As a seasoned researcher with over a decade of experience in the ever-evolving world of cryptocurrencies, I’ve seen my fair share of market volatility and historic milestones. The current rally of Bitcoin towards $100,000 is indeed an exciting development, but it also serves as a reminder that this industry never sleeps, and neither should we.

Bitcoin is nearing a significant historical achievement as its value approaches the sought-after level of $100,000. This impressive surge has sparked enthusiasm among investors, suggesting that Bitcoin will maintain its powerful position within the cryptocurrency sector.

As a researcher examining the Bitcoin market, I must acknowledge that while optimism prevails, Bitcoin remains vulnerable to bearish influences. The pillar of Bitcoin’s price resilience – long-term holders (LTHs) – seems to be showing signs of uncertainty, which has triggered apprehensions about potential short-term price declines.

Bitcoin’s Support Is Wavering

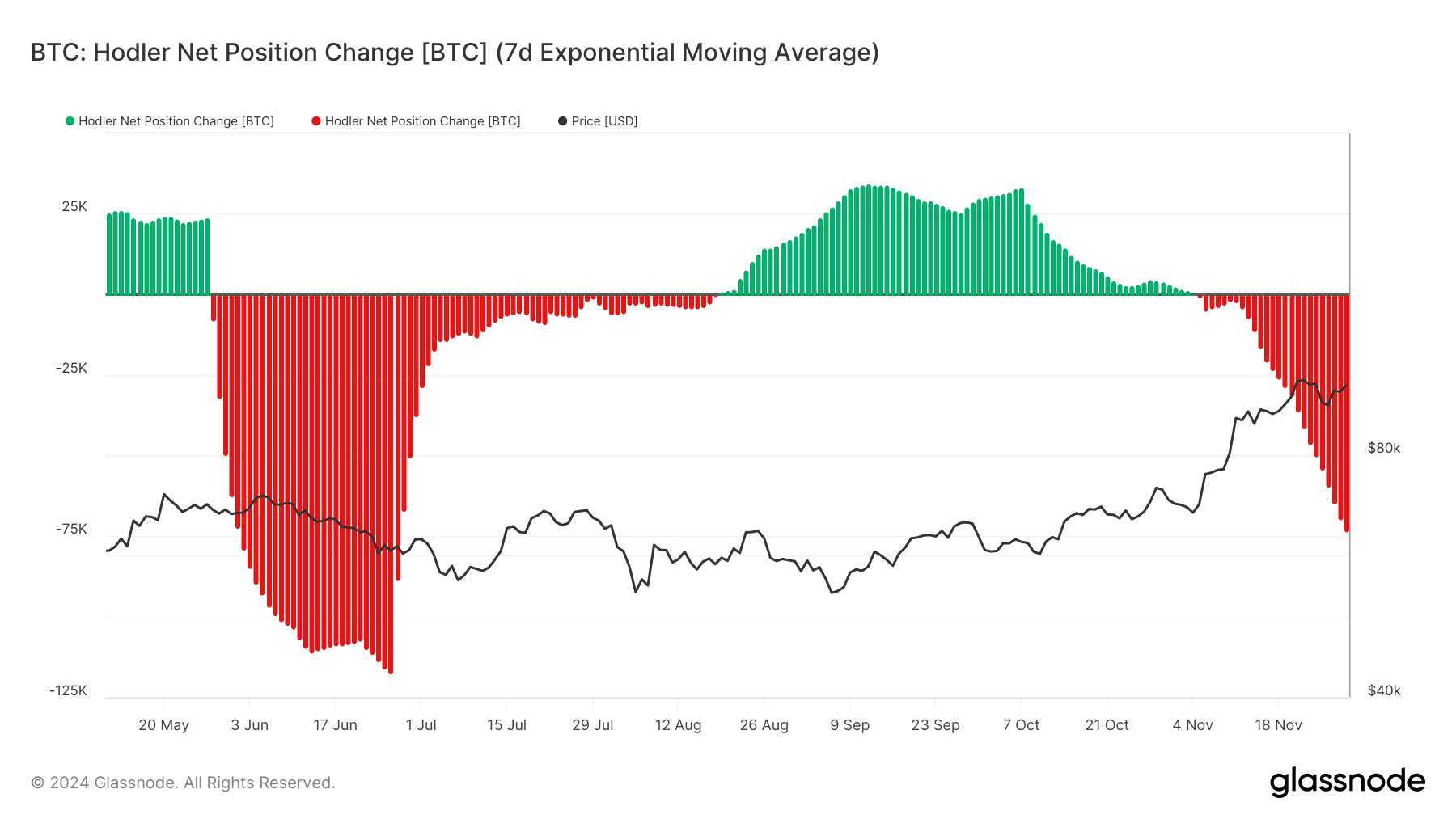

Recently, long-term Bitcoin holders have displayed a shift towards pessimism, as indicated by the Holder Net Position Change Indicator. This tool monitors the actions of these long-term holders, and it’s now showing a negative trend.

This change suggests that many long-term investors are cashing out by offloading their assets. Low values on this measure frequently indicate decreased confidence, potentially leading to downward pressure on the value of Bitcoin.

As a researcher examining the Bitcoin market, I’ve noticed that Long-Term Holders (LTHs) play a pivotal role in maintaining the price structure of Bitcoin. When these investors decide to sell, their actions could potentially interrupt the market’s momentum. These LTHs are known for keeping their assets during market ups and downs, thereby providing a level of price stability within the market.

As sales start, there may be heightened market turbulence, and if this pattern persists, it might initiate a price adjustment. The looming possibility of increased selling pressure is a factor that Bitcoin investors are keenly observing, given the approaching $100,000 mark.

