The crypto market, that most beleaguered of social circles, enters December 2025 with the grace of a drunkard on a tricycle. BTC, once the belle of the ball, now limps toward $85,395, dragging altcoins in its wake like a Victorian widow’s train. Despite whispers of U.S. monetary largesse, the Yearn Finance hack-oh, that most vulgar of parties-and macroeconomic jitters have left Bitcoin, Ethereum, and XRP quivering like a poodle in a thunderstorm.

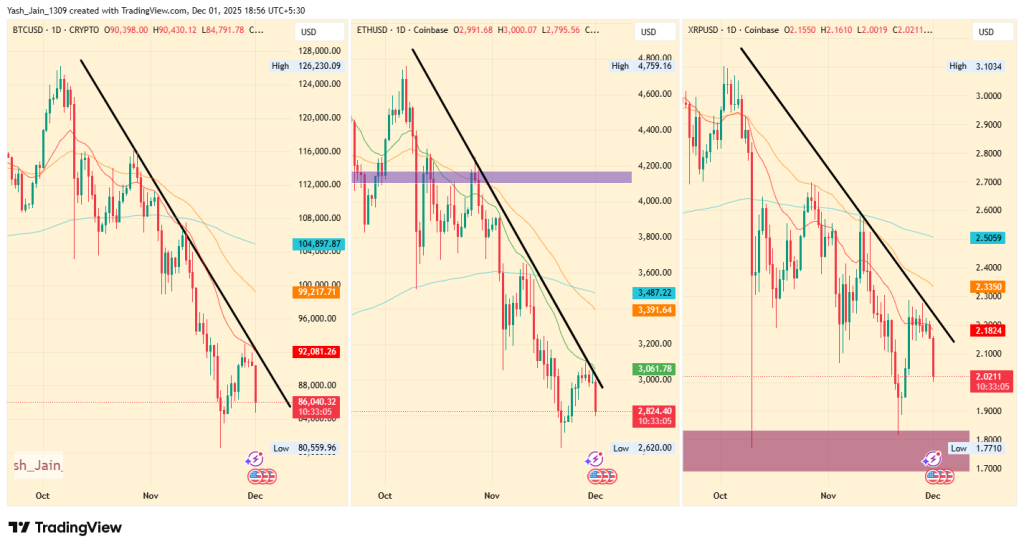

Bitcoin: Can the Market Leader Hold Above Key Support?

BTC, that old rogue, has taken a nosedive of seven per cent, now slinking toward $85,395 after a November that would make a hangman weep. Traders, ever the optimists, cling to an 87% chance of a Fed rate cut, but the Yearn exploit has dashed hopes like confetti at a funeral. If this bearish freefall continues, BTC might yet revisit the $74,458 zone-a price so quaint it belongs in a museum. But fear not! Should BTC reclaim its trendline, a bullish renaissance might yet bloom by mid-December. Or not. 🚀

Ethereum: Liquidity Shock Meets Macro Risk

Ethereum, BTC’s less-put-together cousin, has been rattled by the Yearn exploit. The hack, a masterclass in digital farce, minted infinite yETH tokens and drained liquidity like a vampire at a blood bank. ETH now trades at $2,825, a price that makes one long for the halcyon days of $2,620. Meanwhile, Japan’s BOJ threatens to hike rates, a move that could unravel carry trades and send markets into a tizzy. One can only imagine Governor Ueda sipping tea and declaring, “Shall we stir the pot?” 🍵

#PeckShieldAlert Yearn Finance @yearnfi suffered an attack resulting in a total loss of ~$9M.

The exploit involved minting a near-infinite number of yETH tokens, depleting the pool in a single transaction.

~1K $ETH (worth ~$3M) was sent to #TornadoCash, while the exploiter’s…

– PeckShieldAlert (@PeckShieldAlert) December 1, 2025

The most important macro story right now isn’t in the U.S., Europe, or crypto.

It’s in Japan and it could shake every global market in the next few weeks.Ueda Just Sent a Warning Shot

The Governor of the Bank of Japan, Kazuo Ueda, declared that the BOJ will “consider a rate…

– Techbr0 (@lucas67261771) December 1, 2025

If ETH plummets to $2,105, one might need a smelling salt to revive it. But if it breaks above its trendline, perhaps a bullish parlor trick is in store. Or perhaps not. The gods of finance are fickle. 🎲

XRP: Closely Tracking BTC Price and Ethereum Weakness

XRP, that most timid of tokens, has cratered 8% to $2.027, mirroring the market’s collective panic. With macro uncertainty and DeFi’s latest security scandal, XRP’s slide to $1.90 seems almost… poetic. Yet, history suggests XRP/USD may yet rebound if BTC and ETH stage a synchronized recovery. A trendline break could spark a festive rally by year’s end-or merely a yuletide illusion. 🎄✨

In conclusion, the crypto market in 2025 is a pantomime of despair, with hackers as villains, central bankers as villains, and investors as the unwitting chorus. May your candles burn bright and your wallets remain unexploited. 🕯️💸

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- HSR Fate/stay night — best team comps and bond synergies

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Top gainers and losers

2025-12-01 17:36