Pray, allow me to impart upon you the latest whims of the Bitcoin realm, where the fickle fortunes of the digital purse continue to captivate and confound. The illustrious Bitcoin, once the darling of the financial ball, now finds itself in a most precarious position, struggling to reclaim the lofty heights of $70,000. Its price, much like a hesitant suitor, lingers in a broad range above $60,000, neither advancing nor retreating with any great conviction.

This consolidation, I daresay, is the result of a delicate dance between sellers, who seem determined to guard their resistance levels with the fervor of a dragon guarding its gold, and buyers, who appear equally resolute in their defense of lower grounds. The market, ever the observant spectator, remains in a state of cautious equilibrium, its sentiment as uncertain as a maiden awaiting a proposal.

A recent analysis from the esteemed CryptoQuant has shed a modicum of light on this enigmatic situation, revealing a most intriguing shift in the behavior of Bitcoin miners. These industrious souls, it seems, have been withdrawing their treasures from trading platforms at a pace that can only be described as brisk. Since the dawn of February, a staggering 36,000 BTC have been spirited away from exchanges, a figure that raises more than a few eyebrows.

Such withdrawals, one might infer, suggest a diminution in the immediate desire to part with one’s coins. Miners, those prudent souls, are oft observed moving their holdings to more secure confines when they incline toward long-term custody or alternative liquidity strategies. While this does not guarantee a bullish turn of events, it may, at the very least, alleviate the short-term pressure on spot markets, much like a well-timed intervention at a heated dinner party.

Miners’ Strategic Repositioning: A Coordinated Effort or Mere Coincidence?

The analysis further elucidates the scale and distribution of these recent withdrawals. Binance, that grand emporium of digital trade, has seen more than 12,000 Bitcoin depart its vaults, while the remaining volume-exceeding 24,000 BTC-has been dispersed across various other platforms. This broad-based movement suggests a coordinated strategy rather than the isolated actions of a single entity, hinting at a wider shift in miner liquidity management.

Such behavior is oft interpreted as a move toward longer-term storage, akin to a gentleman retiring his funds to the safety of a country estate. Miners, when less inclined to sell immediately, transfer their holdings to cold wallets, thereby reducing the supply of Bitcoin readily available on exchanges. This, I submit, may signal either increased confidence in future price appreciation or a strategic decision to manage liquidity outside the frenzied halls of active trading.

The intensity of daily withdrawals has also accelerated notably. At one juncture, more than 6,000 BTC were withdrawn in a single day, a feat not witnessed since last November. This pace, I assure you, far exceeds the activity observed in January, lending credence to the notion that miners may be entering a phase of strategic repositioning.

While not inherently bullish, sustained exchange outflows from miners can contribute to tighter spot supply conditions, potentially influencing price stability and market sentiment over time. It is, perhaps, a prudent move in an uncertain world, though whether it shall prove wise or foolish remains to be seen.

