“Bitcoin Finds Its Austen-Style Stability—But Is the Drama Over? 🤔”

It is a truth universally acknowledged that an asset such as Bitcoin, having dazzled with its mercurial temper, might one day settle into an air of decorous tranquility. Indeed, Bitcoin’s volatility hath reached historic lows, an alteration as startling as Mr. Darcy’s confession of affection. One must wonder—does this transformation signal a season of maturity, or merely a loss of the beloved drama for which traders so ardently lived? 🕵️♀️

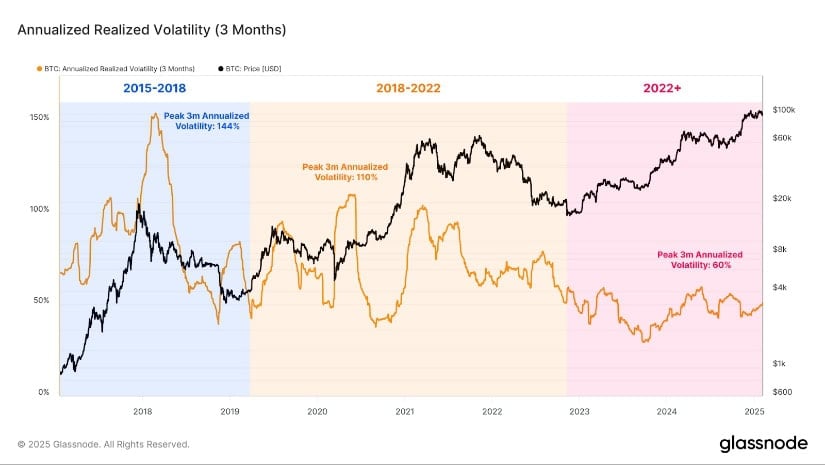

The esteemed scholars of Glassnode hath proclaimed that Bitcoin’s three-month realized volatility hath fallen beneath 50%. During past bullish soirees, wild price swings exceeding 80%, nay, even 100%, were as commonplace as the shrewd remarks of Mr. Bennet. Now, the asset appears to have aspirations of gentility and stability, perchance hoping to woo the approval of institutional investors with deep pockets and reserved temperaments.

Large entities—nay, more aristocratic investors—hath seized upon this opportunity, absorbing Bitcoin in quantities that render the influence of lesser retail traders akin to the faintest note at Bath’s finest assemblies. What follows is a market that no longer crumbles under the weight of panicked sellers, but rather retains its composure, much like a heroine resisting the advances of an unworthy suitor.

Bitcoin’s Price Ascends Gracefully—Crash No More! 🪜

No longer does Bitcoin’s price follow the capricious path of Catherine Morland’s imagination. Instead of plummeting slopes and reckless heights, the price adopts a steady “stair-stepping” pattern. Each rally concludes with a dignified pause, rather like Elizabeth Bennet taking stock after a particularly lively waltz. ‘Tis behavior befitting an asset aspiring to become a stable store of value. 📈

Naturally, the influence of institutional investors cannot be understated. The advent of U.S. spot Bitcoin ETFs hath enabled financial behemoths to partake in Bitcoin with the elegance and regulation customary amongst society’s upper echelons. These ETFs, attracting over $40 billion in net inflows, now resemble the grand ballrooms of crypto-land, ushering in an age of newfound poise for Bitcoin.

Furthermore, Bitcoin’s renown as a macroeconomic asset continues to expand. Countries such as El Salvador and Bhutan hath gambled boldly on its virtues, whilst in the United States, whispers of its potential as a strategic reserve are borne on the tongues of leading thinkers. Mr. Kendrick of Standard Chartered imparts, “Perhaps even the U.S. government may establish a national Bitcoin reserve.” One doth weep for the potential gossip this would create at Rosings Park. 😆

A Measured Market Signals Grand Possibilities 📜✨

According to the firm Unfolded, Bitcoin’s annual volatility hath dwindled to its lowest level in recorded history. Yet, lo and behold, its risk-adjusted returns still outstrip those of most major assets! Mark it well—this combination hath burnished Bitcoin’s reputation as a prudent long-term investment for even the most reluctant of suitors. Surely Mr. Collins himself could not wax more eloquent in praise. 💬

The aforementioned Mr. Kendrick anticipates delights ahead, declaring Bitcoin could ascend to dazzling heights, reaching $200,000 by late 2025 and a stratospheric $500,000 by the distant-but-not-too-distant year of 2028. Parabolic growth, he wagers, shall be inspired by improvements in accessibility and a fair reduction in those frustrating vicissitudes that once plagued the bold investor. His forecast, if correct, may make even Lady Catherine de Bourgh consider diversifying her portfolio. 😏

Good tidings indeed for Bitcoin and its legion of faithful HODLers. If one wondereth what crypto to acquire in this age of sedate propriety, perhaps it is not too late to purchase oneself a slice of destiny. As some would say, “Early days yet,” for should these speculative projections prove accurate, Bitcoin’s story hath many chapters still to unfold. 🧐📖

Read More

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Summer Game Fest 2025 schedule and streams: all event start times

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

2025-02-07 13:16