- March was a rough month for Bitcoin miners – profitability took a nosedive by7.4%. Thanks, Jefferies, for the buzzkill.

- Why the drop? Oh, just a casual11.2% dip in Bitcoin prices and a9.1% cut in those sweet, sweet transaction fees. 🤑 → 😭

- But wait, there’s a silver lining! Bitcoin’s kicking the stock market’s butt in April. Take that, S&P500! 😎

So, Jefferies dropped the bomb: Bitcoin mining profitability took a7.4% hit in March. 📉

Turns out, a double whammy of an11.2% price plummet and a9.1% slash in transaction fees was the culprit. Ouch.

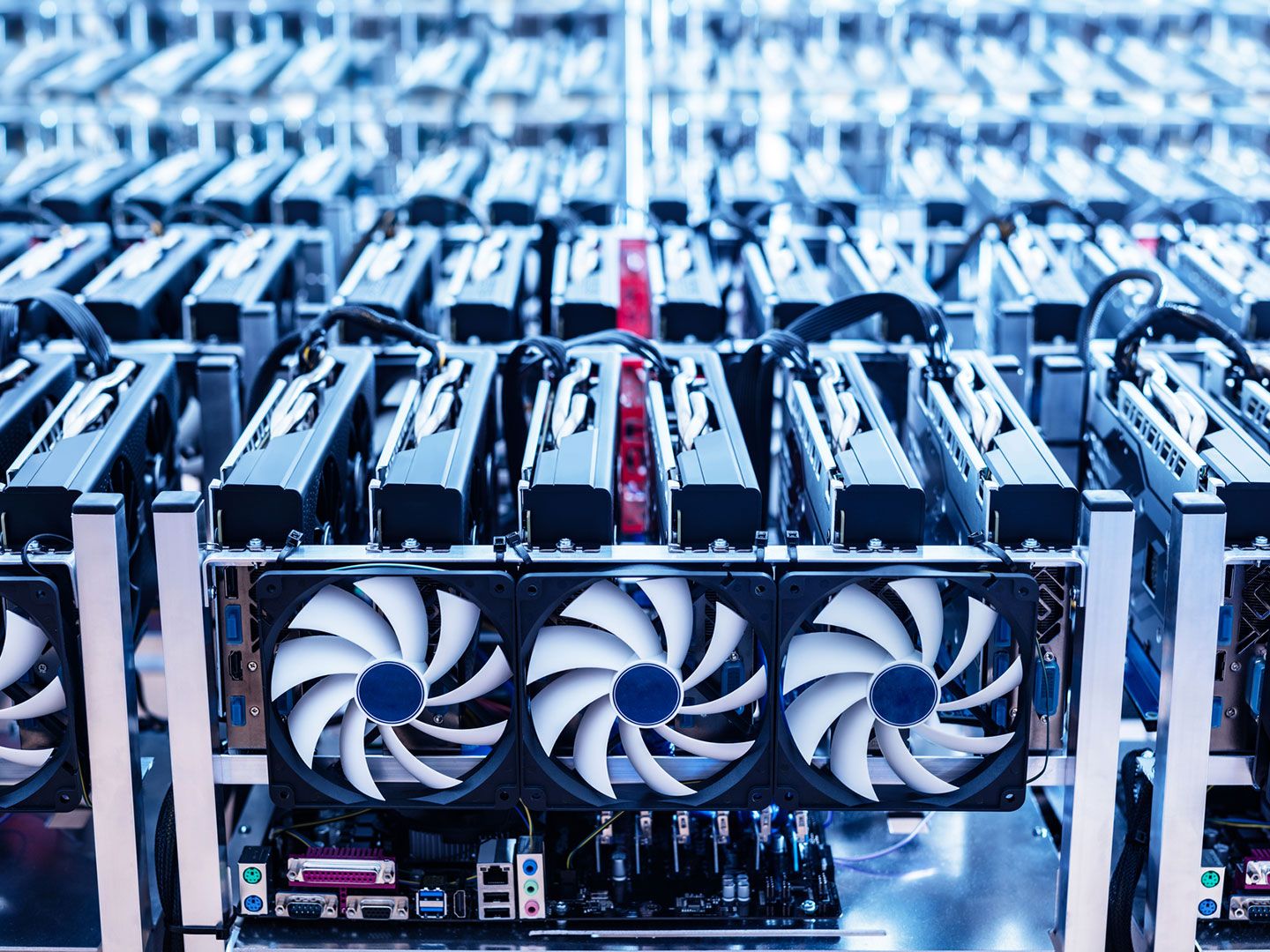

But hey, U.S. miners didn’t let that stop them. They cranked out3,534 bitcoins in March, a step up from February’s3,002. They’re practically the Avengers of the mining world, making up nearly25% of the network. 🦸♂️

MARA Holdings took the crown with829 bitcoins, with CleanSpark right behind at706 BTC. MARA’s also flexing the biggest muscles in the hashrate department, boasting54.3 exahashes per second. CleanSpark’s no slouch either, at42.4 EH/s. 💪

Fast forward to April, and Bitcoin’s holding its ground while the S&P500 takes a tumble. Jefferies suggests the dollar’s not feeling too hot, and that might be why Bitcoin’s looking so good right now. In your face, traditional finance! 🚀

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Gold Rate Forecast

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2025-04-14 17:42