As a seasoned crypto investor with years of experience navigating market volatility, I find the current trend of Bitcoin ETFs quite intriguing. Despite the broader market experiencing a downtrend, these funds show no signs of weakness, extending their bullish momentum for a ninth consecutive day. It’s like watching a well-choreographed dance where one partner leads and the other follows, but both move in perfect harmony.

Bitcoin Exchange-Traded Funds (ETFs) have shown no signs of faltering, continuing to see daily inflows for nine consecutive days, despite a general downward trend in the broader market.

BlackRock’s spot Bitcoin ETF IBIT led with the most inflows over the past day.

Bitcoin ETFs Extend the Bullish Momentum

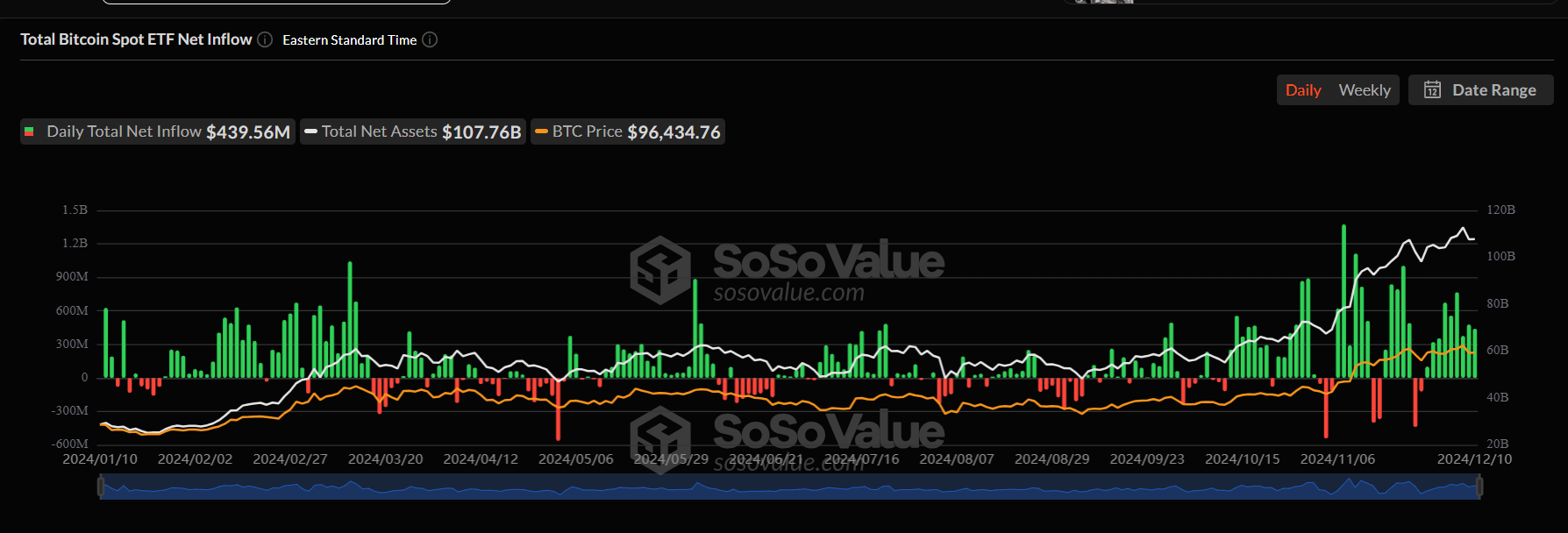

Based on SoSoValue’s data, Bitcoin ETFs continued their winning streak, posting positive inflows for the ninth day in a row on December 10. Over the past week, all 12 funds collectively saw the second-largest weekly inflow of approximately $2.73 billion. Despite market-wide liquidations this week, investors in these ETFs appear very optimistic about the funds.

