- Bitcoin’s inflows to Binance take a nosedive, hinting at a market that’s suddenly gone shy 🕵️♂️

- Short-term holders are chilling like it’s a Sunday afternoon, signaling a shift from “sell everything” to “maybe later” 🛋️

Well, well, well, Bitcoin’s [BTC] short-term traders seem to have hit the pause button. Who would’ve thought? 🤷♂️

A sharp drop in BTC inflows to Binance, coupled with less hustle from 1-3 month holders, suggests the market’s mood has shifted from “let’s make a quick buck” to “let’s sit on this and see what happens.” Short-term traders, once the kings of selling pressure, are now clutching their coins like they’re the last slice of pizza. 🍕

While Binance is seeing fewer visitors, other exchanges are bustling like a Black Friday sale. It seems the crypto crowd is trading in their risk-taking hats for a more cautious fedora. 🎩

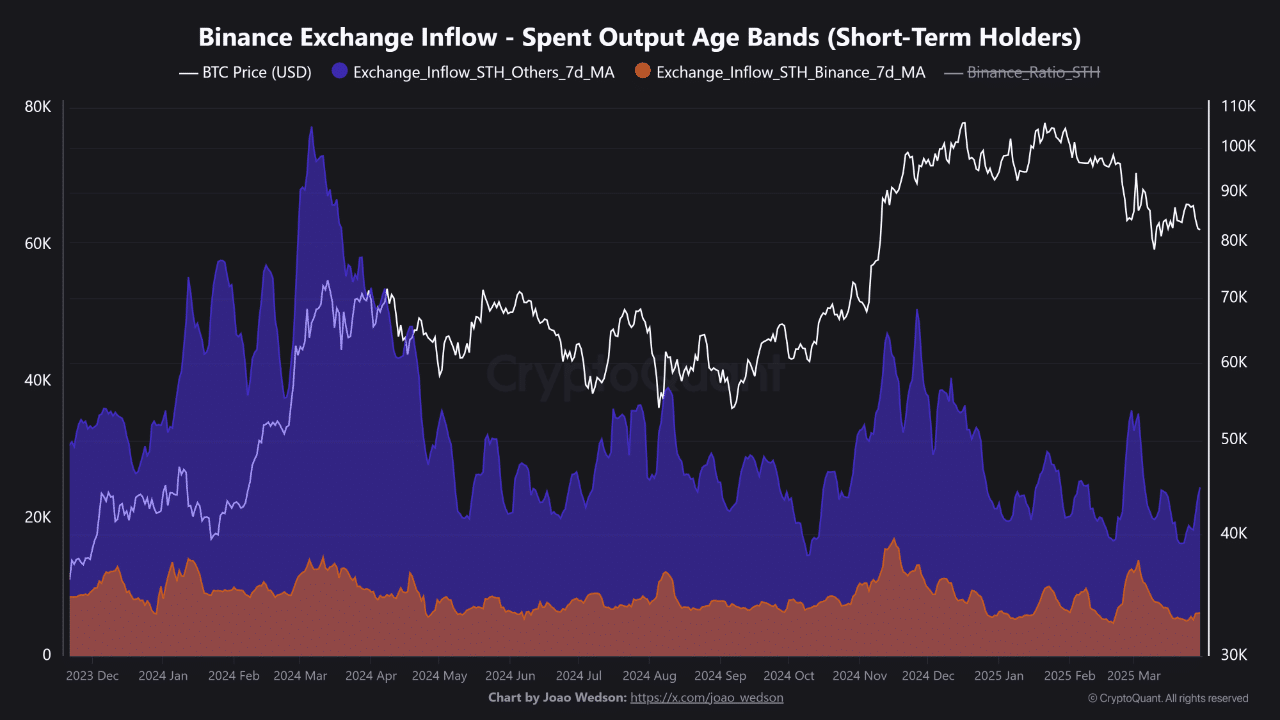

Binance’s Bitcoin Drought

When Bitcoin inflows to Binance drop, it’s like the canary in the coal mine—something’s up. 🐦