Price Lingers Below Resistance: A Tale of Structural Weakness

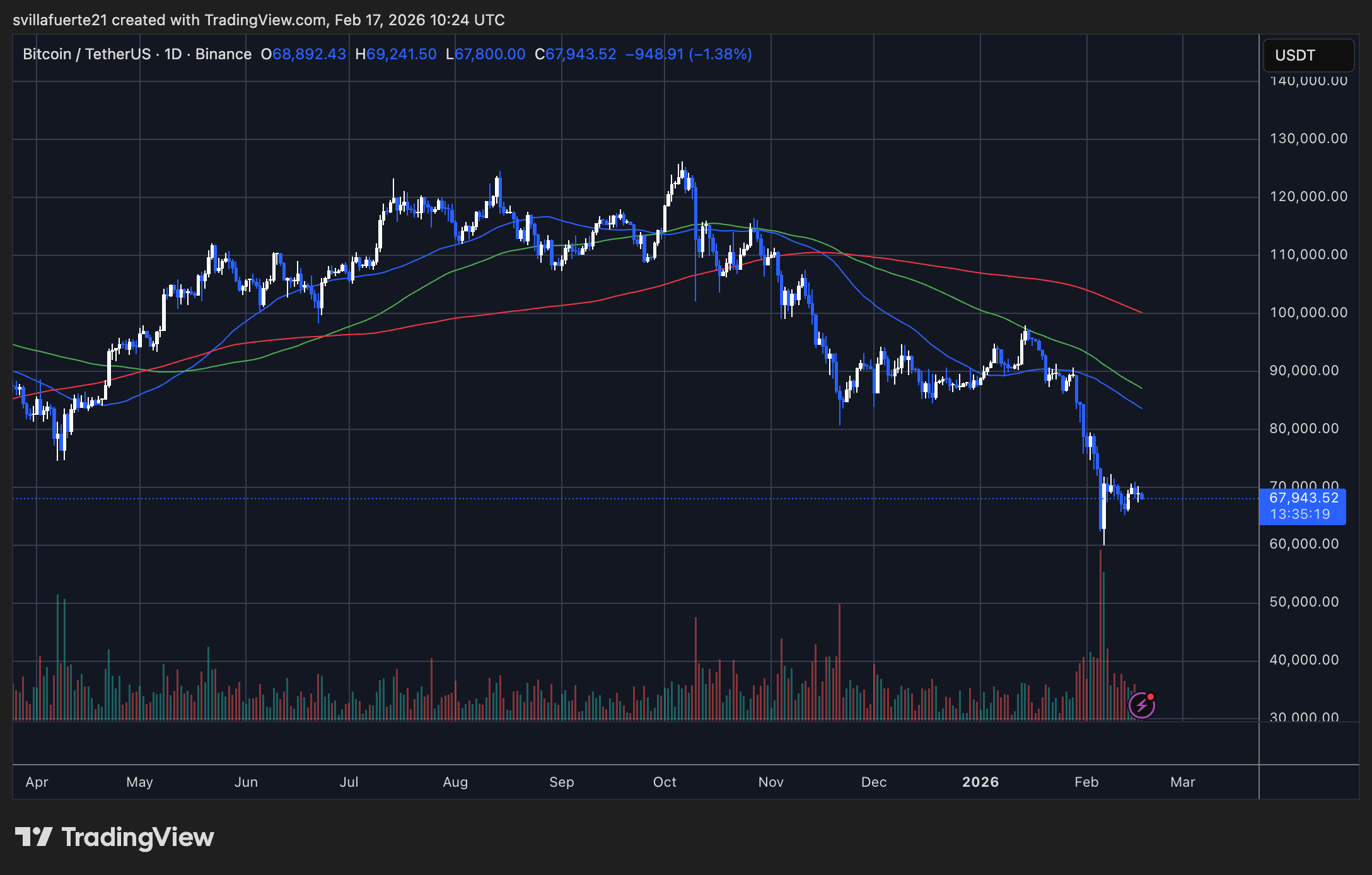

The price of Bitcoin, alas, continues to reflect a structural weakness, its chart a testament to the rejection from the late-2025 highs. Successive lower highs and lower lows remain intact, a clear indication that bearish momentum has yet to be invalidated. The recent decline toward the mid-$60K range appears to be stabilizing temporarily, yet the price has not reclaimed any major technical resistance levels, much like a guest who lingers at the edge of the ballroom, hesitant to rejoin the dance.

The moving average structure reinforces this view. The price remains below key trend indicators, which slope downward and act as dynamic resistance. This alignment, I fear, typically reflects sustained selling pressure rather than a completed correction. Until Bitcoin reclaims these averages convincingly, upside recoveries are likely to face repeated selling interest, much like an unwelcome suitor at a society gathering.

Volume behavior, too, warrants attention. The sharp spike accompanying the recent drop suggests forced selling or panic-driven liquidation, rather than orderly distribution. However, the subsequent reduction in volume during consolidation indicates that aggressive sellers may be temporarily exhausted, though not necessarily absent. It is, perhaps, a momentary reprieve in a longer drama.

From a technical standpoint, the $60K-$65K zone is emerging as an important short-term support area. A sustained breakdown below it could open the door to deeper downside, while a recovery above the $70K region would be required to weaken the current bearish structure and signal potential stabilization. Until then, we must remain vigilant observers of this digital saga, ever prepared for the next twist in the tale.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Where to Change Hair Color in Where Winds Meet

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

2026-02-18 07:51