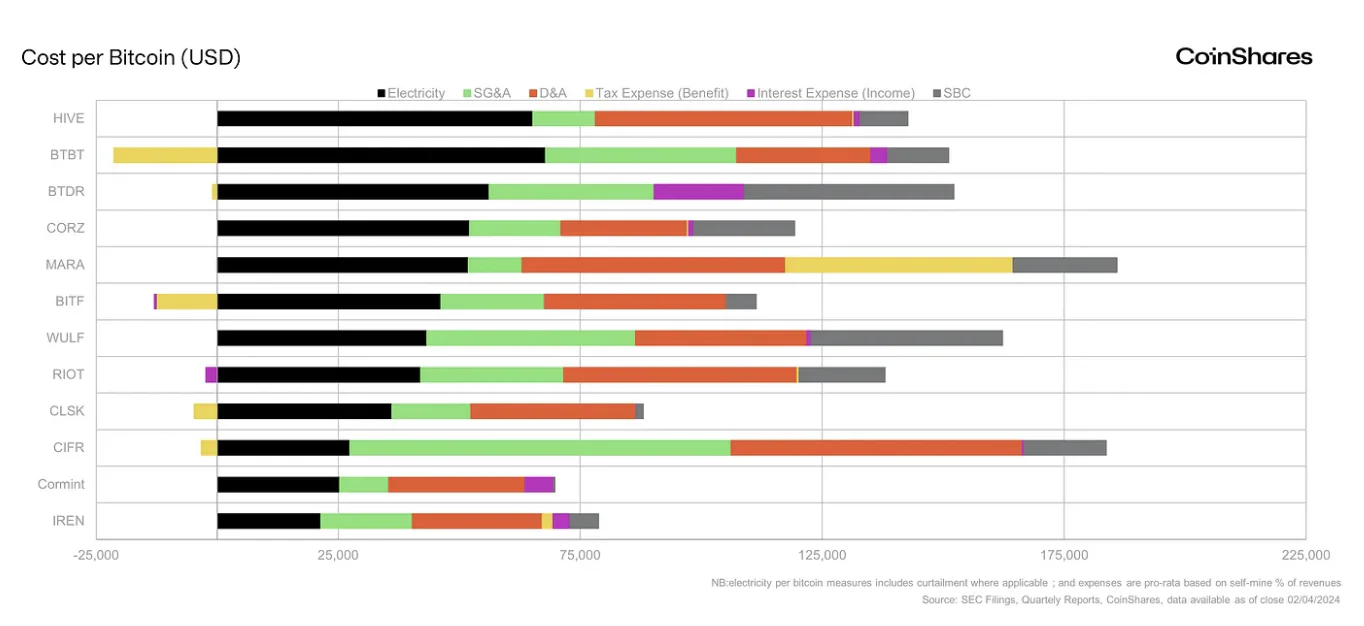

In the bleak and unforgiving world of public miners, the cost of coaxing a single Bitcoin into existence soared to a staggering $82,162—a brutal 47% leap from the last quarter, as if the machines themselves demanded richer offerings for their endless toil.

CoinShares, ever the bearer of grim tidings, unmasked the culprits behind this monstrous climb: armies of new hardware dumped into the fray like desperate gamblers doubling down, taxes looming like vultures ready to feast, and phantom burdens—depreciation and stock-based pay—that suck the marrow dry without a sound.

Strip away Hut 8 Mining’s tax drama, a beast of its own with claws digging $93 million deep, and the pure cash cost for others still drags the lungs at $75,767 per coin. But toss in all the invisible debts and smoke, and the grand total swells grotesquely to $137,018 for a Bitcoin, more than a thief would dare ask on a dark street.

The Taxman Cometh and Hardware Stumbles

It appears the relentless churn of hardware upgrades and a battlefield fiercer than a Bolshevik scuffle tore into the miners’ pockets with vengeful precision. As Bitcoin’s fickle price plays its cruel game, squeezed margins mock the dream of profit like an unruly child denied candy.

Hut 8 stands out, drenched in red ink and deferred taxes—a tragic hero whose cost per Bitcoin blasted beyond $281,000! A price worthy of myth, or madness, whichever suits better.

The Desperate Dance of Efficiency

Yet miners, stubborn as ever, clutch the hope of salvation in efficiency. They scramble to load newer rigs, triple wrench their cost-cutting, and cling to optimism as Bitcoin’s price teeters upward. Like shadows chasing light, they aim to outrun the exploding costs—that relentless beast gnawing at their hopes one block at a time.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-04-26 20:45