As a seasoned analyst with extensive experience in the crypto market, I find the recent trends in Bitcoin outflows from exchanges and the surge in new addresses quite intriguing. The bullish sentiment surrounding these developments is hard to ignore, especially given the current economic climate where the US national debt has surpassed the $35 trillion mark.

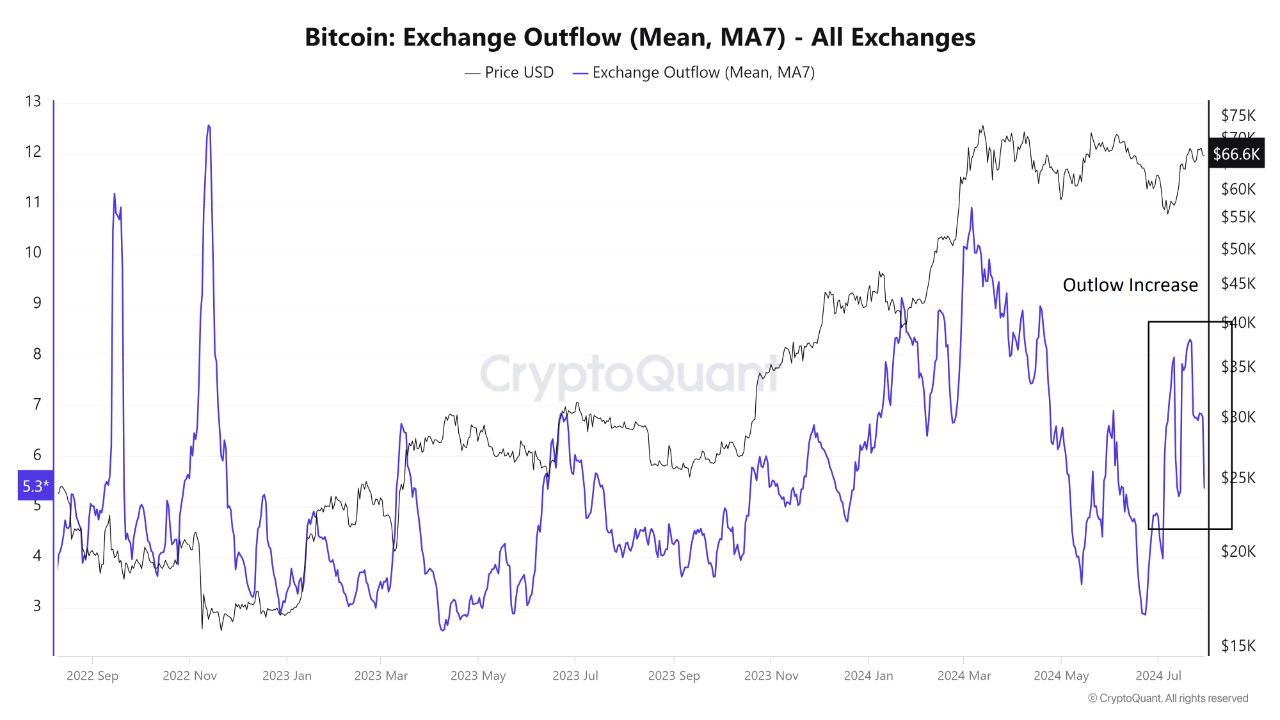

Over the past few months, there’s been a trend of more Bitcoin ($BTC) being withdrawn from exchanges, even though the price of Bitcoin has been experiencing volatility and fluctuations since February.

Based on data released by the crypto analysis firm CryptoQuant, there’s been a progressive increase in Bitcoin withdrawals from exchanges over the past few weeks, which often indicates a bullish market trend. This decrease in BTC supply on exchanges suggests that the cryptocurrency’s price might climb if demand remains consistent or grows further.

Furthermore, it’s worth noting that the count of newly created Bitcoin wallets is on the rise, according to CryptoPotato’s report. After touching record lows in June, this figure has since shown signs of recovery, which is usually indicative of increasing curiosity towards cryptocurrency.

At this point, outflows are happening, coinciding with the U.S. national debt exceeding $35 trillion for the first time. This significant figure was reached before Bitcoin failed to break through the $70,000 barrier and instead corrected, now trading at around $63,000.

As a researcher, I’d like to highlight an impressive milestone reached by Tether, the prominent issuer of stablecoins, specifically the USDT token. In the first half of 2024, they reported staggering profits amounting to $5.2 billion. Moreover, their portfolio of U.S. government bonds has experienced a substantial expansion, now estimated to be worth an impressive $97.6 billion.

The company disclosed that it currently possesses approximately 80,000 Bitcoins, which equates to around $5.1 billion in value. As we reported earlier by CryptoGlobe, last year, Tether pledged to allocate 15% of its realized net earnings towards the purchase of Bitcoin.

Unlike conventional banks that keep only a fraction of deposits on hand while lending out the rest, Tether primarily secures its cryptocurrencies with cash and brief-term U.S. government bonds (mainly 3-month Treasury bills). As I write this, these Treasurys are earning approximately 5.28%. The company also invests in gold.

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- Does Oblivion Remastered have mod support?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- DODO PREDICTION. DODO cryptocurrency

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

- Everything We Know About DOCTOR WHO Season 2

2024-08-02 05:12