Oh, what a surprise! Institutions are on track to grab a whopping 4.2 million BTC by 2026, all thanks to explosive capital inflows, sovereign adoption, and those ever-so-trendy yield strategies. New research just dropped a bombshell showing the unstoppable rise of Bitcoin!

From ETFs to Sovereigns: The Crypto Odyssey for Institutions in 2026

Bitwise Asset Management and UTXO Management teamed up for the ultimate *mind-blowing* report last week, titled “Forecasting Institutional Flows to Bitcoin in 2025/2026: Exploring the Game Theory of Hyperbitcoinization.” (Phew, that’s a mouthful!) This dazzling study gives a crystal-clear view of Bitcoin’s unstoppable adoption by institutional players and the geopolitical mess that might just push demand even higher. Buckle up!

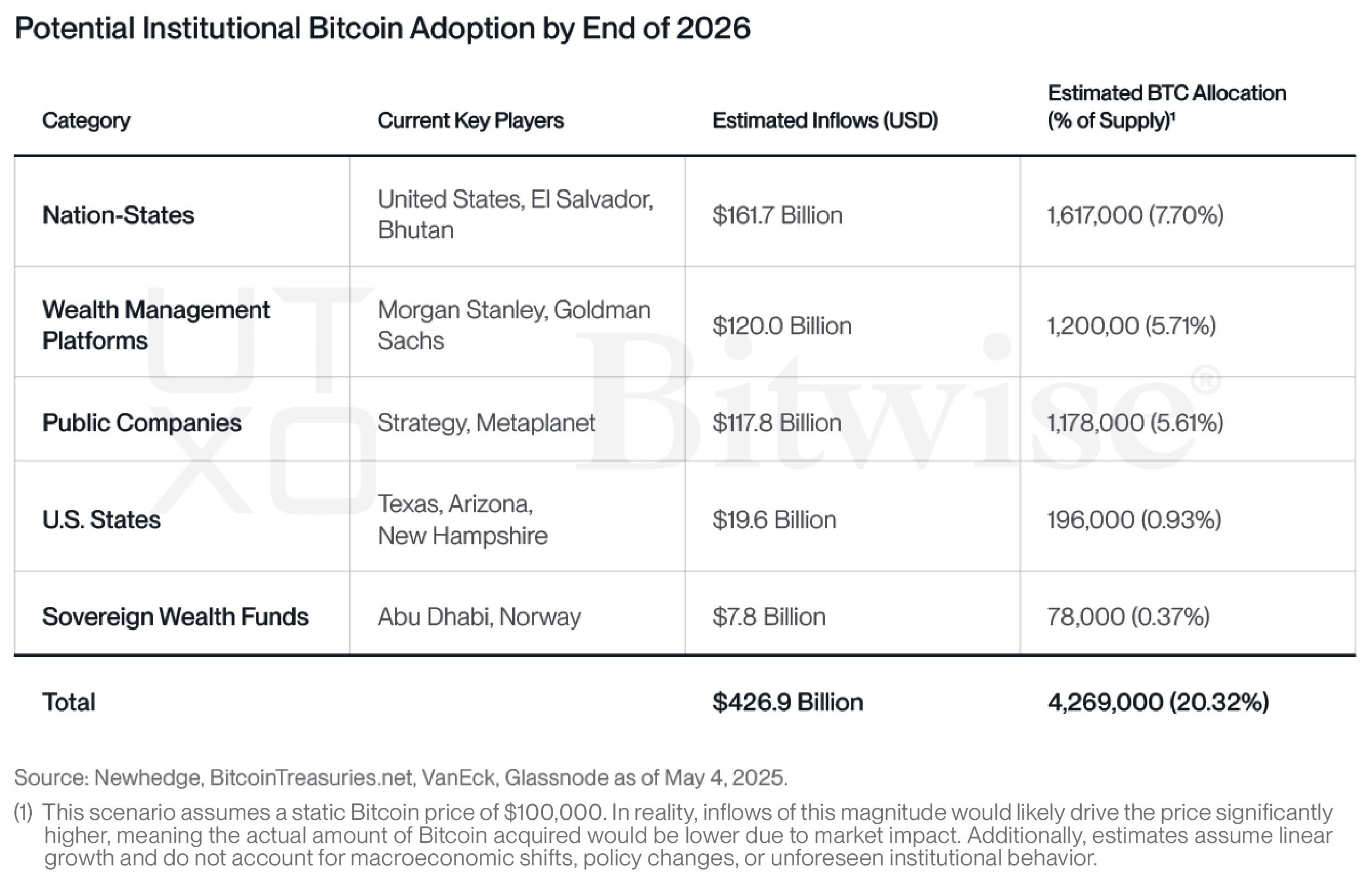

So, here’s the juicy bit: the report suggests that institutions across wealth management, corporate treasuries, and even sovereign entities are on track to snatch up more than 4.2 million BTC by 2026, assuming Bitcoin sits at a steady $100,000 price tag. The authors are predicting an evolving shift in how Bitcoin will be allocated, fueled by global conditions, new laws, and the glittering rise of Bitcoin ETFs. And the report says:

We expect ~$120 billion to flood into Bitcoin by the end of 2025 and ~$300 billion in 2026, pushing over 4.2 million BTC into the hands of a mixed bag of investors, including public Bitcoin treasury companies, sovereign wealth funds, ETFs, and even entire countries!