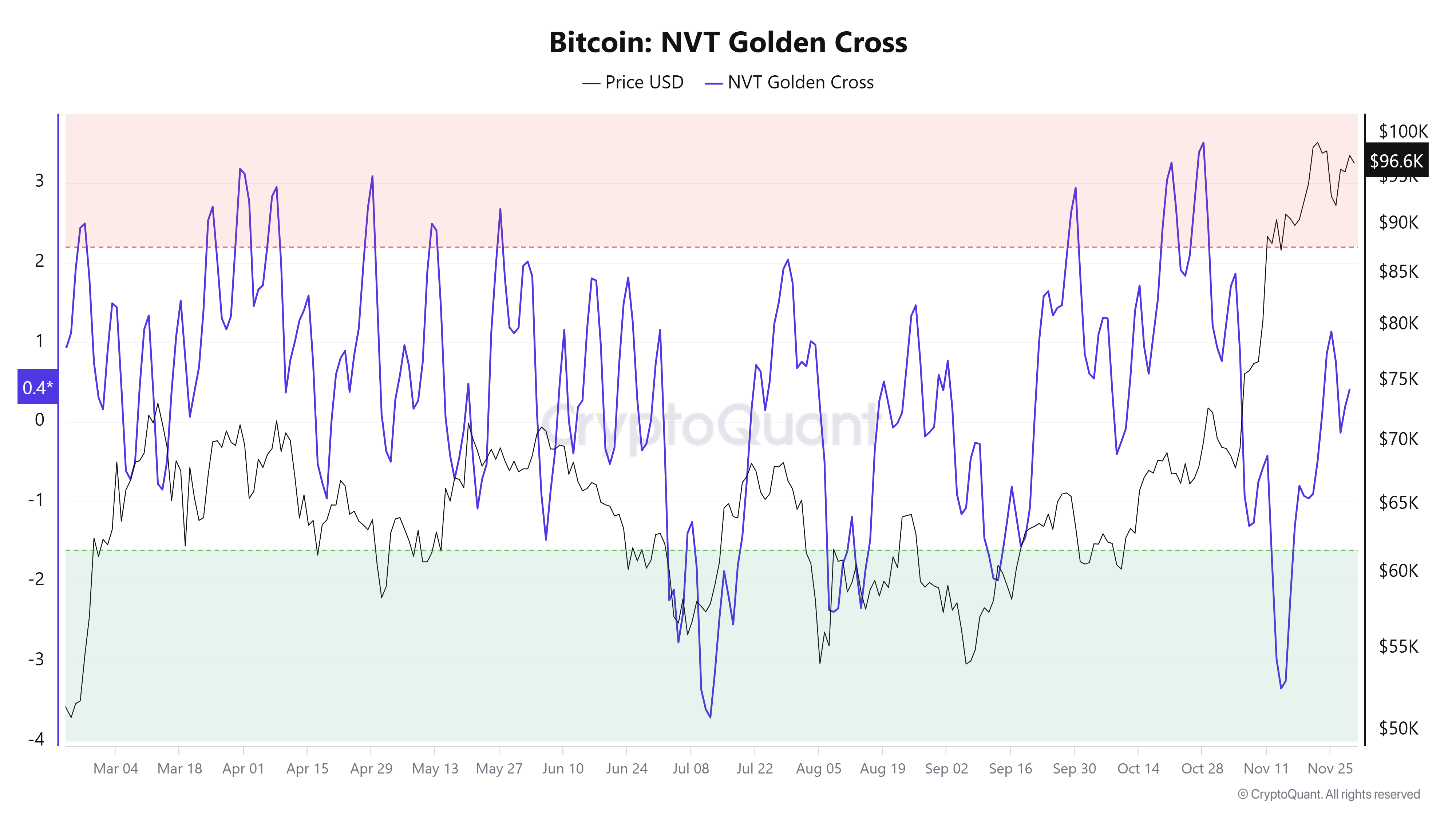

Even though long-term holders are showing a temporary negative outlook on Bitcoin, the overall large-scale trend continues to be robust. It’s worth keeping an eye on the Bitcoin Network Value to Transactions (NVT), specifically its Golden Cross, as it’s currently in a neutral position at this time.

Without reaching the bullish level (-1.6), the NVT Golden Cross serves as a significant indication for potential direction in Bitcoin’s price trends. Traditionally, when the NVT indicator surpasses 2.2, it is frequently viewed as a signal to sell in the market.

Yet, Bitcoin hasn’t dipped into the bearish region as of now, leaving scope for more upward movement. The NVT Golden Cross still signals a favorable trend, suggesting that Bitcoin may continue to climb higher before encountering any possible correction.

As a crypto investor, I find myself closely watching the current neutral zone of the indicator, knowing that it presents an intriguing opportunity for Bitcoin to potentially surge toward $100,000. For now, any substantial bearish pressure seems held at bay.

BTC Price Prediction: Making History

Currently, Bitcoin’s value stands at approximately $96,572, edging ever nearer to the landmark $100,000 level. Over the past few weeks, it has experienced substantial growth, driven by increasing institutional investment and widespread adoption. Should this trend persist, it seems likely that Bitcoin will shatter this psychological barrier, reaching a record-breaking high of around $99,595.

If Bitcoin manages to surpass the $100,000 threshold, it might aim for $120,000 next. Such a leap is likely to inspire both individual and institutional investors to invest more, creating further buying pressure. Yet, it’s important to consider that long-term holders (LTHs) may decide to sell, which could lead to a momentary dip in the market due to profit-taking.

Regarding temporary worries, it’s important to note that Bitcoin’s long-term trajectory stays optimistic, and a recent NVT Golden Cross indicates that the journey towards $100,000 is still viable. As long as Bitcoin continues to hold above crucial support thresholds, the overall perspective remains bullish in the long run.

In simple terms, even though the sale of Long-Term Hold (LTH) may introduce some market fluctuations, it’s expected that Bitcoin will keep moving upwards in the near future, assuming no significant market disturbances occur.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 30 Best Couple/Wife Swap Movies You Need to See

- Persona 5: The Phantom X Navigator Tier List

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

2024-11-30 23:59