Oh, the drama of it all! Bitcoin ETFs, those once-mighty titans of finance, have stumbled into a swamp of outflows—$115 million gone in a puff of smoke. Meanwhile, Ether ETFs are sipping champagne on their 20th consecutive day of inflows, adding a cheeky $17 million to their treasure chest. 🎉

Ah, but let’s zoom in on the chaos of Thursday, July 31—a day that will live in infamy for bitcoin ETFs. The market sentiment did a little pirouette, and suddenly, Blackrock’s IBIT was bravely hoarding $18.62 million, while Franklin’s EZBC, Grayscale’s Bitcoin Mini Trust, and Invesco’s BTCO were pooling their pennies to contribute nearly $16 million. Even Vaneck’s HODL chipped in $3.31 million like a good sport. But alas, it wasn’t enough.

The villains of the piece? Ark 21shares’ ARKB, bleeding $89.92 million like a leaky faucet, followed by Fidelity’s FBTC, which waved goodbye to $53.63 million, and Grayscale’s GBTC shedding $9.18 million. Oh, the humanity! Or should I say, the *bitcoinality*? 😅 Despite a trading volume of $3.56 billion and net assets clinging to $152.01 billion, the scales tipped deep into the red zone.

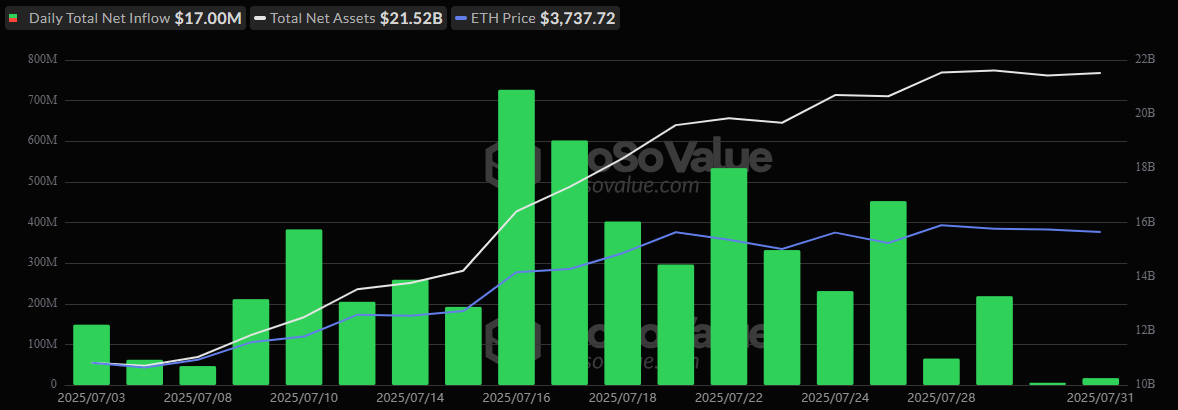

But wait! Over in the land of Ether, the sun is shining, birds are singing, and ETFs are laughing all the way to the bank. Their 20th straight day of inflows saw them tuck away another $17 million, with Blackrock’s ETHA leading the charge at $18.18 million. Fidelity’s FETH joined the party with $5.62 million, while Grayscale’s ETHE had a minor hiccup, losing $6.80 million—but who cares? The streak lives on! 🚀

Trading volume hit $1.28 billion, and net assets soared to $21.52 billion. Clearly, ether is becoming the belle of the institutional ball. And why not? It’s consistent, charming, and doesn’t throw tantrums like its older sibling, bitcoin.

So, what’s the moral of this financial fairy tale? Bitcoin ETFs are having a midlife crisis after heavy institutional moves earlier this month, while Ether ETFs are proving that slow and steady wins the race—or at least keeps the green streak alive. 💚

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- 9 Video Games That Reshaped Our Moral Lens

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-02 01:58