As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous bull runs and bear markets, but none quite like the one we are currently experiencing with Bitcoin. The sheer magnitude of profit-taking activity among long-term holders is simply astounding.

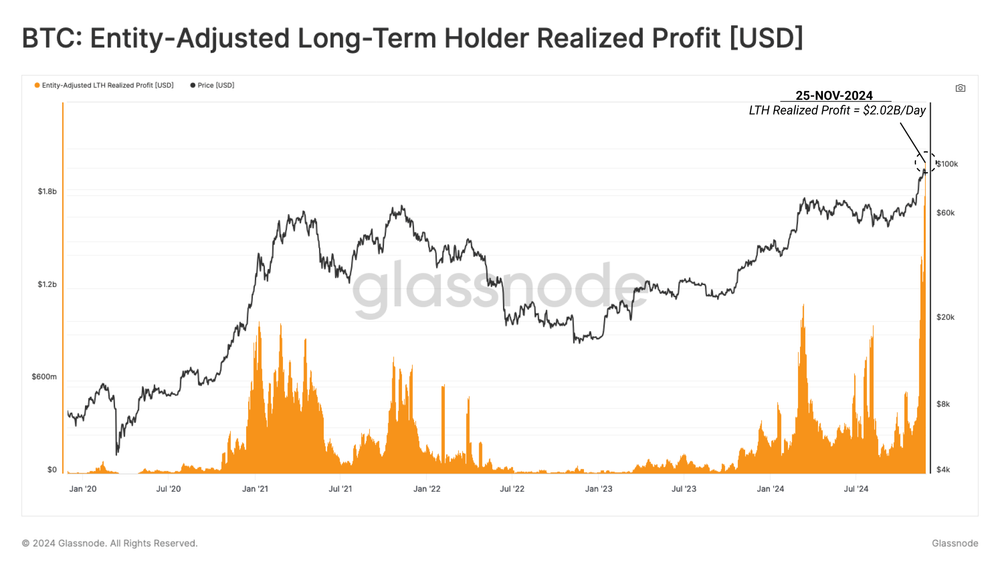

In simple terms, a massive $2.02 billion has been earned by long-term Bitcoin investors on a daily basis recently, an extraordinary amount that underscores the high level of profit-taking as the value of Bitcoin approached $100,000 during the last few days.

Based on a recent Glassnode analysis, the current data exceeds a previous peak observed from March this year. A strong demand is needed to effectively manage this surplus, which could necessitate a phase of restocking before it’s fully absorbed.

Over the past three months, a significant number of bitcoins held for a longer period (approximately 507,000) have been sold. The data indicates that the majority of these long-term holder coins being transacted were probably obtained relatively recently, implying they are statistically more likely to be 6 months old rather than 5 years old on average.

The realized profit data reveals a diversity of strategies among Bitcoin holders. Investors with modest percentage gains accounted for $10.1 billion in profits within the 0%-20% range, while high-return holders—those earning over 300%—generated $10.7 billion.

This data indicates that those who initially bought Bitcoin at a lower price tend to sell fewer Bitcoins, but still make similar profit amounts in U.S. dollars. The report also emphasizes a period of increased selling, as the current rate of large holders selling is greater than during the March 2020 peak.

According to a report by CryptoGlobe, this year’s bull run for Bitcoin has led to a significant rise in on-chain activity, mirroring the surge in its price. This increased activity has brought the number of daily active addresses close to one million, marking a notable uptick following three years without such growth.

Based on information from the on-chain analysis company IntoTheBlock, it appears that Bitcoin’s long-term behavior pattern has undergone a clear change. This is because on-chain activity associated with Bitcoin is experiencing substantial increase as its price continues to climb.

Keep in mind that an active Bitcoin address does not automatically imply an active user, because users are free to generate multiple addresses. In fact, experts suggest employing different addresses for reasons related to privacy and security.

It’s important to clarify that the given figure might not reflect one million individual users of Bitcoin (BTC), as some users may transact through cryptocurrency exchanges where their funds could be pooled together with others, making the address appear to represent assets belonging to multiple users instead of just one.

Furthermore, numerous individuals invest in cryptocurrencies and keep their assets secure in cold wallet systems that remain untouched for extended periods, a preference among long-term holders due to the enhanced security benefits provided by such solutions.

Read More

- PENGU PREDICTION. PENGU cryptocurrency

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 30 Best Couple/Wife Swap Movies You Need to See

- All 6 ‘Final Destination’ Movies in Order

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

2024-11-28 05:30