As a seasoned analyst with over two decades of experience tracking digital assets, I have witnessed Bitcoin‘s remarkable journey from its inception to becoming a global financial phenomenon. The recent market fluctuations, while challenging, are nothing new for a seasoned observer like myself.

Historically, I’ve seen Bitcoin defy expectations and break through barriers, so the possibility of it reaching $100,000 and beyond is not a long shot in my book. With a keen eye on market trends, I can confidently say that the bullish sentiment surrounding Bitcoin remains robust, despite its current struggles to reclaim the $100,000 support level.

The resilience displayed by short-term holders at the $94,000 price point is particularly noteworthy, as it highlights their growing confidence in Bitcoin’s long-term potential. This cautious optimism stems from a combination of factors, including the strong macro outlook for digital assets and the increasing acceptance of cryptocurrencies by mainstream institutions.

In my experience, these are all positive signs that bode well for Bitcoin’s future performance. With a target of $120,000 on the horizon, I believe that we could be witnessing the early stages of another monumental leg up in Bitcoin’s price trajectory. However, as always, there will undoubtedly be short-term fluctuations and risks along the way. As an analyst, it’s my job to navigate these challenges while keeping a long-term perspective.

On a lighter note, I remember back when Bitcoin was trading for just a few cents, and some people thought it would never amount to anything. If you had told me then that one day we’d be discussing whether or not $100,000 is a realistic target, I wouldn’t have believed you. But here we are, and the future of Bitcoin continues to amaze and intrigue me every single day.

Over the last few days, Bitcoin has struggled to regain the $100,000 mark, suggesting a temporary uncertainty in the market regarding its short-term prospects.

On a larger scale, it seems that Bitcoin could be on track for substantial growth as we approach 2025, with a growing number of investors becoming optimistic about its future.

