Oh, dear reader, gather ’round and let me regale you with a tale of Bitcoin spot exchange-traded funds (ETFs) in the United States. It seems that the inflows of these peculiar financial contraptions have, in the year 2025, surpassed the same period in 2024, according to the latest data. 📊

Bitcoin Spot ETF Net Inflows Have Crossed $14.8 Billion In 2025 So Far

On the grand stage of X, Julio Moreno, the Head of Research at CryptoQuant, has taken to the microphone to share his insights on the curious comparison between the US spot ETF inflows for Bitcoin in 2024 and 2025. 🎤

Spot ETFs, you see, are like magical vehicles that allow the common folk to partake in the grand adventure of Bitcoin’s price movements without the hassle of dealing with digital wallets and exchanges. The ETF provider, a kind soul, holds the coin on your behalf, so you can invest in Bitcoin as if it were a traditional stock. 🤴

It was on the 10th of January, 2024, that the Securities and Exchange Commission (SEC) bestowed its blessing upon BTC spot ETFs. These ETFs quickly became the talk of the town, a cornerstone of the market, if you will. 🏛️

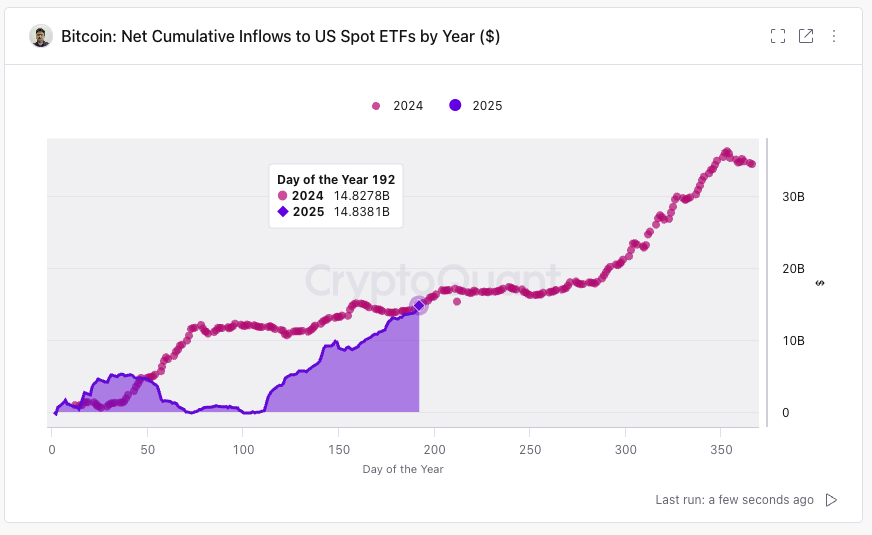

2024 was a year of unbridled joy for these ETFs, but 2025 has taken a different turn. Behold the chart shared by Moreno, which illustrates the cumulative net inflow trend for Bitcoin spot ETFs, comparing this year to the last. 📈

As you can see, the inflows for US Bitcoin spot ETFs were initially ahead in 2025 compared to 2024, but as the market took a nosedive, the inflows dried up, and 2025 fell behind. However, a few months into the year, the demand for spot ETFs began to return, and the gap started to shrink. Now, with the latest wave of inflows accompanying the rally to new price all-time highs (ATHs), 2025 has not only caught up but surpassed 2024. 🚀

From the chart, it is clear that 2025 cumulative net inflows stand at $14.8381 billion, while at the same point in 2024, they amounted to $14.8278 billion. Last year, the demand for spot ETFs was rather stagnant, so if the current pace continues, 2025 might just pull ahead. 🏆

However, only time will tell if the demand can sustain itself, as 2024 saw a surge in inflows toward the end of the year, driven by the market’s excitement and the price surge beyond $100,000. 🤞

