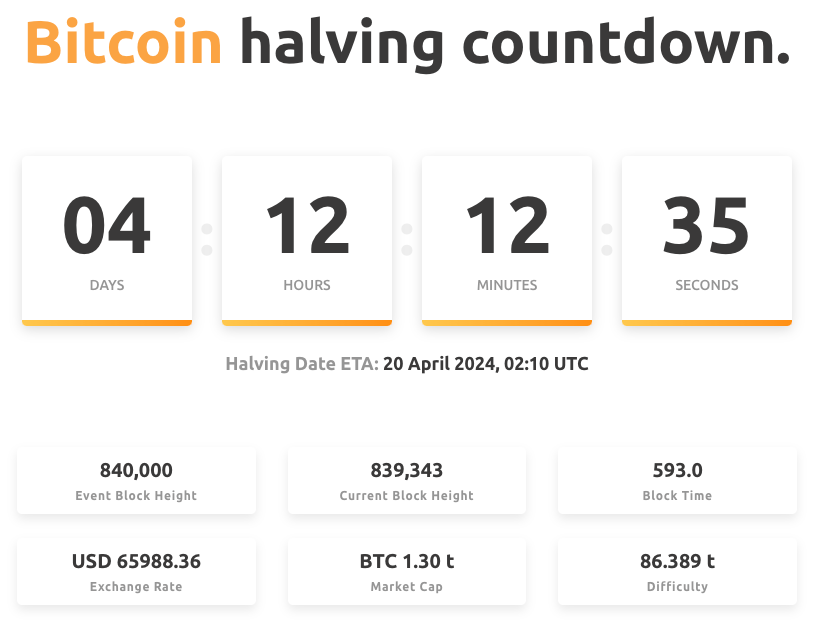

The much-awaited Bitcoin halving is scheduled to take place some time between April 19 and April 21, 2024. During this occurrence, the production of new Bitcoins gets reduced by half. Historically, this event has marked the beginning of new market phases and bull runs. However, as CNBC points out in a recent article, the upcoming halving in 2024 could be exceptional due to several factors that might cause a significant surge in Bitcoin’s price.

Based on CNBC’s report, a notable variation in this year’s Bitcoin halving is the U.S. Securities and Exchange Commission (SEC) approving eleven Bitcoin spot ETFs in January 2024. This decision has sparked substantial interest in Bitcoin due to the increased accessibility these ETFs offer. Antoni Trenchev, Nexo’s co-founder, shared his insights with CNBC.

“For Bitcoin enthusiasts, the halving is the most anticipated event, but the one scheduled for 2024 holds even more excitement. With less Bitcoin being mined and increasing demand from new ETFs, the combination could lead to a powerful explosion. What sets this halving apart is that Bitcoin’s price has already surpassed its previous peak – something it hasn’t achieved before the quadrennial event. As a result, predicting the duration and intensity of this cycle becomes more challenging.”

According to CNBC’s latest update, Bitcoin’s price has broken its old record high before the upcoming halving event – an unprecedented occurrence. This makes it harder to estimate how long and intense this cycle will be.

According to CNBC’s analysis, Bitcoin has a tendency to significantly rise in value after undergoing a halving event. For instance, following the halvings in 2012, 2016, and most recently in 2020, the price of Bitcoin surged roughly 93 times, 30 times, and 8 times, respectively, from the day of the halving to its peak in each cycle.

Although past results don’t assure future gains and the effect of the halving on prices might lessen, Steven Lubka from Swan Bitcoin advocates to CNBC that this could be an opportune time for hopefulness regarding post-halving profits – particularly in 2021.

The current Bitcoin rally, fueled by the January green light for spot ETFs, could potentially be quicker and more intense, reaching its peak sometime around late 2024 or early 2025.

According to CNBC’s report, the Bitcoin network undergoes a technical adjustment called the halving, which lessens the incentives for miners. Mining is the process by which transactions are verified and added to the blockchain, with rewards being new bitcoins and transaction fees. The current reward of 6.25 bitcoins will be cut in half to 3.125 bitcoins during this event. This decrease in rewards given to miners gradually decreases the creation rate of new coins, thereby preserving Bitcoin’s rarity and its reputation as a scarce “digital gold.”

According to CNBC’s report, while the Bitcoin halving itself may not trigger immediate market instability, the eventual decrease in supply could lead to considerable consequences. Lubka shares with CNBC that approximately $30 million less worth of Bitcoins will be put up for sale each day post-halving by miners. This decrease in selling pressure can accumulate over time, possibly leading to a noticeable increase in Bitcoin’s price during the ensuing months.

According to CNBC’s report, not only is there a supply shock due to the upcoming 2024 Bitcoin halving, but the market is also experiencing extraordinary demand for Bitcoin. Data from CryptoQuant indicates that the desire for Bitcoin among large investors, newcomers, and Bitcoin ETF holders is currently at an all-time high. This implies that the surge in demand, rather than the halving itself, might be the major factor behind the price increase during this cycle, as suggested by CNBC.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- 9 Kings Early Access review: Blood for the Blood King

- Every Minecraft update ranked from worst to best

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 10 Shows Like ‘MobLand’ You Have to Binge

2024-04-15 17:18