Recent data shows a dramatic dip in BTC transfers from short-term holders (STHs) to Binance, plummeting to a mere 6,300 BTC. Meanwhile, other exchanges are soaking up an average of 24,700 BTC. This decline suggests Binance might be losing its charm, with traders adopting a “wait and see” approach. 🕰️

If this trend keeps up, Binance’s liquidity and trading volume could take a hit, potentially shaking up Bitcoin’s price stability. Meanwhile, the rise in BTC inflows to other exchanges hints that the crypto crowd is playing musical chairs with their trading preferences. 🎶

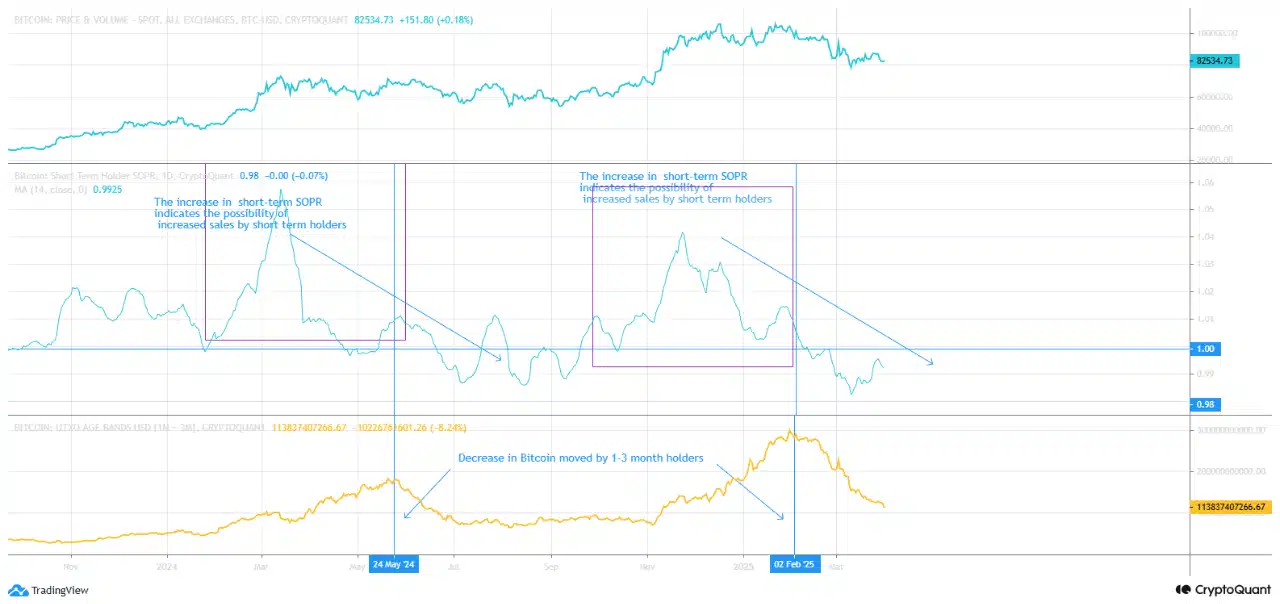

Short-Term Holders on a Break

Short-term Bitcoin holders are like the weather—unpredictable and often a bit dramatic. 🌦️

Their actions usually reflect quick profit grabs or panic sells, making them the drama queens of the crypto world. Recent data shows a significant drop in BTC activity from these folks. Both the Short-Term SOPR and UTXO Age Band metrics are pointing to a “let’s not sell just yet” vibe. 🎭

After cashing in on recent trades, these holders seem to have entered a more cautious, “let’s hold onto this” phase. This shift could mean less selling pressure and a more balanced market outlook—at least for now. ⚖️

