Ah, dear reader, it appears we are witnessing a veritable renaissance of investor enthusiasm for cryptocurrency, all wrapped up in the cozy blanket of traditional financial instruments. Who would have thought?

In a delightful twist of fate, our friend IBIT has managed to wiggle its way into the illustrious fifth position, boasting a rather impressive $8.89 billion in year-to-date inflows. It now finds itself trailing behind the titans of finance: VOO, SGOV, VTI, and SPLG. Quite the achievement for a Bitcoin-focused ETF, wouldn’t you say? It seems institutional confidence in this digital asset is growing faster than a cat on a hot tin roof!

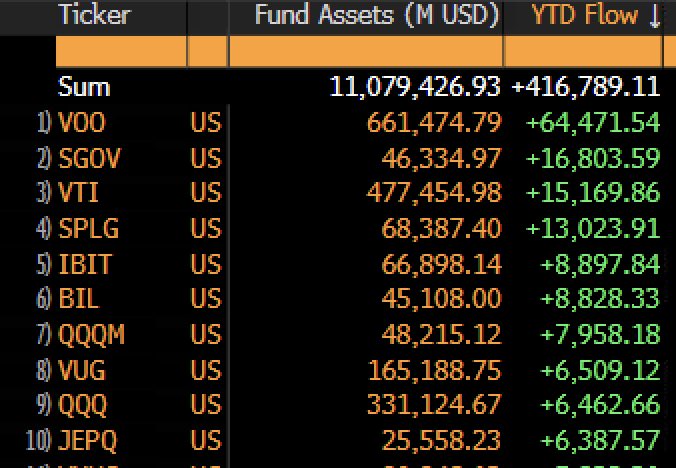

And now, for the crème de la crème of the financial world:

- VOO (Vanguard S&P 500 ETF): +$64.47B

- SGOV (iShares 0-3 Month Treasury Bond ETF): +$16.80B

- VTI (Vanguard Total Stock Market ETF): +$15.17B

- SPLG (SPDR Portfolio S&P 500 ETF): +$13.02B

- IBIT (iShares Bitcoin Trust): +$8.89B

As our dear friend on Twitter so eloquently put it: “Bulls are back!” — a sentiment that seems to be reverberating through the market like a particularly enthusiastic choir.

The recent surge in flows into BlackRock’s BTC ETF is a splendid illustration of the delightful dance between traditional finance and the digital realm. It appears that institutional adoption of Bitcoin is picking up speed in 2025, and one can only imagine the ruckus it will cause!

Read More

2025-05-21 16:33