According to a recent analysis by investment research company Bravos Research, as Bitcoin approaches the year 2025, several key factors are anticipated to shape its path. These include a possible downturn in the overall stock market and substantial withdrawals from Bitcoin Exchange-Traded Funds (ETFs), both of which are predicted to pose significant challenges.

Bitcoin May Track Stock Weakness

As an analyst, I posit that Bravo’s Research indicates a potential downturn for Bitcoin’s price, given its current “parabolic phase.” This prediction is based on the possibility of Bitcoin’s trajectory mirroring the underperformance of the broader stock market.

In a contrast to the scenario of September 2024 as described by Bravos Research, it was stocks that reached record highs while Bitcoin faced challenges. However, eventually, Bitcoin managed to match the strength displayed by the stocks, as suggested in their December 31 report titled “Is the 2025 Bitcoin Crash Starting?“.

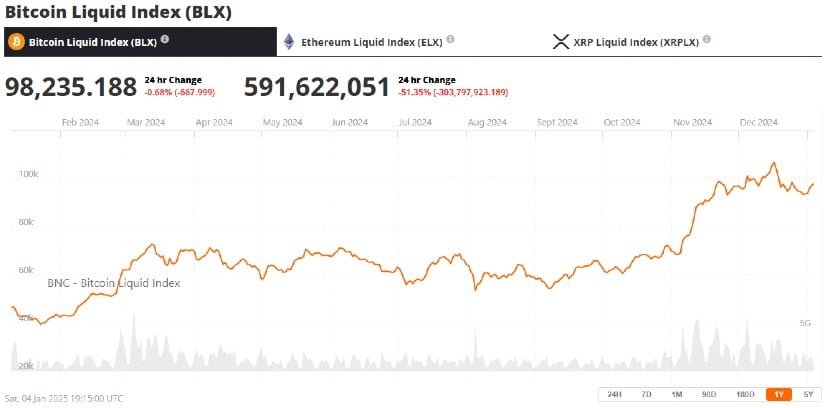

The report pointed out a possible dip in Bitcoin’s price, implying that Bitcoin could fall in line with stock market vulnerabilities. A related graph also showed the BTC/USD rate alongside the S&P 500, emphasizing a significant difference particularly in December 2024.

As a crypto investor, I’m keeping an eye on Bitcoin’s price movements. If there’s a correction and Bitcoin dips around $80,000, that could be an opportunity to buy for the next potential increase. This view aligns with current market sentiment, which considers $80,000 as a crucial support level.

