As a seasoned researcher who has been tracking the cryptocurrency market for over a decade now, witnessing the growth and evolution of Bitcoin has been nothing short of astounding. The recent milestone achieved by US spot Bitcoin ETFs, surpassing the estimated 1.1 million BTC associated with Satoshi Nakamoto, is a testament to the increasing institutional adoption of digital assets.

Spot Bitcoin ETFs in the US now hold more Bitcoin than the estimated 1.1 million BTC associated with Bitcoin’s pseudonymous creator, Satoshi Nakamoto.

Reaching 1,105,923 Bitcoins across all U.S.-based Bitcoin Spot Exchange-Traded Funds (ETFs) signifies a major achievement in the crypto market.

A New Milestone for Bitcoin ETFs

In terms of asset management, BlackRock’s IBIT ETFs lead, followed by Grayscale’s GBTC and Fidelity’s FBTC. Combined, the 12 Bitcoin ETFs available in the US have amassed more than $33 billion in total net inflows since their debut in January.

This week alone, the funds saw nearly $2.35 billion net inflow. Bitcoin’s $100,000 milestone has pushed the total assets under management for these ETFs beyond $109 billion.

It’s thought that Satoshi Nakamoto mined roughly 22,000 of the initial Bitcoin blocks, which awarded him 50 Bitcoins per block due to the original reward system. This adds up to about 1.1 million Bitcoins. Since these coins were first created, they haven’t been moved or spent.

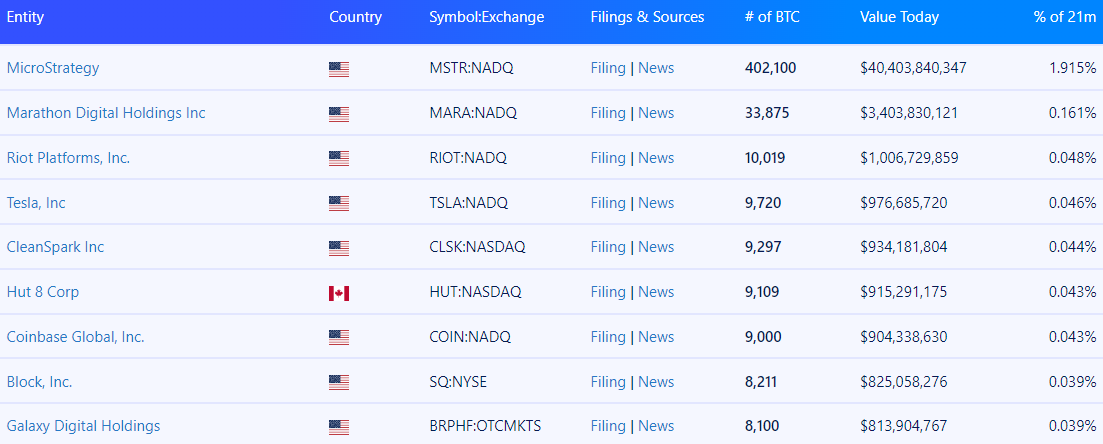

Although Satoshi Nakamoto is known as the biggest individual Bitcoin owner, numerous other entities also possess substantial amounts of this digital currency. For instance, MicroStrategy holds a considerable stake, boasting approximately 402,100 Bitcoins, worth more than $40 billion.

In 2020, the company chose to make Bitcoin its main treasury asset, and in November alone, it bought approximately $13 billion worth of Bitcoin. Companies such as MARA and Worksport, like this firm, have opted for a similar approach, amassing large quantities of Bitcoin.

At a national scale, the United States owns approximately 208,109 Bitcoins valued at around $21 billion, derived from confiscated assets. This makes the U.S. the world’s leading Bitcoin owner, outstripping both China and the UK in this regard.

According to ETF analyst Eric Balchunas, posted recently on social media platform X (previously known as Twitter), US spot Bitcoin ETFs have amassed over 1.1 million bitcoins, making them the largest holders of this cryptocurrency worldwide. Remarkably, these ETFs are only a year old, which means they’re essentially still infants in investment terms. This information is nothing short of astonishing.

Ongoing Speculation Over Satoshi’s Identity

2024 saw the persistent speculation over Satoshi Nakamoto’s true identity persist. In recent times, Australian researcher Craig Wright found himself under legal examination due to his frequent assertions that he is the inventor of Bitcoin.

Nevertheless, a UK court discarded his testimony and decided that his case had no substantial chance of winning. Subsequently, a debate arose after the airing of an HBO documentary titled “Money Electric“.

In October, a documentary suggested that Canadian cryptographer Peter Todd was actually the anonymous figure known as Satoshi Nakamoto. However, Todd rejected these allegations and, as a result of the ensuing unwanted attention and threats, is said to have withdrawn from public view.

At a London press conference held in late October, a man named Stephen Mollah announced that he was Satoshi Nakamoto. However, the event soon turned sour when Mollah couldn’t present convincing proof, and technical glitches added to the uncertainty surrounding his assertions.

Regardless of ongoing speculation and widespread curiosity, the real identity behind the creator of Bitcoin continues to elude us.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2024-12-07 04:11