As a seasoned researcher with over two decades of experience in the financial markets, I have witnessed numerous market cycles and trends come and go. Yet, the recent surge of Bitcoin and the unprecedented demand for Bitcoin ETFs has left me genuinely intrigued and somewhat awestruck.

On Friday night, Bitcoin reached an unprecedented peak of around $77,000, concluding a remarkable week during which it was announced that Donald Trump would once again become President. This period also saw Bitcoin setting multiple new record highs. The crypto community is hopeful that Trump’s presidency will lead to more favorable regulations for the industry, potentially accelerating its growth.

On yesterday alone, Bitcoin ETFs experienced an unprecedented surge in investments totaling approximately $1.36 billion, surpassing the previous record of $1.14 billion set in March. This isn’t a minor increase; it represents a substantial step forward.

Approximately $1.1 billion was solely contributed by BlackRock’s IBIT fund, which is almost equivalent to the combined total inflows of all 11 ETFs on their best single day. That’s correct—one fund almost reached the peak daily inflow amount of all eleven funds together!

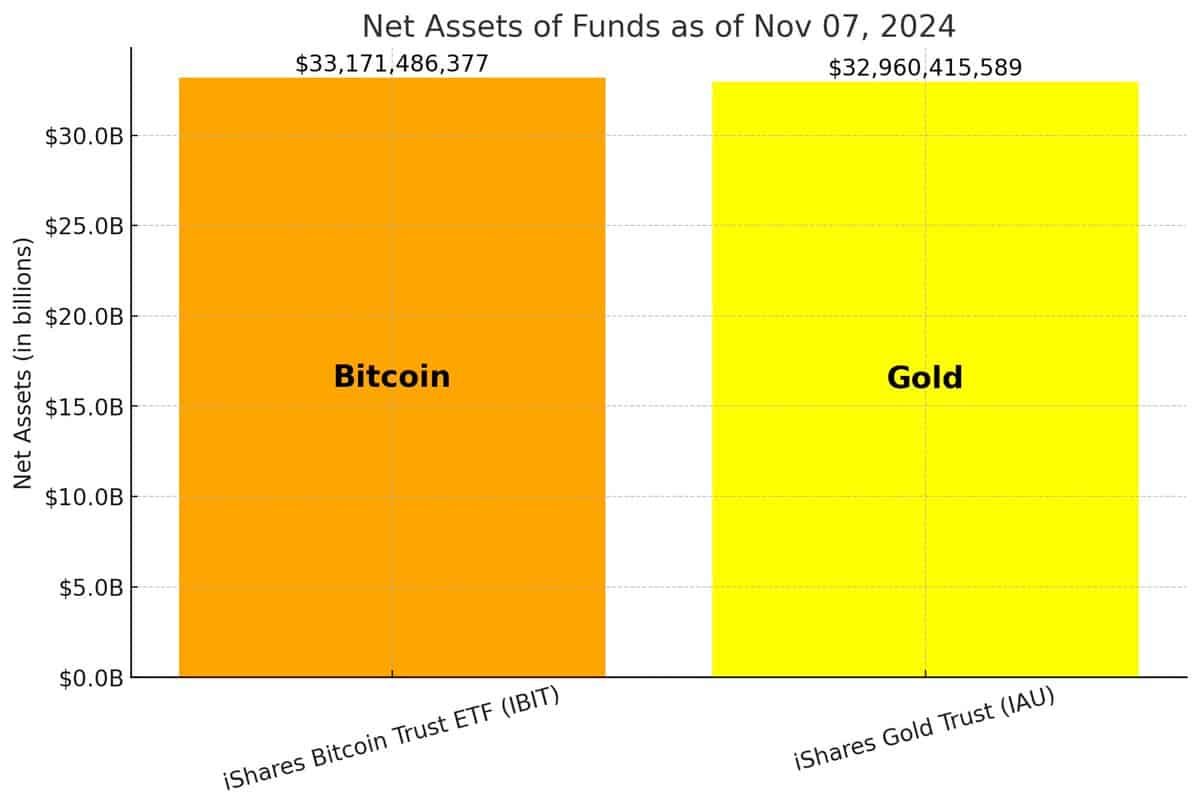

Consequently, Blackrock’s Bitcoin Exchange-Traded Fund (ETF) has surpassed the size of its Gold ETF. This remarkable achievement was accomplished within just ten months.

Supply Shock Incoming?