On Tuesday, Exchange-Traded Funds (ETFs) received a substantial investment totaling approximately $439.56 million. Leading the way was BlackRock’s IBIT, which garnered investments amounting to $295.63 million. Close behind was Fidelity’s FBTC, with an inflow of around $210.48 million.

simultaneous with this, Grayscale’s GBTC experienced withdrawals exceeding $60 million; however, the overall $400 million in inflows underscores the robust investor appetite for US Bitcoin spot ETFs.

The total net assets under these ETFs have crossed $107.76 billion, which marks 5.65% of Bitcoin’s total market cap. More interestingly, these funds currently hold more Bitcoin than Satoshi Nakamoto.

Last month saw Bitcoin ETFs receive an impressive $6.1 billion, which is the largest amount of inflows since they were launched in January. So far in December, these inflows are approaching $4 billion, and if the trend continues, we might see another record-breaking month for these funds.

On Tuesday, Ethereum-based Exchange Traded Funds (ETFs) attracted over $305 million in a day, which was quite impressive. However, the same level of performance was not mirrored across the broader market.

Crypto Liquidations Soar to Billions

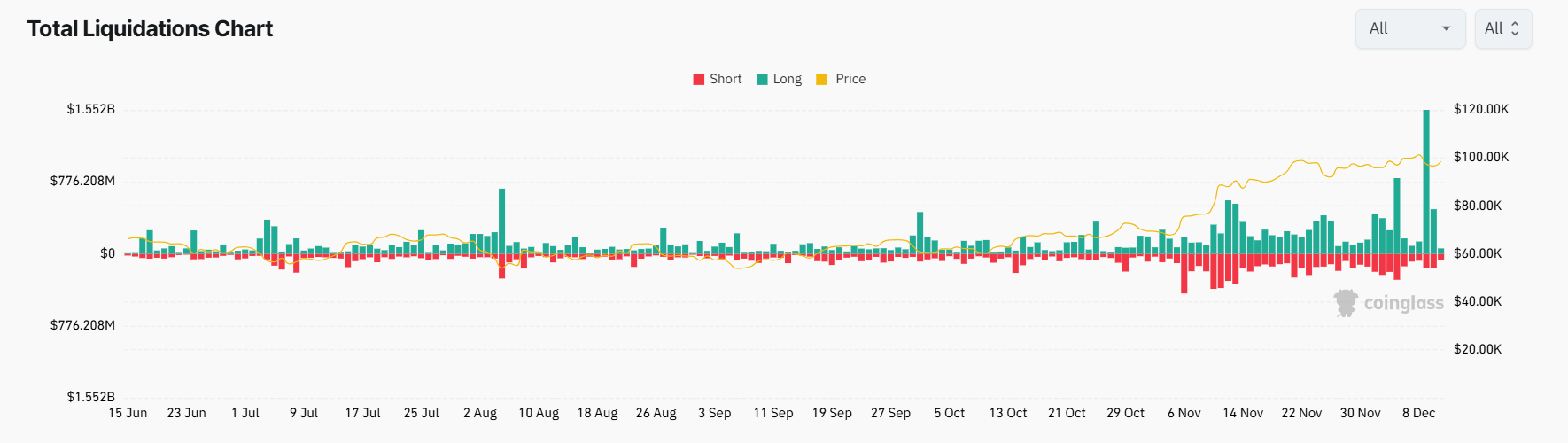

Although the ETF market has been expanding, the last couple of days have witnessed an increase in liquidations due to Bitcoin’s failure to maintain its value above $100,000. This drop in Bitcoin’s price pulled down the rest of the market as well, causing a decrease in the total crypto market cap. Notably, significant altcoins such as XRP and Solana followed suit in experiencing similar losses as Bitcoin.

Based on information from Coinglass, a staggering $1.7 billion worth of positions were closed down on the 9th of December due to Bitcoin’s price drop to approximately $97,000 following its previous high of $100,000.

This week saw a persistent decline in the market, with the accumulated selling off amounting to approximately $2.5 billion during the last three days.

Currently, Bitcoin has bounced back and is being traded at approximately $100,555, representing a 5.06% increase over the last 24 hours. If it maintains this level above $100,000, it will further fortify its presence within institutional investment portfolios.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

2024-12-11 23:39