In just a few days, Bitcoin‘s mining reward is set to be reduced for the fourth time – an event known as a halving. This change will decrease the number of new Bitcoins created with each mined block from 6.25 to 3.125. Previous halvings have led to extended price growth for Bitcoin, fueling excitement among crypto enthusiasts that this trend will continue.

An article from CoinDesk published today warns of caution from Goldman Sachs. The bank’s Fixed Income, Currencies and Commodities (FICC) and Equities teams point out that while previous bitcoin halvings have resulted in price increases, the timeframes and extents of these rallies have significantly differed. They emphasize the need to examine the distinctive economic circumstances surrounding each occurrence instead of expecting past patterns to recur automatically.

In contrast to past economic situations that accompanied Bitcoin’s previous halvings, the current one presents distinct differences. Previously, easy monetary policies and near-zero interest rates from central banks such as the U.S. Federal Reserve, European Central Bank, Bank of Japan, and People’s Bank of China fueled risk-taking in various asset classes, including cryptocurrencies. These conditions contributed to the bullish markets that followed earlier halvings.

Instead of a sharp contrast, the economic situation in the US now features elevated inflation and interest rates exceeding 5%. This cools down investor excitement towards riskier assets like tech stocks and cryptocurrencies. Goldman Sachs explains that this persistent high-interest rate climate and the market’s acceptance of fewer anticipated rate reductions in 2023 makes it harder for Bitcoin prices to surge following its halving event.

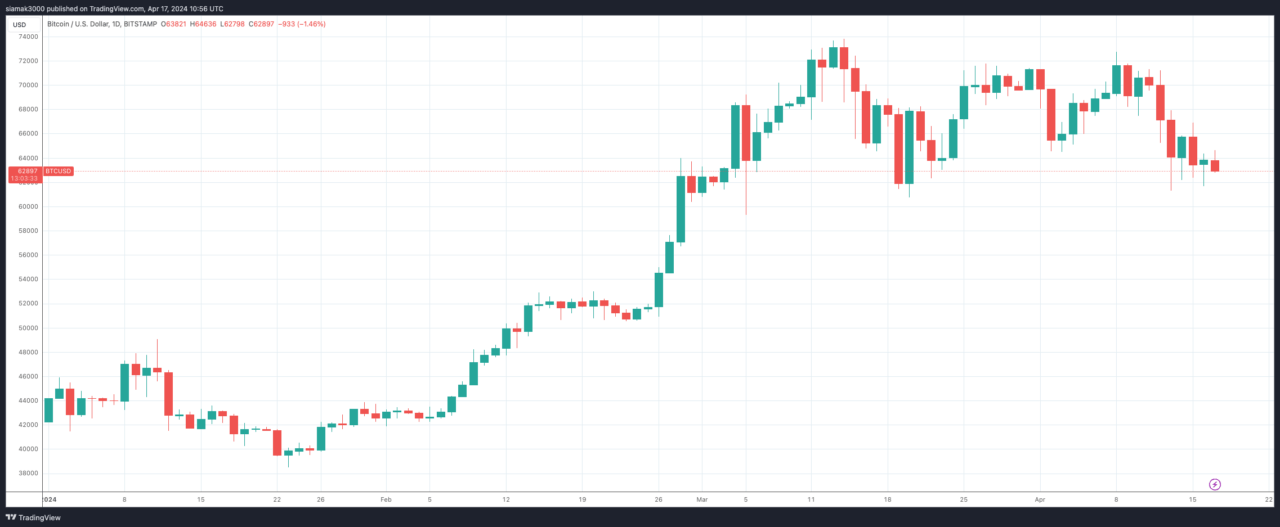

In spite of the warning signs, Bitcoin’s price has surged by over 50% this year so far, reaching an unprecedented high of $73,737 on March 14, 2024 – nearly a month prior to the scheduled halving event.

A significant portion of this rally can be attributed to the massive inflows into U.S. ETFs for Bitcoin spot trading, which were introduced in January. As reported by Bloomberg, these funds have amassed over $59 billion in assets within a span of three months. Some financial experts suggest that this quick accumulation may have caused an imbalance between supply and demand, potentially leading to an earlier price surge than usual following the Bitcoin halving event. They now anticipate that the period right after the halving could see a “sell-the-news” reaction, where prices might decrease despite the event.

Based on Goldman Sachs’ analysis, the Bitcoin halving acts as a reminder of its finite supply, but the short-term effect on Bitcoin’s price might be outweighed by broader market influences and escalating demand for US-traded spot Bitcoin ETFs. According to their assessment, these elements are expected to significantly influence Bitcoin’s price trend in the coming months.

In simpler terms, it’s debatable whether next week’s Bitcoin halving will significantly affect its long-term trend since other factors, such as supply and demand dynamics and growing interest in Bitcoin ETFs, primarily influence its price movements. Crypto markets have a self-referential behavior that amplifies these trends.

During an interview on Bloomberg TV on April 15, 2024, Kris Marszalek, CEO of Crypto.com, shared his perspectives on the cryptocurrency sector as the Bitcoin halving approached. Bloomberg’s Chief International Correspondent for Southeast Asia, Haslinda Amin, led the discussion. They explored Crypto.com’s approaches to adapting to market shifts, managing regulatory challenges, and growth plans.

Marszalek expressed approval for Hong Kong’s regulatory changes, specifically the green light given to Bitcoin and Ethereum spot ETFs. He considered these developments as positive advancements. In making his comparisons, he noted the vigorous consumer demand for cryptocurrencies in South Korea, despite the challenges foreign entities frequently encounter. As part of its growth plans, Crypto.com intends to debut its app in South Korea, with the goal of establishing a notable presence in this prominent crypto marketplace.

Addressing the anticipated Bitcoin halving, Marszalek remarked:

As the halving date approaches, there may be some traders looking to sell due to the common mentality of “buying the hype, selling the fact.”

After the Bitcoin halving, he voiced confidence in the market’s future based on the decreased supply and ongoing institutional investor demand.

Based on the six-month period following the Bitcoin halving, I anticipate noticeable market fluctuations. The consequences may not be immediately apparent, but over a six-month span, they’re expected to be quite significant and largely beneficial for the market.

Despite this, Marszalek understood the larger influences shaping the financial world, implying that the cryptocurrency market could experience a period of stability similar to past trends.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- All 6 ‘Final Destination’ Movies in Order

- Every Minecraft update ranked from worst to best

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

2024-04-17 14:36