The price of Bitcoin has been about as enthusiastic as a sofa at a napping convention. It continues its heroic limbo act, hovering below the $110,000 mark. Though it’s steadier today-steady in the same way as a jelly on a paint mixer-there’s still an atmosphere of existential dread swirling around, as if Bitcoin’s fortunes are auditioning for a Beckett play.

Enter: A market expert lurking on X (the social network, not the algebraic unknown, though one could argue Bitcoin behaves suspiciously similar to both). This expert muses that Bitcoin could be preparing for a comeback. On-chain signals, those enigmatic tea leaves of crypto, are apparently pointing to a market bottom. Or maybe they’re just winking at us because they know we have no idea what they actually mean.

Bitcoin Price: Somewhere Near the Floor, Possibly Digging Furiously

On August 30, the esteemed analyst Willy Woo (no relation to the sound your wallet makes when empty) posted on X suggesting Bitcoin’s price structure has started to hit rock bottom. Woo hints, with all the gravitas of an oracle who’s misplaced their crystal ball, that recovery may finally be in play after weeks of movement best described as “glacial with a hint of molasses.”

The optimism here hangs by a couple of on-chain metrics, which we can only assume are very clever if somewhat mystical. First, there’s this capital inflow metric, tracking how much cash sloshes into Bitcoin over a period (much like tracking how many marbles are rolling under your sofa after a particularly wild party).

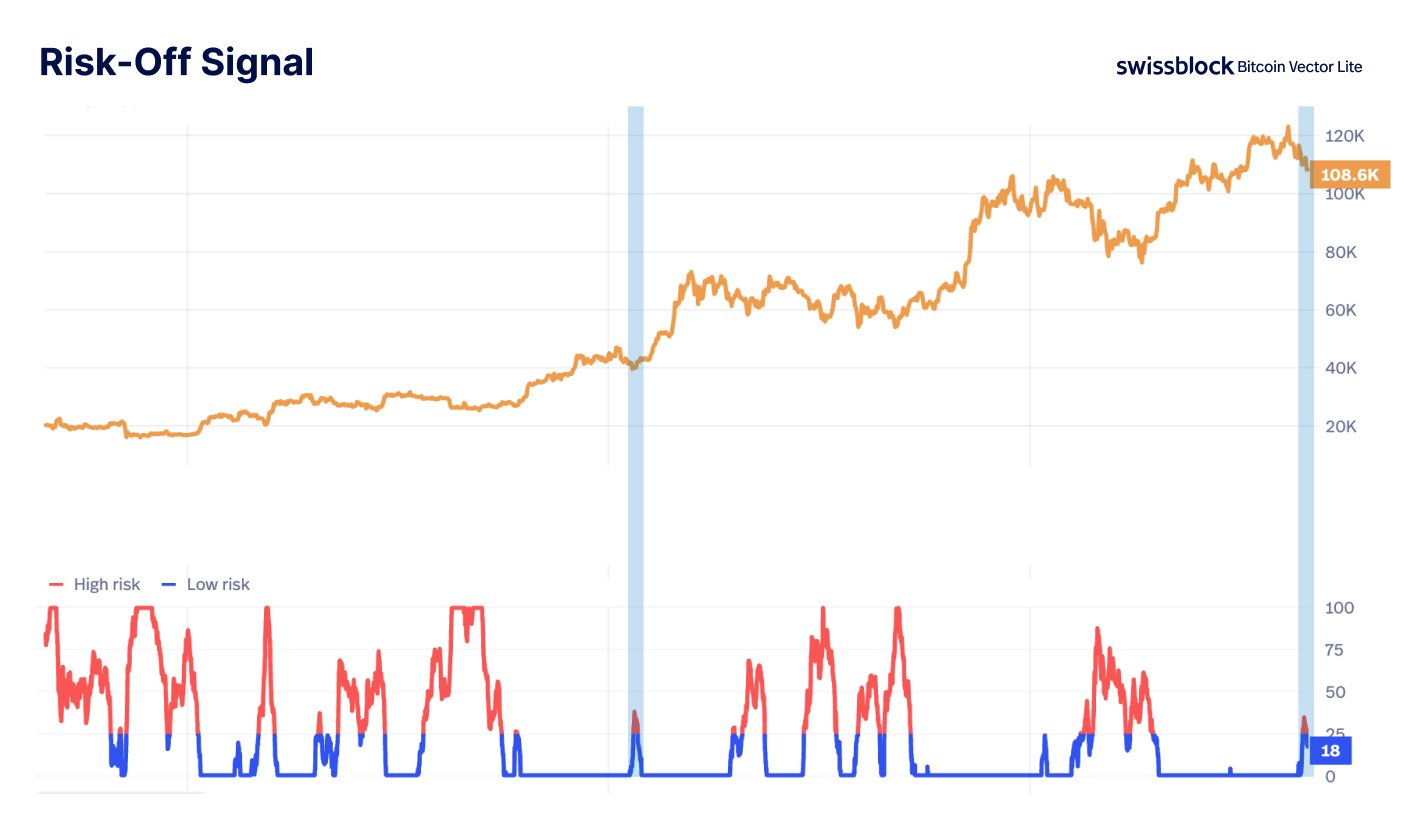

As the above chart demonstrates, the Bitcoin network recently celebrated its “first daily print” of positive inflows after weeks of watching money walk out the door like it was late for dinner. Woo interprets this as the first sign Bitcoin might have reached bottom-though, if it starts tunneling, all bets are off.

Second, there’s the Macro Cycle Risk, which has formed a “new lower high”-a technical phrase for “it’s less risky than the time your cousin tried to make soup with a hairdryer.” This, it’s suggested, means liquidity (the magical substance no one understands but everyone wants) might be sneaking back into the network, possibly to buy up riskier assets-the financial equivalent of bungee-jumping while reciting your PIN number aloud.

This same expert also cited the Risk-Off signal, which has peaked and is now declining. Translation: Investors are apparently bored of caution and ready to throw money at risky things again, like Bitcoin, homemade rockets, and limited-edition Beanie Babies.

Woo wraps it up with the conclusion that Bitcoin is stabilizing (in the way a penguin stabilizes while rollerblading) and a bullish structure is materializing-just as soon as enough brave souls “buy the dip.” So if you’re looking for financial adventure, bring snacks.

Bitcoin Price: Currently Not Digging to the Earth’s Core

As of this particular moment in time-so fleeting and precious-the price of BTC wobbles around $108,756. That’s a whole 1% bump in the last day! If this pace keeps up, Bitcoin may eventually challenge the price of a moderately large cheese wheel. 🧀

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- DOT PREDICTION. DOT cryptocurrency

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-08-31 17:49