As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market fluctuations, and today’s Bitcoin ETF outflows have certainly caught my attention. The scale of these outflows is unprecedented, reaching $671.9 million – a figure that even the most ardent crypto bulls might find hard to swallow.

On Thursday, Bitcoin ETFs (Exchange-traded funds) saw a significant reversal in investment trends, experiencing the largest single-day outflows since their debut in January. Similarly, Ethereum ETFs also reported a pause in inflows, ending an 18-day streak of positive investment flows.

The situation persists as financial markets grapple with remarks delivered by Jerome Powell, the Federal Reserve chair, on Wednesday.

Bitcoin ETF Outflows Set New Peak at $672 Million

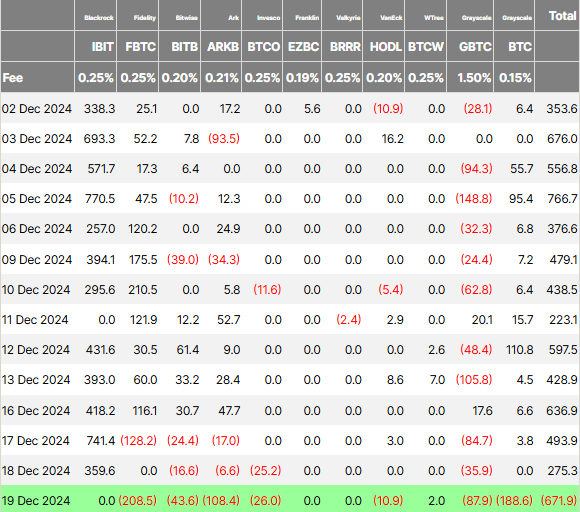

Based on Farside investor data, Bitcoin ETF saw record-breaking outflows amounting to $671.9 million on Thursday, surpassing the previous peak of -$564 million from May 1, 2024. This indicates a significant withdrawal of investments from the Bitcoin ETF during that period.

On December 19, Fidelity’s FBTC fund had the most significant selling volume among all funds, with a total of $208.5 million being withdrawn. This is worth noting as it represents the largest outflow since the fund began operation on January 11, making it the first day these financial instruments were offered to the public.

Yesterday saw significant withdrawals from Grayscale’s Bitcoin fund, amounting to $188.6 million – its poorest performance since the fund was launched. Additionally, Ark Invest’s ARKB added over $108 million to this total outflow during Thursday’s trading session. In contrast, BlackRock’s IBIT fund and Franklin Templeton’s EZBC, along with Valkyries’ BRRR, didn’t experience any inflows or outflows in the same period.

As a crypto investor, I’ve noticed a shift in the Ethereum ETF market recently. After an 18-day streak of positive inflows, we’re now seeing outflows worth approximately $60.5 million. This change could be linked to the news that the Federal Reserve is not authorized to hold Bitcoin. Such a stance might potentially impact the chances of a Bitcoin reserve being established in the U.S., which could be causing some uncertainty and driving investors away from Ethereum ETFs.

As a crypto investor, I noticed that all U.S.-based Bitcoin ETFs appear to be experiencing a significant downturn following the news about the Federal Reserve not being authorized to own Bitcoin. This seems to imply that there won’t be a strategic Bitcoin reserve fund. In other words, there are total outflows amounting to -$671.9 million as Cullen shared.

At his press conference on Wednesday, Jerome Powell indicated that the Federal Reserve does not have the authority to invest in Bitcoin, instead focusing on giving advice and enforcing regulations. Moreover, Powell seemed to suggest that the interest rate cuts predicted for 2025 might not materialize as originally anticipated. This shift in tone was prompted by data revealing that US inflation rates were not decreasing at the pace Federal Reserve officials had anticipated.

Given this scenario, it’s plausible that the significant sell-offs observed on December 19 were primarily a response from Wall Street investors, as they anticipate only two potential interest rate reductions in the coming year.

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- In Conversation With The Weeknd and Jenna Ortega

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- USD ILS PREDICTION

2024-12-20 11:06