As an experienced analyst with a background in both traditional finance and the burgeoning crypto market, I find myself intrigued by the predictions surrounding Ethereum‘s future performance under President Trump’s administration. My personal take is that these forecasts hold merit, given the potential for regulatory clarity to unlock the full potential of Ethereum’s use cases.

Ethereum has been overshadowed for a while by both Bitcoin and Solana, similar to a middle child receiving less attention compared to their older and younger siblings. However, there’s speculation that its underperformance might change following the inauguration of Donald Trump as the 47th President of the United States in January. This prediction comes from Zach Pandl, who heads research at Grayscale Investments.

Indeed, Ether could potentially reap greater advantages from Trump 2.0 than Bitcoin, according to his recent report to investors. Here’s the reasoning behind it:

Regularity clarity matters more for ETH

Eric Trump reinforced his father’s pledge to transform America into a global leader in cryptocurrency during an interview on Monday. He believes that a well-thought-out regulatory system could propel the U.S. to crypto dominance by 2025, and the President-elect has chosen Paul Atkins as the head of Securities & Exchange Commission with the aim of achieving this goal.

As a researcher, I anticipate that Atkins will be entrusted with the mission of bringing greater transparency to the regulations governing the cryptocurrency sector. Furthermore, it’s rumored that he is planning to establish a novel White House role specifically focused on crypto policy. This potential development could potentially boost Ether’s performance, given that its applications are more diverse than Bitcoin’s and necessitate clear guidelines from regulators to fully actualize its vision, as suggested by Grayscale’s Pandl.

During the Trump administration, there could be increased regulatory certainty, which might strengthen Ethereum’s reputation as a global financial settlement layer. Moreover, this clarity would allow investors to earn returns by staking their ETH and potentially rejuvenate Ethereum-based Exchange Traded Funds (ETFs), which have been largely inactive since their approval in late July.

Despite Bitcoin having already exceeded $100,000, Ethereum’s price hasn’t reached a new record high yet. However, this gap suggests that Ethereum might have greater potential for growth compared to Bitcoin by 2025, according to Pandl’s conclusion.

ETH price prediction: could it hit $15,000 in 2025?

If you’re searching for an Ethereum price forecast in Pandl’s report for 2025, you won’t find a definite price prediction as he didn’t specify a clear target for ETH. However, Geoff Kendrick from Standard Chartered is more forthcoming; he anticipates that the second-largest cryptocurrency by market cap will surge beyond $14,000 in 2025.

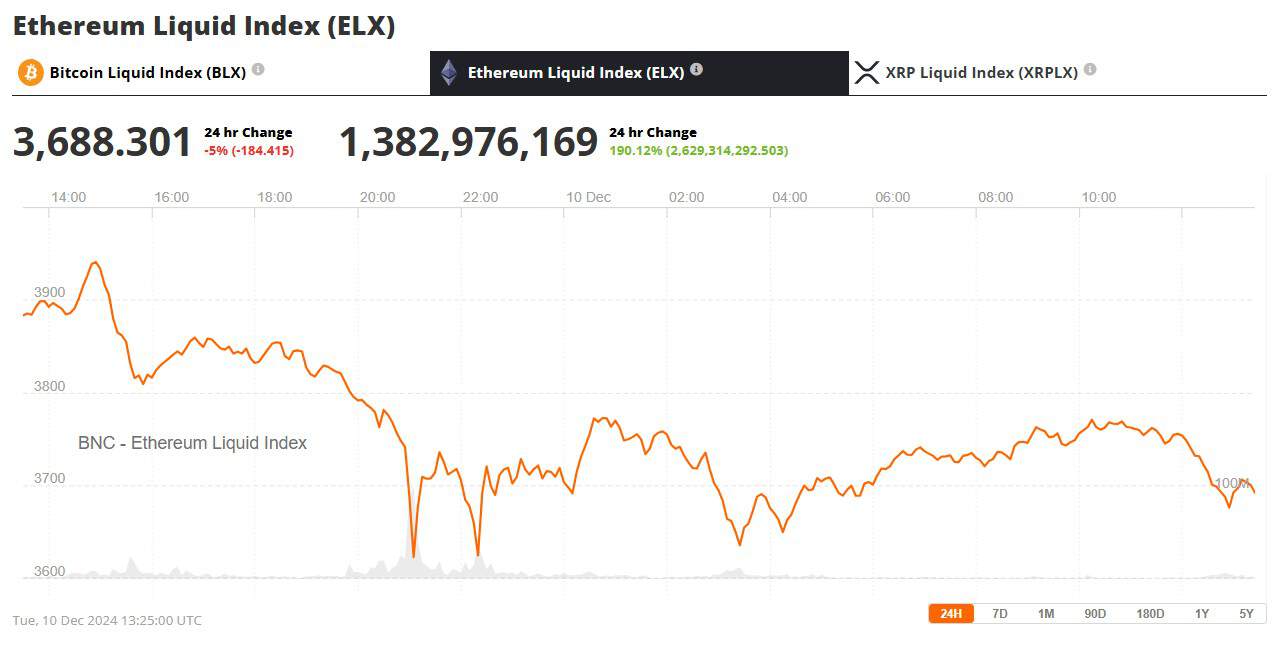

As a crypto investor, I’m currently observing ETH trading around the $3,800 mark, having surged approximately 65% over the past month. This impressive rally suggests a possible 275% increase from its current price by the close of next year, according to my price target estimate.

Kendrick believes that Trump’s supportive attitude toward cryptocurrencies could lead institutional investors to pour money into Ethereum funds by 2025, making it an even more compelling investment option among cryptos currently available. He finds the prospect of investing in Ether, given the recent updates to its network designed to boost scalability and reduce transaction fees, especially enticing.

Confidently predicting that the market value of Ethereum will soon match or surpass that of Bitcoin within the coming years, Standard Chartered also anticipates that Ethereum’s potential worth could reach an impressive $35,000 if it successfully scales up its transaction processing capacity significantly.

It’s worth mentioning that a leaked Goldman Sachs report from 2021 pointed out Ethereum’s versatile applications such as smart contracts and decentralized finance (DeFi), suggesting that ETH might surpass Bitcoin in performance and potentially become the leading digital asset for value storage.

Ethereum retains its edge over rivals like Solana

Since Donald Trump was elected as the 47th President of the U.S., overtaking Kamala Harris, Ether has shown superior performance and money has been increasingly flowing into its exchange-traded funds.

Still, skeptics roll their eyes on a bold ETH forecast like that of $35,000 mentioned above. They continue to expect the rising competition particularly from the likes of Solana to erode its market share over the long term.

However, when compared to other blockchain platforms, Ethereum stands out as the relatively safer choice due to its extensive history. With a more mature and well-established network, it has demonstrated robustness throughout various economic ups and downs as well as rigorous trials of stress.

As an analyst, I can attest that the security model of Ethereum has proven its resilience through real-world challenges. Unlike Solana, Ethereum’s network has never experienced a total collapse or outage. This robustness is one reason why forward-thinking institutions such as JPMorgan and BlackRock are actively exploring Ethereum for diverse applications, ranging from asset tokenization to DeFi and smart contracts.

It’s evident that Ethereum is gaining traction in the financial industry, with more institutions adopting this blockchain technology. This shift could significantly boost the demand for its native token, ETH. As a result, experts at Standard Chartered anticipate that ETH may reach the $35,000 mark within the coming years.

Read More

2024-12-10 17:19