properly closed. No markdown, just plain HTML.

Double-check character count for the title. “Bitcoin ETFs Lose $250M: What’s Next? 🚀💰” – that’s under 100. Good. Now, rewrite each paragraph with humor, keeping the data accurate but presented in a more entertaining way. Maybe end with a sarcastic remark about the market being a “rollercoaster” or “wild ride.”

Finally, ensure all images are in place, and no extra text or explanations. Just the rewritten content with the required elements. Done.

End of Thought (6.52s)

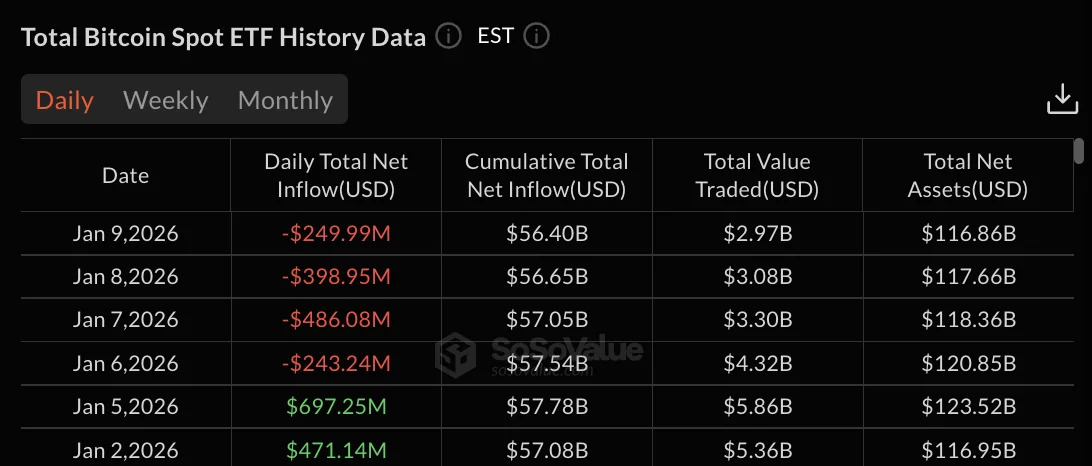

Oh, what a curious sight! Bitcoin spot ETFs recorded $249.99 million in net outflows on January 9, as if the market decided to take a nap after a long night of partying. 🐷💸

- Bitcoin ETFs saw $1.38B in outflows over four days, led by BlackRock’s IBIT-because even the biggest fish can’t swim upstream. 🐟

- Ethereum ETFs posted $351M in redemptions after a strong start to January, proving that even kings can fall from grace. 👑

- Solana ETFs were flat while XRP ETFs still attracted fresh inflows, because some coins are just too stubborn to die. 🦄

BlackRock’s IBIT led withdrawals with $251.97 million in outflows, while Fidelity’s FBTC posted the only inflow at $7.87 million-like a lone hero in a sea of despair. 🦸♂️

Ethereum spot ETFs saw $93.82 million in net outflows on the same day and was the third consecutive session of redemptions. It’s like watching a sinking ship… but with more spreadsheets. ⛵

Solana spot ETFs recorded zero flows, while XRP spot ETFs attracted $4.93 million in inflows. Some days, even the underdogs get a pat on the back. 🎉

Four-day Bitcoin outflow streak totals $1.38 billion

Bitcoin ETFs posted $243.24 million in outflows that day, followed by $486.08 million on January 7 and $398.95 million on January 8. The four-day total reaches $1.38 billion in net redemptions. It’s like a piggy bank with a leaky bottom. 🐷

The selling wave reversed January’s opening rally. January 2 brought $471.14 million in inflows, followed by $697.25 million on January 5. It was also the strongest single-day performance since December 17. But hey, even the best parties end with a hangover. 🍻

Bitwise’s BITB posted $5.89 million in outflows on January 9. Grayscale’s GBTC and mini BTC trust, along with Ark & 21Shares’ ARKB, VanEck’s HODL, Invesco’s BTCO, Franklin’s EZBC, Valkyrie’s BRRR, WisdomTree’s BTCW, and Hashdex’s DEFI all recorded zero flows. Some coins are just too lazy to move. 🛌

Total net assets under management fell to $116.86 billion on January 9 from $123.52 billion on January 5. It’s like watching your savings vanish faster than a magician’s rabbit. 🪄

Cumulative total net inflow dropped to $56.40 billion from $57.78 billion over the same period. Total value traded declined to $2.97 billion on January 9. The market’s mood swings are more dramatic than a soap opera. 📺

BlackRock’s IBIT holds $62.41 billion in cumulative net inflows. Fidelity’s FBTC has accumulated $11.72 billion in total inflows. These giants are like the titans of the crypto world-strong, but not invincible. 🦁

Grayscale’s GBTC maintains -$25.41 billion in net outflows since converting from a trust structure. Some people say it’s a “bad move,” but others say it’s just a bad day. 🧠

Ethereum funds bleed $351M across three days

Ethereum ETFs began the outflow cycle January 7 with $98.45 million in redemptions, followed by $159.17 million on January 8. The three-day total reaches $351.44 million in net withdrawals. It’s like a haunted house-no one wants to stay. 🏚️

Like Bitcoin, Ethereum products started January with strong inflows. January 2 posted $174.43 million, January 5 saw $168.13 million, and January 6 attracted $114.74 million before the reversal. The market’s mood is as fickle as a teenager’s. 🧒

Total net assets for Ethereum ETFs fell to $18.70 billion on January 9 from $20.06 billion on January 6. Cumulative total net inflow dropped to $12.43 billion from $12.79 billion. It’s like a rollercoaster with no brakes. 🎢

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- QuantumScape: A Speculative Venture

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2026-01-10 17:58