Bitcoin Frenzy: The $75 Billion Gamble

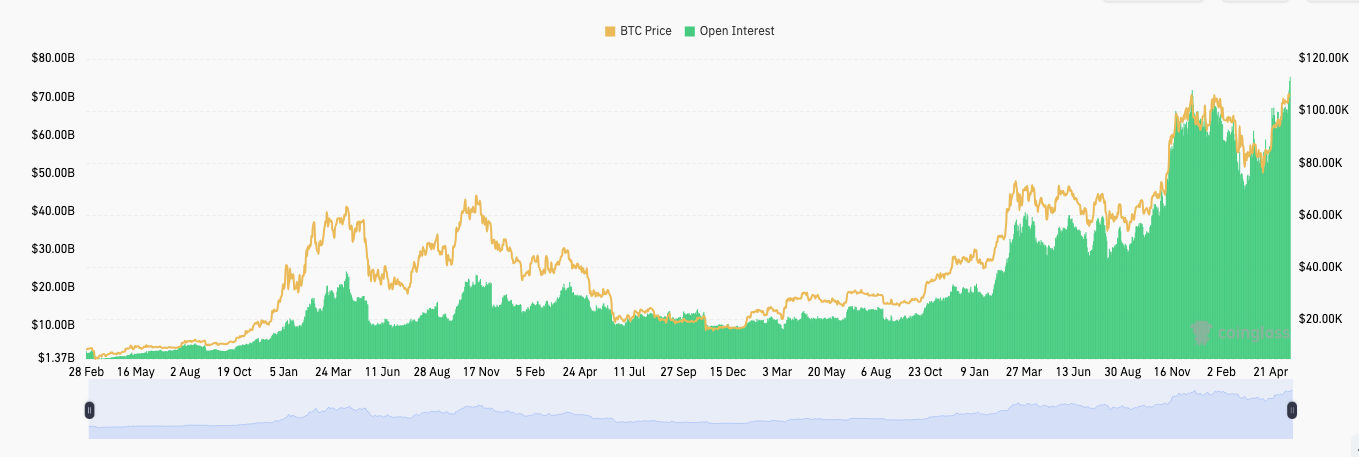

Well, folks, it’s official: the Bitcoin futures market has gone utterly bonkers 🤯. Open interest has skyrocketed to a record $75 billion, because who needs a social life when you can gamble on cryptocurrency? 🤑

According to Coinglass data, Bitcoin (BTC) futures OI has reached a new all-time high of over $75 billion. That’s a 4.23% increase in just 24 hours, because traders are basically throwing their money at the screen and hoping for the best 🤪.

The Chicago Mercantile Exchange is leading the charge with $17.43 billion in OI, followed closely by Binance with $12.41 billion, Bybit with $7.41 billion, Gate.io with $7.07 billion, and OKX with $4.6 billion. And Hyperliquid? Well, they’re the real MVPs with a 30.21% growth in open interest over the past 24 hours 🚀.

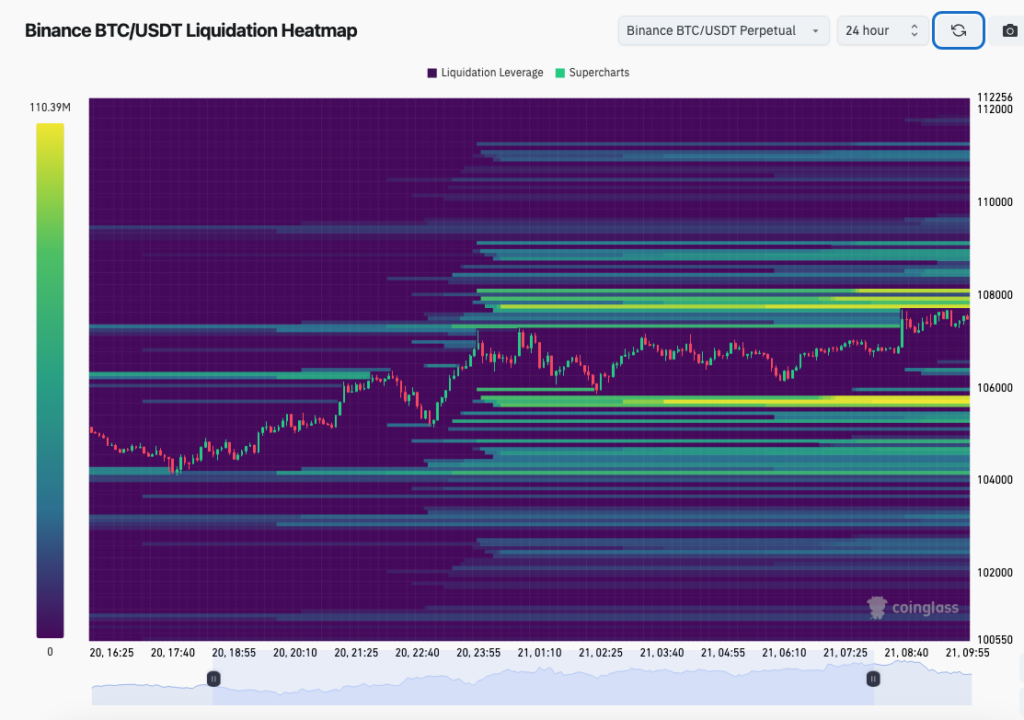

Now, you might be thinking, “But what about the bears?” Well, let me tell you, they’re about to get squeezed 🐻. With all this leveraged exposure floating around, the potential for bearish liquidations is higher than a Bitcoin enthusiast’s hopes and dreams 🌟.

The latest BTC/USDT liquidation heatmap is basically a treasure map of short liquidations just waiting to be triggered 🏴☠️. And if the $108K level is broken, well, buckle up, folks, because it’s about to get real 🚀.

As of press time, the Bitcoin price is hovering around $106.5K, trying to muster up the courage to close above $107K 🤔. But if it does break through the $108K level, the next big hurdle is $110K, which Arthur Hayes thinks is the magic number for the next leg up 🔮.

According to Hayes, the BTC price needs to break above $110K and make a beeline for $150–$200K to spark a true altcoin season 🎉. And with rising liquidity and trading volume, it’s possible that this breakout could happen as early as Q3 📆.

Read More

2025-05-21 13:21