Right! So, the Bitcoin brigade is at it again, valiantly flinging themselves upward from the rather dramatic ledge of $97,000, as if their group therapy session just moved to the next floor. After loitering by $95,000 for a week like someone awkward at a house party clinging to the snack table, Bitcoin finally made a dash for $97,000. Then, predictably, it decided to make life “interesting” (translation: confusing) by reversing and leaving behind—wait for it—a “fair value gap.” No, not a trendy new yoga pose, just crypto jargon for “mind the gap, or disappear into the financial abyss.” 😵💫

Cue wild scenes on the Bitcoin blockchain—everyone’s dusting off their wallets, asking “Are we there yet?” The burning question: will this new “structure” be as reliable as a British weather forecast or will resistance (like my willpower around cake) absolutely destroy it?

Bitcoin Sets a New Record: Not for Drama, But for Active Addresses 📈

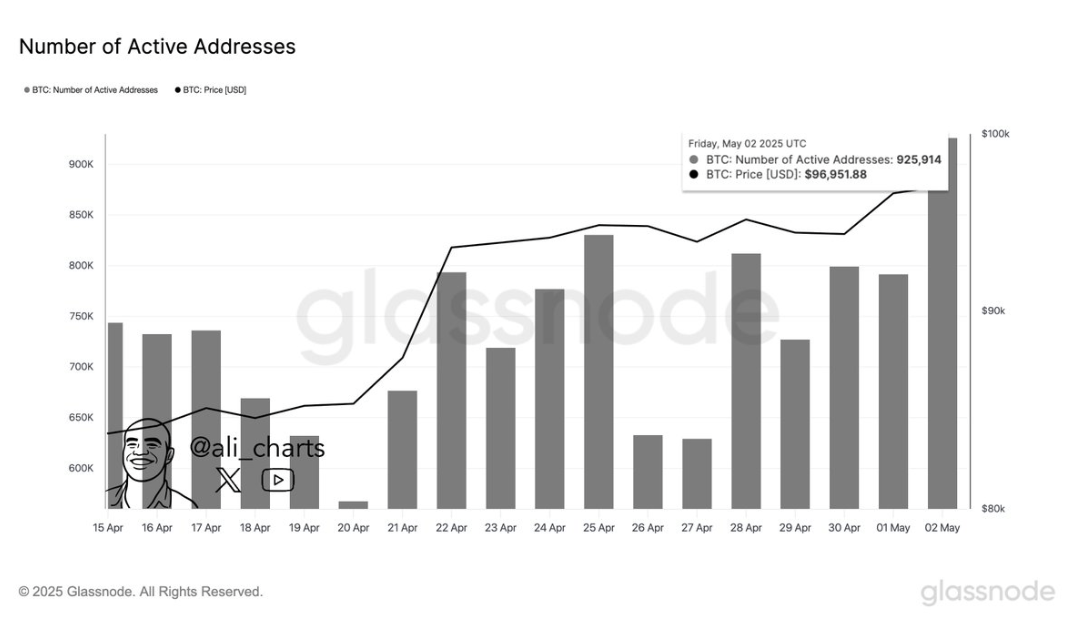

In a twist nobody saw coming (except everyone on Crypto Twitter), analyst Ali Martinez reports a galaxy-brained 925,914 Bitcoin wallets swinging into action in a single manic day. That’s right, nearly a million people all decided to “do something” at the same time—statistically, more than actually go to the gym on January 2nd. According to Martinez’s trusty Glassnode chart, this wasn’t just a blip; activity has been steadily ramping up since the end of April, just in time to coincide with Bitcoin’s victorious parade back to the lush pastures of $95,000.

Image From X: @ali_charts

Meanwhile, TehThomas (presumably lacking a real surname and loving it) chips in with an all-too-earnest bit of technical analysis. He’s basically suggesting Bitcoin is reenacting its favourite old trick: consolidate, break out, forget its keys, pop back for the keys, then run up another $10K like an electrified squirrel. At the moment, it seems Bitcoin is determinedly squashing itself below $95,000, then squeezing out a breakout and, naturally, leaving behind another cryptic “FVG” between $94,200 and $95,000.

Key thing, according to TehThomas, is to resist FOMO-ing into the madness, and instead “wait for a clean retest.” Yes, just like waiting for someone to text after a first date—if the signals are there, bliss awaits; if not, it’s back to doomscrolling and old price ranges below $94,000. Stay vigilant, bulls, lest you find yourself stampeding the wrong way. 🐂

Bear Time: Beware of the Seductive Golden Pocket 🐻

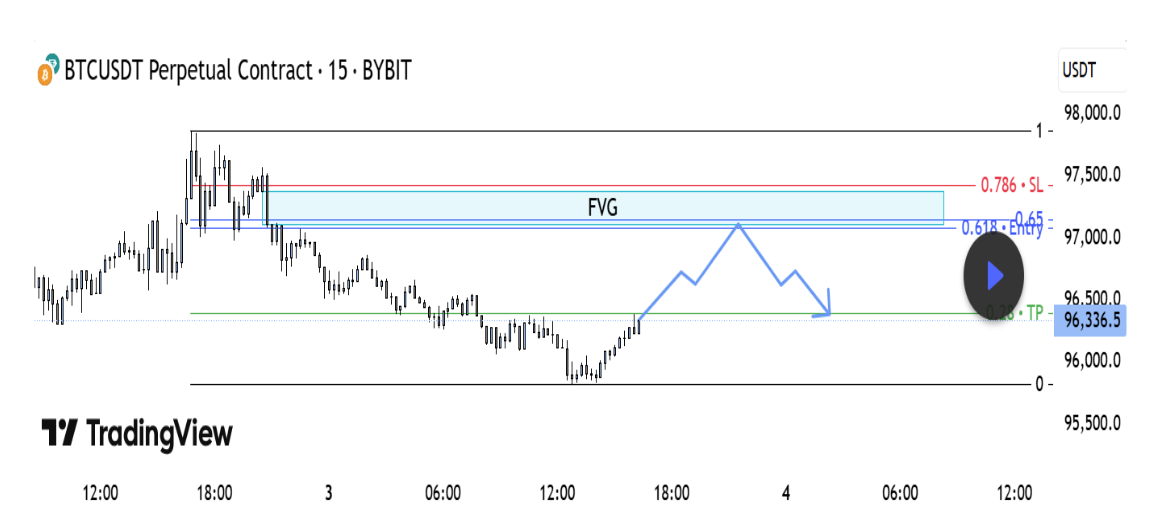

Now, not everyone’s convinced we’ll reach $100,000 without a bit of proper carnage. Enter: Skeptical Analyst from TradingView, party pooper par excellence, who warns of a possible “shakeout” (never good, unless it’s a martini) based on the 15-minute chart. They mutter darkly about the rally looking “corrective, not impulsive,” and see a classic short setup poking its nose from the infamous “golden pocket” (which, honestly, feels like Willy Wonka designed Fibonacci retracements).

So the current gap sits primly between $97,000 and $97,450, daring Bitcoin to break it—or else. If the bulls fizzle out here, the market may do what it does best: reverse suddenly and leave everyone wondering what just happened, like the end of an especially confusing rom-com.

Chart from TradingView

Anyway, as of now, Bitcoin’s planted itself at $96,040. Grab some popcorn, hold onto your wallets, and don’t try this at home (unless you enjoy rollercoasters, existential dread, and “strong” opinions on social media). 🚀💸

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-05-04 23:48