Bitcoin ETFs had a day to remember, with a whopping $936 million influx, the largest since January 17. Meanwhile, Ether ETFs shed their gloom and welcomed $38.74 million in fresh capital.

Bitcoin ETFs Hit $936 Million Inflows, Ether ETFs Finally Get a Hug with $38 Million

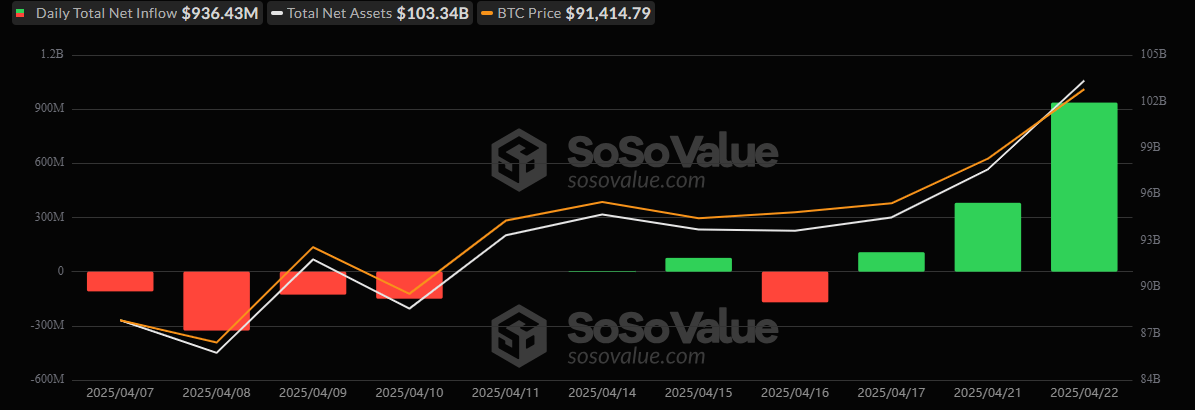

A veritable tsunami of capital flooded U.S. spot bitcoin ETFs on Tuesday, April 22, as though the financial gods had smiled upon them. A stunning $936.43 million surged into these funds, marking their most glorious single-day inflow since the bleak days of January 17. With this exuberance, total net assets broke through the $100 billion mark like a promising young debutante entering high society, closing at $103.34 billion.

The ever-reliable Ark 21shares’ ARKB led the charge, dragging in a princely $267.10 million. Not far behind, Fidelity’s FBTC posted a respectable $253.82 million in inflows, while Blackrock’s IBIT brought in $193.49 million. Bitwise’s BITB, like a determined underdog, added $76.71 million, and Grayscale’s flagship GBTC snatched up $65.06 million with quiet dignity.

Even the lesser-known funds got a slice of the pie. Valkyrie’s BRRR received $23.82 million, as though it was an afterthought in a wild party. Grayscale’s Mini Bitcoin Trust snatched up $21.09 million, while Invesco’s BTCO added a modest $18.27 million. Franklin’s EZBC quietly pocketed $10.60 million, and Vaneck’s HODL took a humble $6.47 million—probably buying lunch with it.

There were no outflows in sight for the ETFs, as if the market decided to spare them from their usual fate. Trading volume surged to $5.59 billion, as though everyone suddenly remembered that money can, indeed, buy happiness.

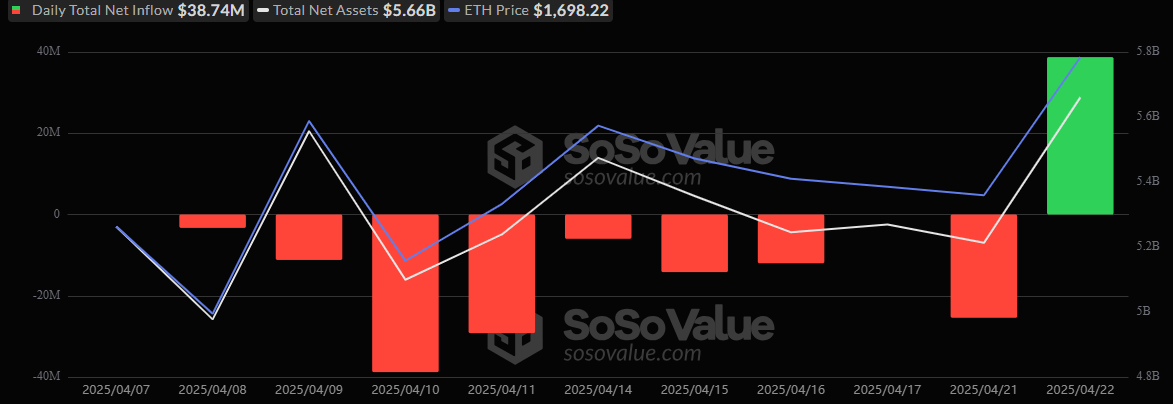

Meanwhile, on the Ether front, there was hope at last. Ether ETFs, which had been languishing in the pit of despair, finally experienced a bit of relief. A robust $38.74 million found its way in, led by Fidelity’s FETH ($32.65 million) and Bitwise’s ETHW ($6.09 million). The dark clouds parted, if only briefly.

The total ether ETF volume more than doubled to $496.30 million, and net assets rose to $5.66 billion, as if the world of crypto was suddenly paying attention again.

So, with bitcoin ETFs leading the way and ether ETFs, well, at least not collapsing, the once-dormant crypto markets may be coming back to life, like a grumpy cat finally acknowledging that it is, in fact, being petted.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

2025-04-23 17:59