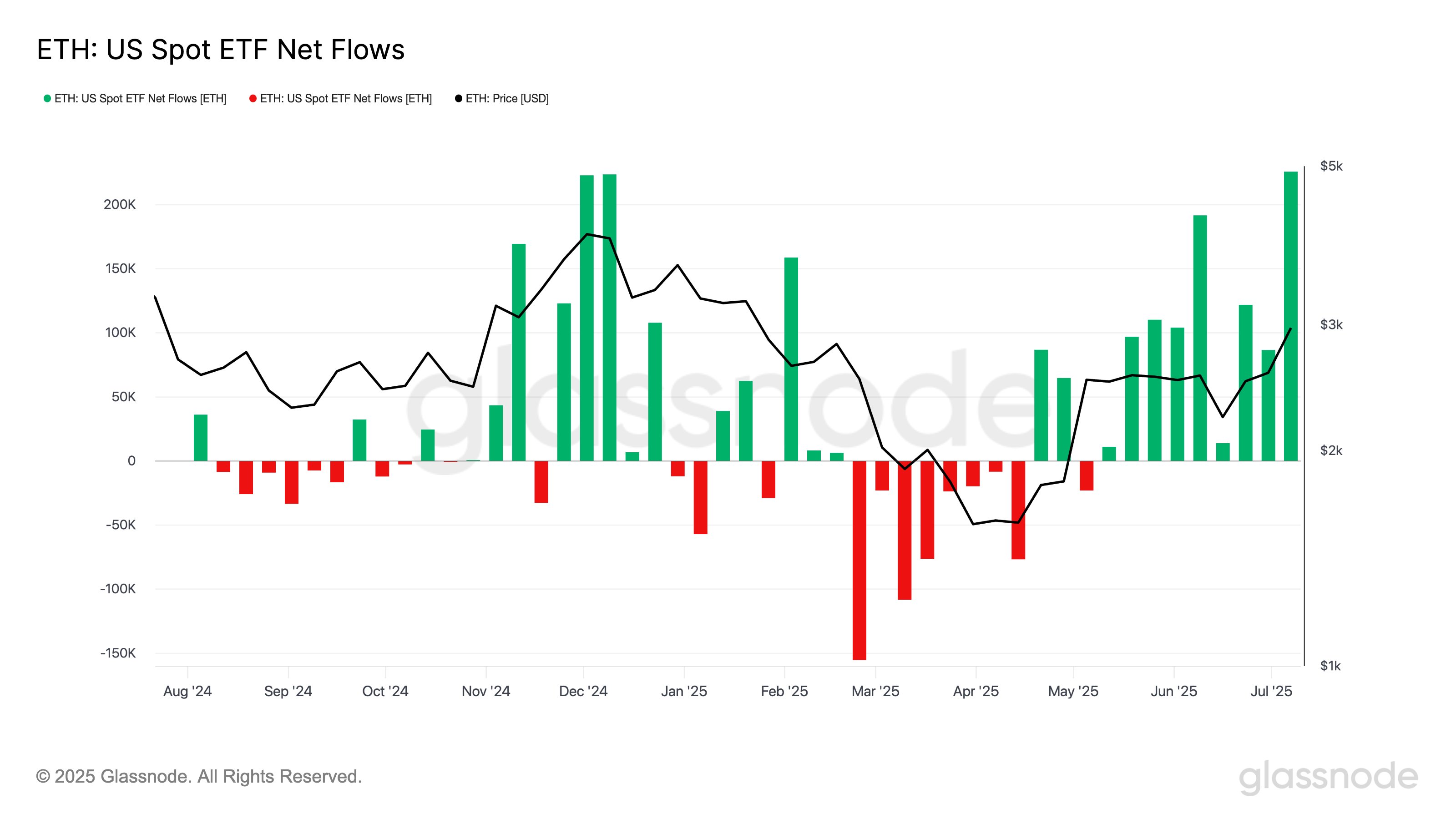

Meanwhile, in other news, US Ethereum spot ETFs have also been experiencing their own boom, with net inflows remaining positive for many weeks. Last week was the largest for Ethereum spot ETFs since the SEC approval in mid-2024, with inflows totaling 225,857 ETH. 🦊

BTC Price

Bitcoin, the grand protagonist of our story, set a new ATH beyond $123,000 yesterday, but alas, the joy was short-lived as the price has since retreated to $117,300. 🌠

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Silver Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- NEAR PREDICTION. NEAR cryptocurrency

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- USD COP PREDICTION

2025-07-16 12:44