After five weeks of consecutive outflows, US spot Bitcoin ETFs have rebounded with $744 million in net inflows this week. On Monday, March 17, ETFs saw a $274 million inflow, which was the highest daily figure in over a month.

This rebound suggests that institutional investors are coming back to the Bitcoin market as macroeconomic factors have priced in. However, BTC still remains below the $90,000 threshold, much to the chagrin of many a hopeful investor. 🙄

Bitcoin ETFs Start Recovering from a $5 Billion Loss

//beincrypto.com/wp-content/uploads/2025/03/image-212.png”/>

This shift suggests that institutional players may be positioning themselves for a potential market recovery. Crypto influencer and Open4Profit founder Zia ul Haque pointed to this resurgence, questioning whether institutional investors are acting on inside knowledge.

“Institutes started Accumulating Again: Do they know something?! Bitcoin ETF saw a positive inflow for the last consecutive 5 days! This is the major consecutive inflow this month. From the beginning of March, giants sold BTC heavily which created a massive panic and price dump in the market. But in the last few days, they are accumulating again. This could be a good sign for the market,” ul Haque wrote.

His observation aligns with the steady recovery in ETF inflows and Bitcoin’s price action, which continues to defend against further downside. However, not everyone shares the bullish outlook and optimism for Bitcoin’s price recovery. Some analysts think that Bitcoin ETF inflows do not clearly reflect resuming buyer interest.

Institutional trading strategies are potentially experiencing structural shifts. Hedge funds often leverage a low-risk arbitrage strategy involving Bitcoin spot ETFs and CME futures. It’s a game of cat and mouse, with the market as the ultimate playground. 🐱🐭

“The ETF ‘demand’ was real, but some of it was purely for arbitrage. There was a genuine demand for owning BTC, just not as much as we were led to believe. Until real buyers step in, this chop & volatility will continue,” popular analyst Kyle Chasse explained.

If this structural shift continues, it could influence market stability despite the recent return of ETF inflows. It’s a delicate balance, much like a tightrope walker in a circus act. 🤹♂️

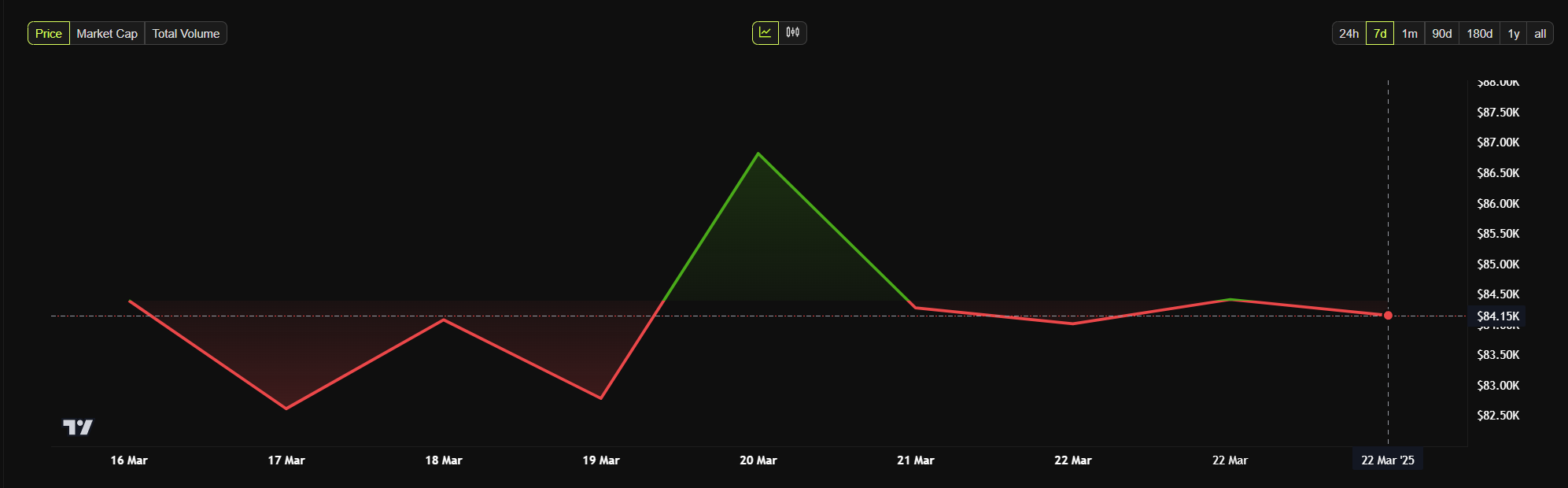

As of this writing, Bitcoin is trading at around $84,148. It is down by a modest 0.46% in the last 24 hours, failing to reflect optimism amid the recent uptick in Bitcoin ETF investments. Meanwhile, Ethereum ETFs continue to post negative flows, with net inflows in 12 consecutive trading days (over two weeks). It’s a tale of two cryptocurrencies, one rising and the other falling, like a comedy of errors on the financial stage. 🎭

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-03-22 13:03