So, Bitcoin ETFs are on a 10-day winning streak, huh? $433 million in inflows, all thanks to Blackrock’s IBIT. I mean, who knew they had it in them? Ether ETFs are also doing their thing, racking up $84.89 million over eight days. It’s like a crypto party, and everyone’s invited! 🎉

Bitcoin and Ether ETFs Soar with Nearly $520 Million in Combined Inflows

Momentum in the crypto ETF market is like that one friend who just won’t leave the party. Both bitcoin and ether funds are charging ahead, accumulating like it’s going out of style. Seriously, what’s next? A crypto parade? 🎈

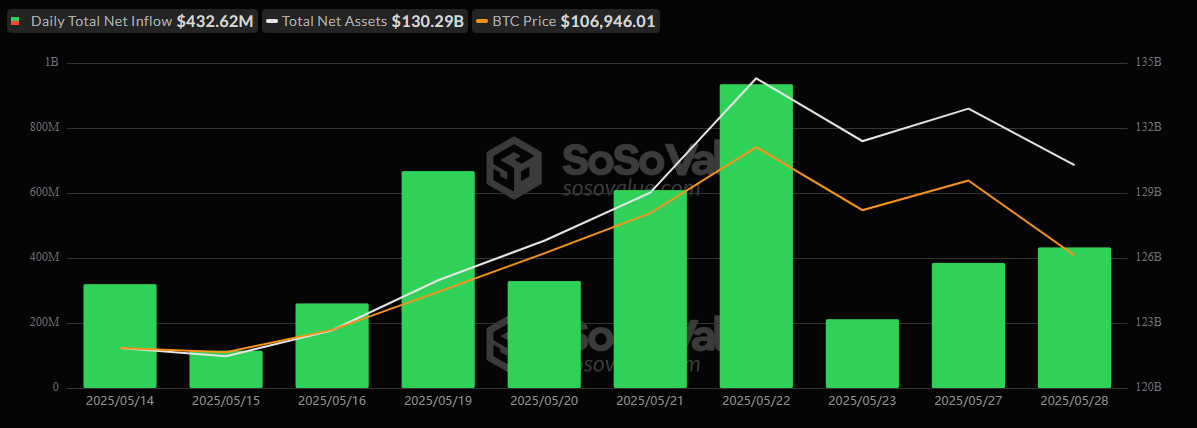

Bitcoin ETFs are celebrating their 10th consecutive day of net inflows, pulling in a whopping $432.62 million. And guess what? It’s all from Blackrock’s IBIT. Talk about a one-man show! $480.96 million just from them. I mean, come on! Where’s the love for the little guys? 😏

Sure, there were some outflows from Ark 21shares’ ARKB ($34.29 million) and Fidelity’s FBTC ($14.05 million), but IBIT’s got the charm to keep the streak alive. Total trading volume hit $3.50 billion. That’s billion with a “B”! And total net assets? A cool $130.29 billion. I can’t even count that high! 💸

Meanwhile, ether ETFs are not slacking off either, with $84.89 million in inflows, marking their 8th day in a row. Blackrock’s ETHA is leading the charge with $52.68 million, followed by Fidelity’s FETH ($25.71 million), Grayscale’s Ether Mini Trust ($4.93 million), and Invesco’s QETH ($1.57 million). Total value traded? $459.49 million. Total net assets? $9.48 billion. I mean, who’s counting? 🤷♂️

Even with the broader markets doing their usual dance, institutional appetite for crypto exposure through ETFs is still bullish. It’s like they’re saying, “Forget the rest, we want the best!” Capital rotation into top-performing funds is the name of the game. And here I am, just trying to figure out how to pay for my morning coffee! ☕️

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- USD ILS PREDICTION

- 9 Kings Early Access review: Blood for the Blood King

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- All 6 ‘Final Destination’ Movies in Order

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- 10 Shows Like ‘MobLand’ You Have to Binge

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

2025-05-29 18:01