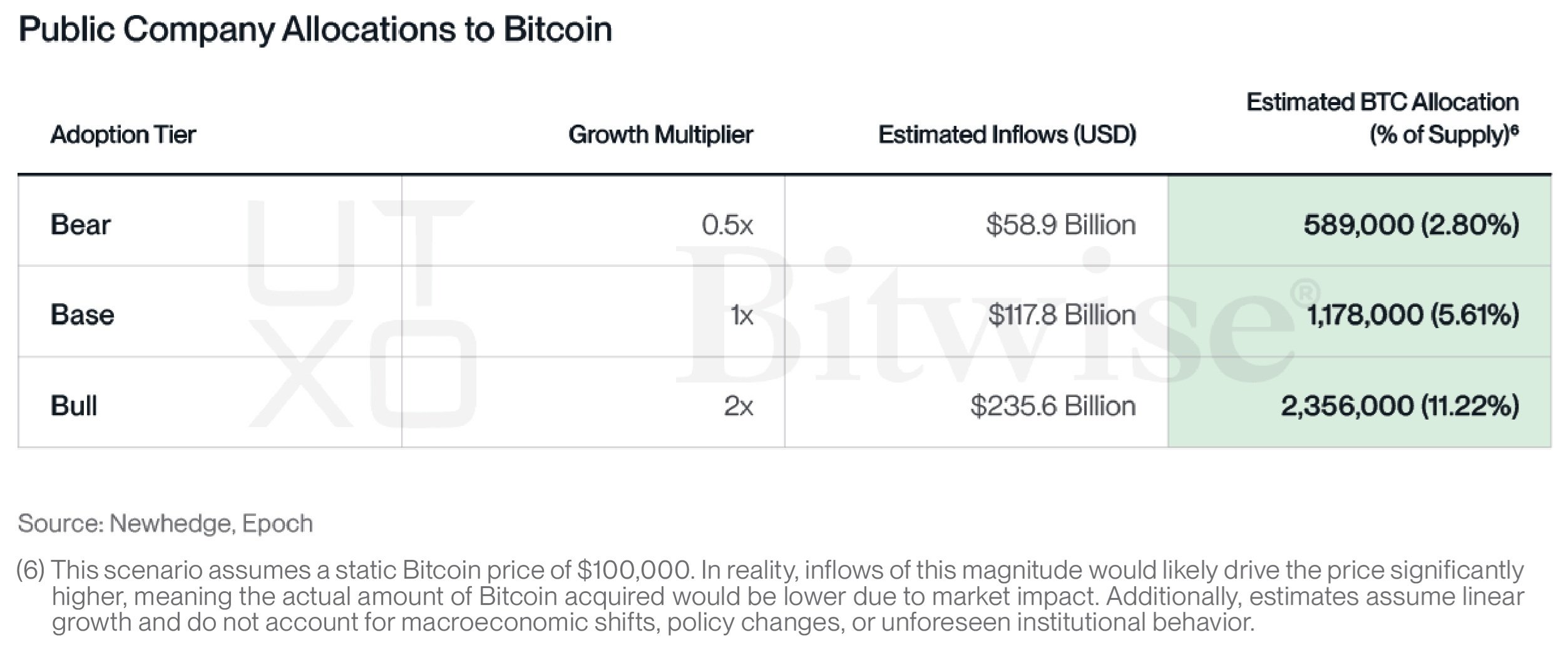

Hold on tight because public companies like Strategy, Metaplanet, and fresh faces like Twenty One are rewriting the rulebook! They’re not just holding Bitcoin as a reserve anymore – nope, they’re using it to measure how well their companies are doing. Can’t make this stuff up! The report boldly claims:

By the end of 2026, more than 1 million BTC will be hoarded under this wild new accumulation model. Who knew Bitcoin was so *hot*?

And there’s more! The report dives deep into the rise of Bitcoin-native yield infrastructure. Institutions are drooling over the opportunity to *grow* their Bitcoin holdings without selling any off. With Bitcoin Layer 2 solutions and decentralized protocols at the ready, a brand-new $100 billion market is about to pop up! Sure, there are some pesky obstacles like smart contract risks and the regulatory maze, but don’t worry, the study confirms that Bitcoin’s future as a store of value and productive asset is looking pretty darn solid.

Read More

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2025-05-26 03:59