As a seasoned crypto investor with a decade of experience under my belt, observing the current trend in miner reserves feels like watching a rollercoaster ride – exhilarating yet nerve-wracking at times. The recent plunge in Bitcoin miners’ reserves to levels not seen since early 2021, when BTC skyrocketed from $25k to over $69k, is a stark reminder of the volatile nature of this digital gold rush.

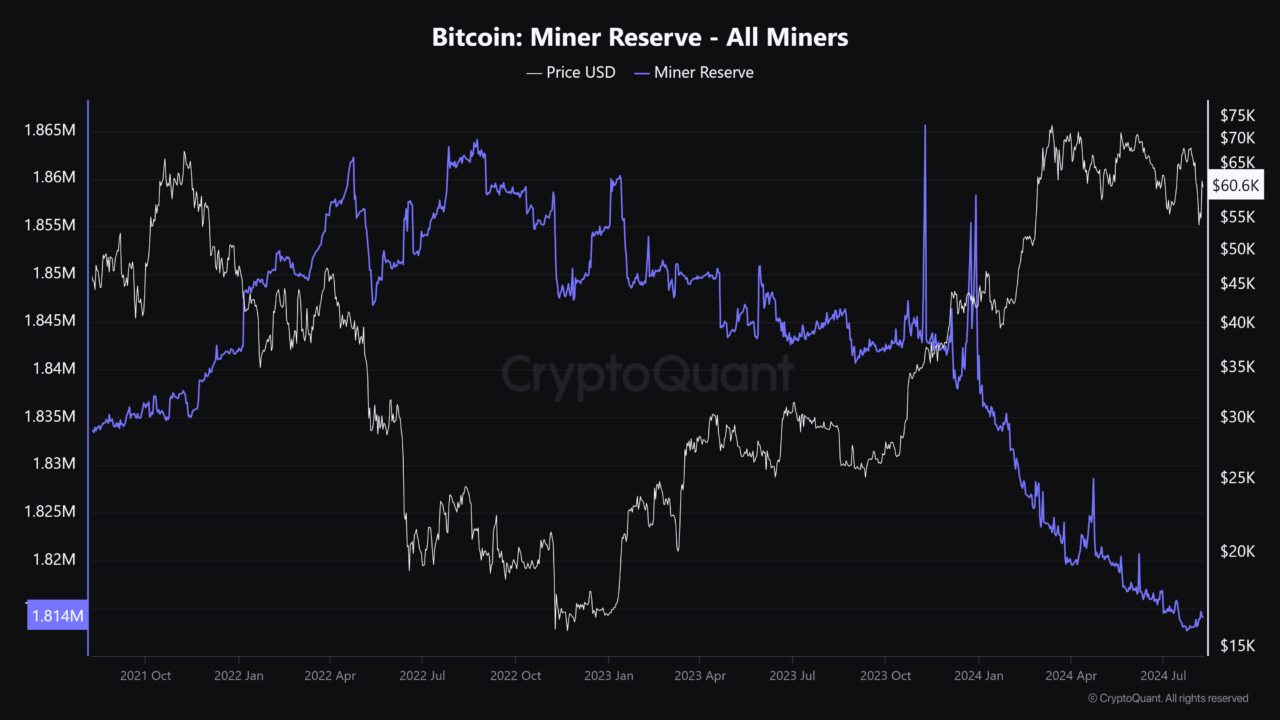

Over the past few months, Bitcoin miners have noticeably decreased their Bitcoins holdings, reaching levels not seen since January 2021. This was a period when the value of Bitcoin skyrocketed from approximately $25,000 to over $69,000 before it began a decline.

Due to the recent halving event in April, the quantity of Bitcoins owned by miners has dropped to its lowest point in three years. This decline is attributed to the reduction in the reward for discovering a new block, which was cut in half during this upgrade.

Based on data from Kaiko as reported by Bloomberg, miners currently hold approximately 1.5 million Bitcoins, valued at around $86 billion. Since the cryptocurrency market experienced a surge in late 2023, miners have been observed selling tokens regularly. The income generated from these sales is typically channeled towards financing their ongoing operations.

According to data from the cryptocurrency analytics firm CryptoQuant, it appears that there’s been a significant decrease in miner reserves, indicating roughly 1.8 million Bitcoins are being held.

Contrary to the general trend, companies such as CleanSpark and Riot Platforms, which are publicly traded mining firms, have boosted their Bitcoin holdings by approximately 60% since the beginning of this year, based on SEC filings. Moreover, Marathon Digital Holdings has recently pumped in $100 million into cryptocurrency investments.

Nevertheless, the wider sector is experiencing strain, as evident in Core Scientific’s substantial $804 million loss during Q2, largely attributed to the decrease in value of their financial assets.

Significantly, the amount of Bitcoin that miners hold is decreasing just as the Bitcoin price chart approaches a potential bearish trend called the “death cross.”

In simpler terms, a ‘Death Cross’ happens when a shorter timeframe moving average falls beneath a longer timeframe moving average for a specific cryptocurrency. For instance, right now, the 50-day moving average for this crypto might be going lower than its 200-day moving average.

As explained by Investopedia, the historical data of death crosses usually indicates an upcoming short-term recovery that often brings above-average gains.

Experts noted that by October 2023, Bitcoin encountered what’s known as a “death cross,” where its short-term trendline dipped beneath the long-term one. However, this situation was soon reversed as the Bitcoin price began to spike upward.

In early 2024, when Bitcoin was trading near $27,000, a “death cross” pattern emerged, which was subsequently followed by an impressive bullish trend that propelled its price to a record high of approximately $73,000. The surge in value came after the U.S. Securities and Exchange Commission (SEC) approved the launch of Bitcoin exchange-traded funds (ETFs) within the country.

Over the past month, there’s been an enigmatic purchasing frenzy in the Bitcoin market, leading to a significant accumulation of approximately $23 billion worth of Bitcoin by long-term investors. This sudden increase in demand has fueled speculation and is now shaping the formation of what’s known as a “death cross” pattern.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gold Rate Forecast

- Every Minecraft update ranked from worst to best

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2024-08-10 02:12