🚀 Bitcoin: The Rally of the Century (Or Not)? 🤔

- The Bitcoin sell-side ratio and moving averages hint at a possible market rally.

- The adjusted spent output profit ratio (aSOPR) shows that long-term traders are selling at a loss.

As I sipped my tea, I pondered the enigmatic world of Bitcoin. It has maintained a relatively stable performance over the last 24 hours, dropping slightly by 0.84%, a testament to the market’s exhaustion.

But, my dear friends, do not be fooled by this calm exterior. Several indicators whisper to me that a rally is near, like a sly seductress beckoning me to the dance floor.

Has Bitcoin bottomed yet?

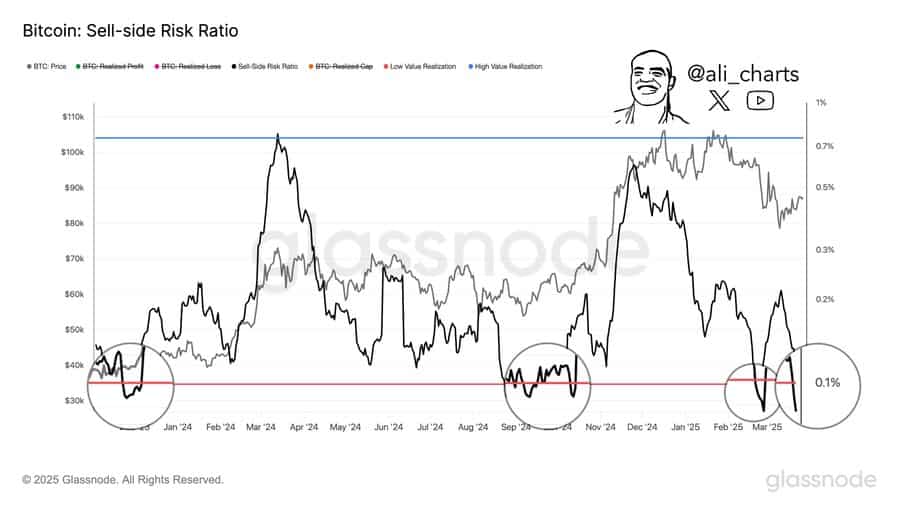

One critical metric, the sell-side ratio, aligns with the bullish narrative. This ratio compares investor spending within a specific period to the realized market capitalization. Historically, when it drops to the 0.1% region or below, it often signals the start of a major price rally. Currently, the sell-side ratio is at 0.086%, implying that Bitcoin could resume its rally soon.

Adding to this bullish outlook is the adjusted spent output profit ratio (aSOPR), which recently crossed below 1, with a reading of 0.99—indicating that traders are selling at a loss. Ah, the sweet taste of desperation!

Selling at a loss often forces the market upward as Bitcoin is accumulated at a discount. It’s like finding a rare gem in a dusty old shop – one must be willing to take a chance.

While these indicators remain bullish and suggest a rally could be near, my analysis shows that traders may be waiting for the optimal buying opportunity.

The Bitcoin Market Value to Realized Value (MVRV) momentum (70-day) indicator helps determine this prime opportunity. A major price run typically begins when the MVRV crosses above its 70-day moving average.

If this happens, Bitcoin could start making higher highs, increasing its overall monthly gain, currently at 4.32%, according to CoinMarketCap.

Market activity remains low

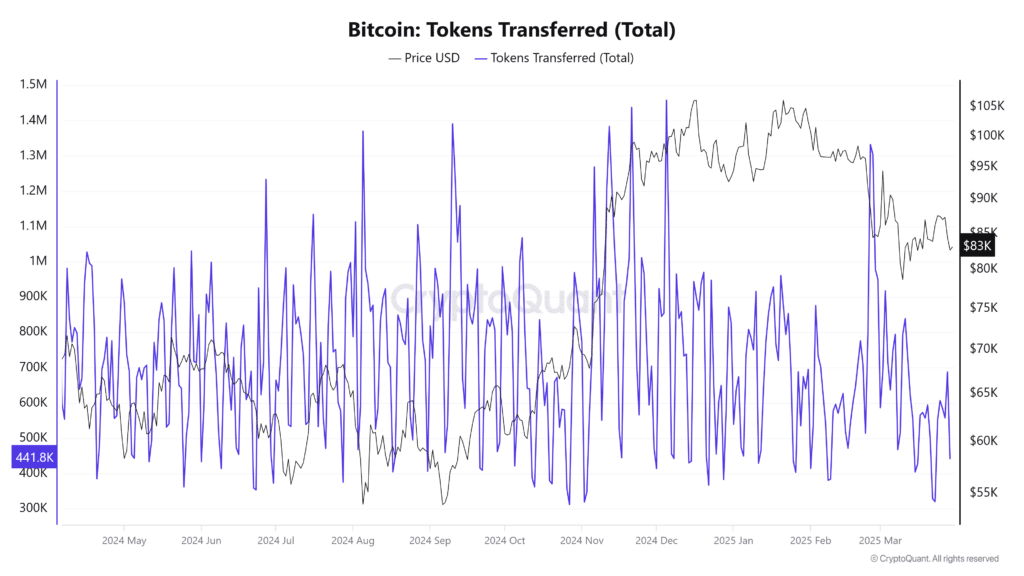

Market activity remains subdued, with fewer transactions occurring, indicating a lack of momentum to push Bitcoin forward. It’s like trying to get a cat to do tricks – it’s just not happening.

At the time of writing, the amount of BTC being transferred has dropped significantly, currently at approximately 441,000 BTC—a sharp decline from previous highs.

If market momentum continues to decline, the likelihood of a sustained rally remains slim. For a rally to occur with full force, both volume and price must rise simultaneously. A divergence between the two would indicate weak momentum, making a rally unlikely.

And so, my friends, we wait with bated breath for the next move. Will Bitcoin rise like a phoenix from the ashes, or will it continue to languish in the shadows? Only time will tell.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- 30 Best Couple/Wife Swap Movies You Need to See

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Persona 5: The Phantom X Navigator Tier List

2025-03-30 23:07