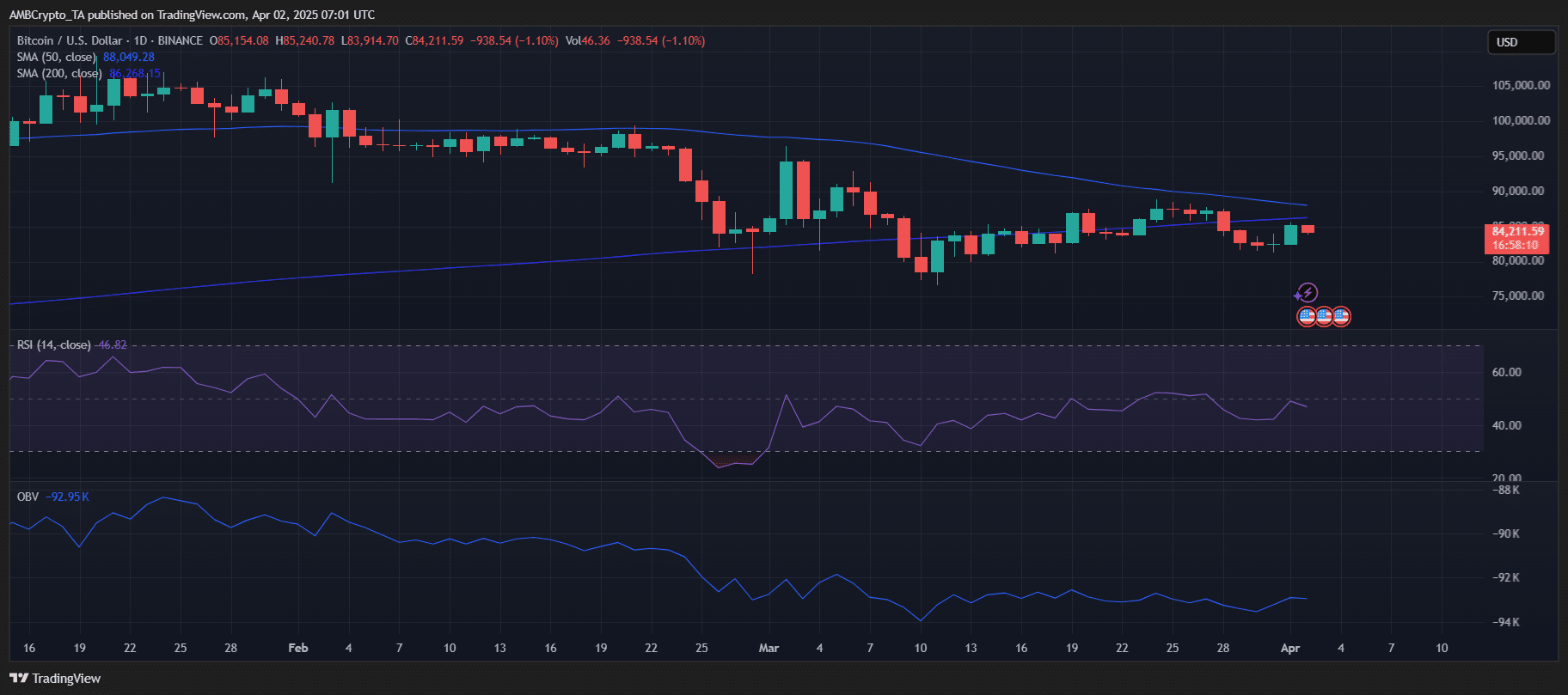

Bitcoin’s Price: The Rollercoaster Continues

Bitcoin’s recent attempt to break above the 50D SMA at $86,268 was like trying to climb a greased pole—slippery and ultimately unsuccessful, pushing the price back toward $84,211. 🎢

At press time, the RSI at 46.82 indicated the market was in a neutral to slightly bearish zone, suggesting buyers are still on the sidelines. The OBV at -92.95 K hinted at low trading volume and weak buying pressure. If BTC can’t reclaim the 50-day SMA, it might retest support near the 200-day SMA at $88,049. But hey, if it manages a breakout, we could be in for a recovery party. 🎉

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2025-04-02 12:10