Bitcoin’s New High May Not Be A Long Shot

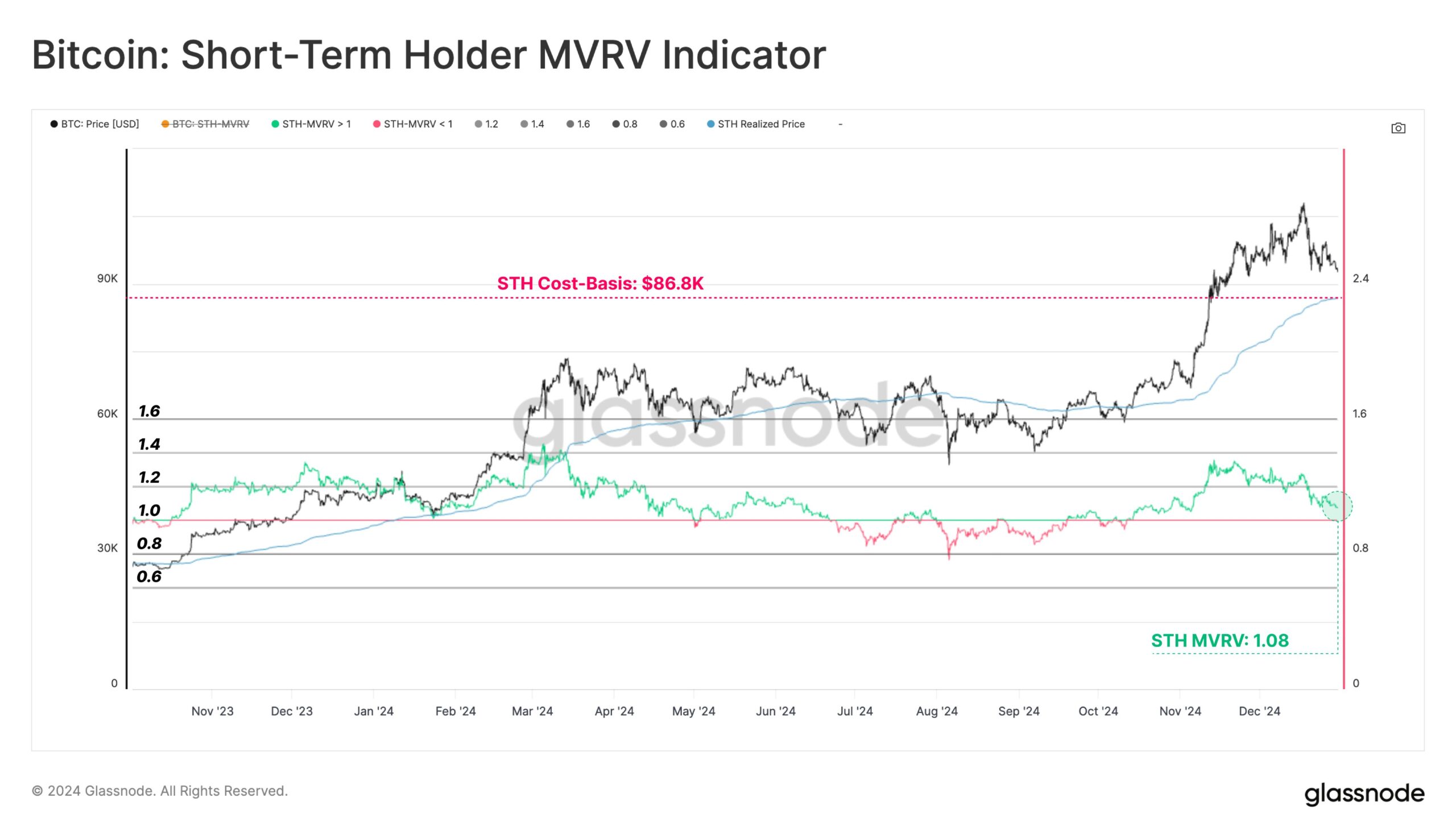

Presently, the total cost basis for short-term investors stands at approximately $86,800, which is quite close to Bitcoin’s current price of about $94,170. Traditionally, these investors tend to sell quickly when there are price changes. However, given that they have potential gains of 7.9%, they might be inclined to hold onto their investments, as the market sentiment appears to be optimistic.

This cautious optimism arises from increasing faith in Bitcoin’s long-term prospects, as indicated by the growing confidence among its investors. These investors, influenced by market trends, seem prepared to sustain their investments. As Bitcoin approaches significant resistance points, the prospect of higher price goals encourages holders to delay selling prematurely, thereby strengthening the argument for a bullish 2025 prediction.

Analyst Crypto Rover recently shared on Twitter that the rebound from Bitcoin’s $94,000 mark may generate new millionaires. This repeated resistance at this price, proven over the last six weeks, underscores it as a crucial support line.

As a researcher, I’m observing an extended surge in Bitcoin’s price that seems to be propelling forecasts towards a potential increase up to $112,000 in the short term. The resilience of Bitcoin in maintaining above $94,000 despite escalating purchasing activity indicates robust macroeconomic impetus. If this momentum persists, Bitcoin could break through existing resistance barriers and aim for higher milestones on its ascending path.

BTC Price Prediction: Noting A Rise

At the moment, Bitcoin is being exchanged at approximately $94,060, and its upcoming major goal is estimated to be around $120,000. On a larger time scale, Bitcoin seems to be shaping a parabolic trendline, indicating persistent bullish energy. This technical pattern coincides with broader assumptions for substantial growth as 2025 draws near.

According to the weekly chart analysis, Bitcoin is forming a third base between Q2 and Q3 2024. This foundation is essential for pushing Bitcoin towards new heights, possibly surpassing its previous all-time high of $108,384. If this upward trend continues, we might see Bitcoin’s value exceed $120,000 within the upcoming months.

Nevertheless, risks persist. If some significant players decide to sell their Bitcoins, the price could drop to around $89,586 where it might find support. If this level is lost, there could be a further dip to approximately $72,569, potentially altering the current optimistic view. The immediate market conditions will significantly influence Bitcoin’s direction.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gold Rate Forecast

- Every Minecraft update ranked from worst to best

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2024-12-31 15:34