Approximately 450 Bitcoins are mined every day as a rule. Yesterday, Bitcoin ETFs used approximately 18,000 Bitcoins. This implies that the daily demand from these ETFs was around 40 times greater than the freshly-mined supply entering the market.

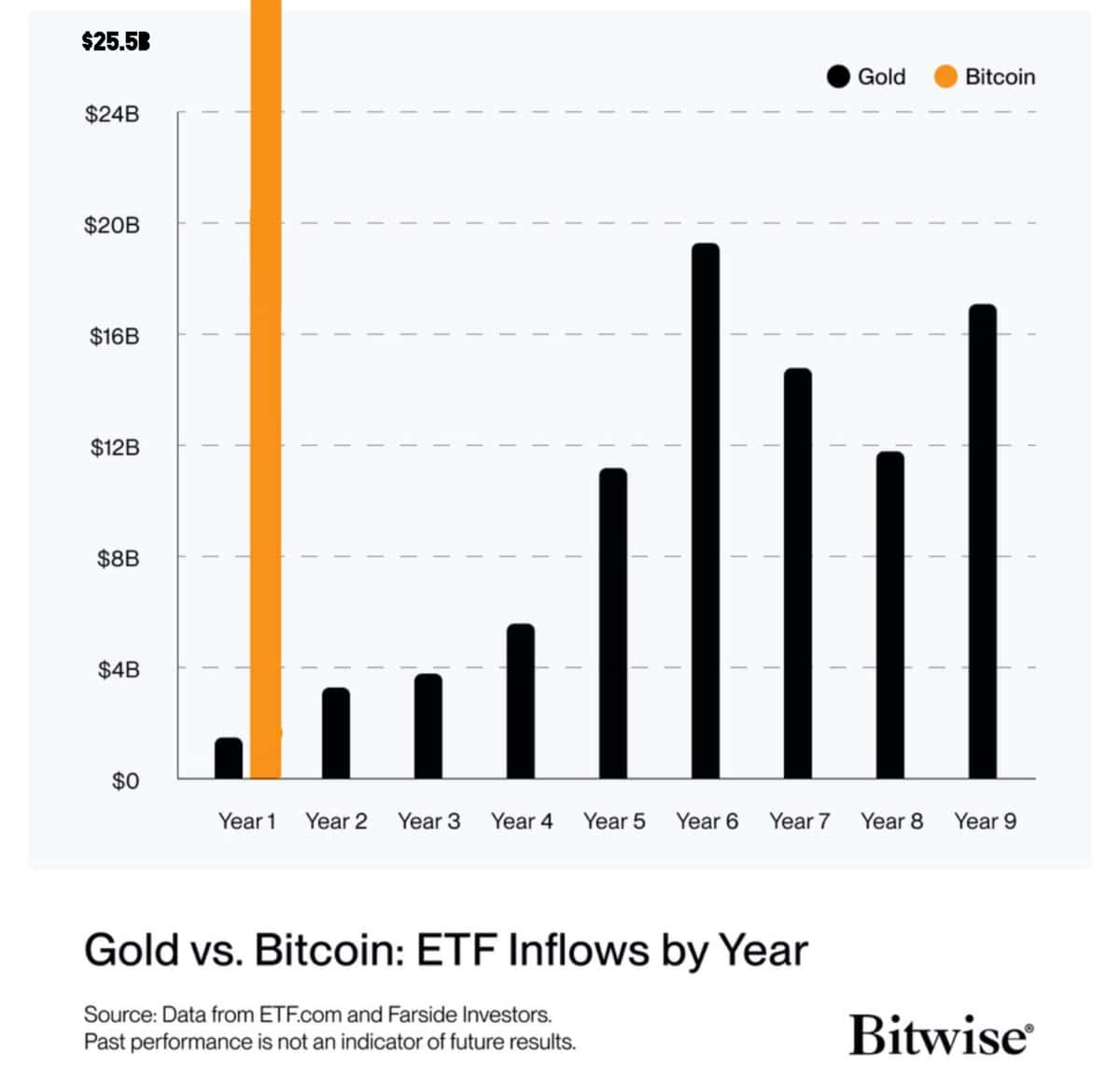

The equation is simple: increased demand combined with limited supply equals rising prices. As it stands now, the total inflows into Bitcoin ETFs have reached an impressive $25.5 billion—and the numbers are still climbing.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Summer Game Fest 2025 schedule and streams: all event start times

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2024-11-08 23:40