ETF Outflows Add to Pressure

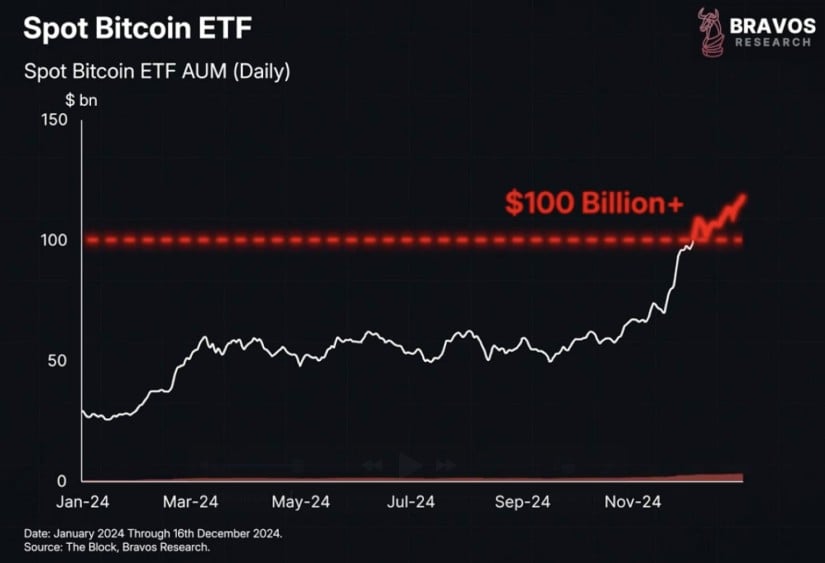

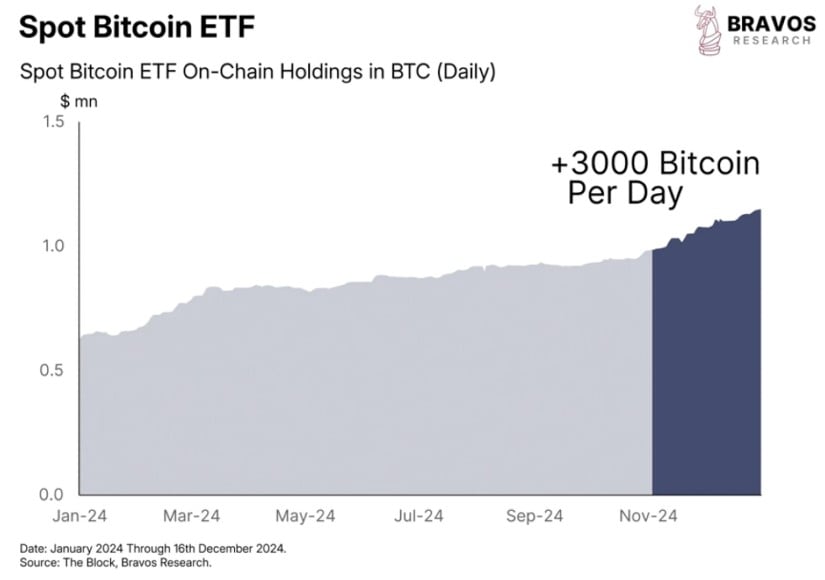

Approximately 3,000 Bitcoins are being added daily to the Bitcoin ETFs, which collectively hold more than 1.15 million Bitcoins. But Bravos Research has warned that any slowdown in this buying spree might cause Bitcoin prices to decrease.

According to Bravos’ calculations, Bitcoin ETF purchases at their current rate could potentially cause a 50% increase within approximately 50 days. Yet, a minor decrease in ETF purchases might lead to a drop in prices.

The ongoing withdrawals from BlackRock’s iShares Bitcoin Trust (IBIT) add fuel to the growing apprehensions. Although ETF purchases held steady throughout most of 2024, Bravos highlighted past examples like March 2024, where Bitcoin prices dropped by 30% even as ETF buying persisted.

Bitcoin Price Trends and Technical Indicators

2025 has seen me witnessing a drop in the price of Bitcoin as it hovers below $100,000, taking a step back from its record-breaking high in November 2024 of $97,938. This dip coincides with a more aggressive stance from the Federal Reserve, which is impacting overall sentiment towards risky assets. As an investor, I find myself keeping a keen eye on Bitcoin’s relationship with macroeconomic factors such as inflation statistics and interest rate adjustments.

Looking at it technically, Bitcoin’s soaring trend indicates there could be a sudden drop prior to regaining its bullish pace. Crucial support points, such as the $80,000 mark, play a significant role in preserving investor trust.

Market Sentiment Remains Divided

There’s a split opinion among investors about what will happen to Bitcoin in the short term. Some people think there might be more price drops, but others believe that any dip is an excellent chance to buy Bitcoin strategically.

According to an analyst at Farside Investors, although Bitcoin’s price fluctuations are significant, it has a robust foundation. This volatility might offer chances for long-term investors during periods of correction.

In the year 2025, Bitcoin’s ability to withstand economic and market turbulences could decide if it continues to hold its place as a top digital currency. The behavior of ETFs, stock market fluctuations, and regulatory changes will significantly influence the environment, so traders and investors should brace for a vibrant and changing year.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2025-01-05 16:12