Bitcoin ETF Flows Resurrect After Brief Slack! 🎉💸

On the illustrious Tuesday, amidst the whispering winds of financial destiny, Bitcoin exchange-traded funds (ETFs) — those enigmatic guardians of fortune — defied the mundane and reversed three days of silent outflows, conjuring over $350 million in net inflows. Perhaps even the markets tire of their gloom and decide to dance again, who can say? 🤔

This resurrection is all the more dramatic as BTC closed the day in a somber shade of red, yet investors’ hearts seem to beat with a new conviction, whispering promises of bullish days to come. A curious paradox, surely, but such is the twist of modern finance! 📉➡️📈

Institutional Titans Load Up on Bitcoin ETFs Amid the Lazy Market

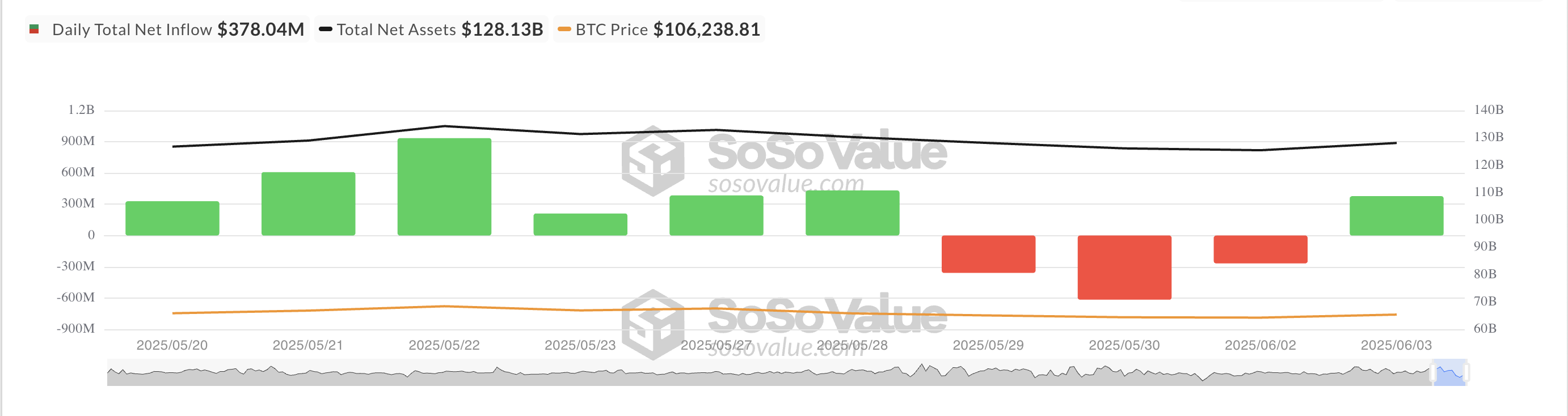

According to the wise SosoValue, on this very Tuesday, brave investors poured a staggering $378.04 million into BTC-backed funds, swelling the total net asset value of all BTC spot ETFs to the impressive sum of $128.13 billion. Yes, billion — enough to make an emperor blush.

While Bitcoin’s spot price continues its stubborn sideways waltz—making only modest steps forward—ETF demand seems to be dancing to a different tune, uncoupled from the short-term price tantrums. The inflows suggest that the wise institutional overlords are buying the dip, perhaps just for fun, even as the market appears to dawdle in indecision. 🤷♂️

Ark Invest and 21Shares’ ETF ARKB, those darling enfants terribles of investment, recorded the largest daily net inflow, a hefty $140 million, bringing its total to a respectable $2.51 billion. Fidelity’s ETF FBTC wasn’t left behind, adding $137 million and inflating its total to an astonishing $11.69 billion. The market may be cautious, but some players are clearly eager for the coming storm — or maybe just a better party. 🎉

Market Mood: A Whisper of Caution as Open Interest Dives

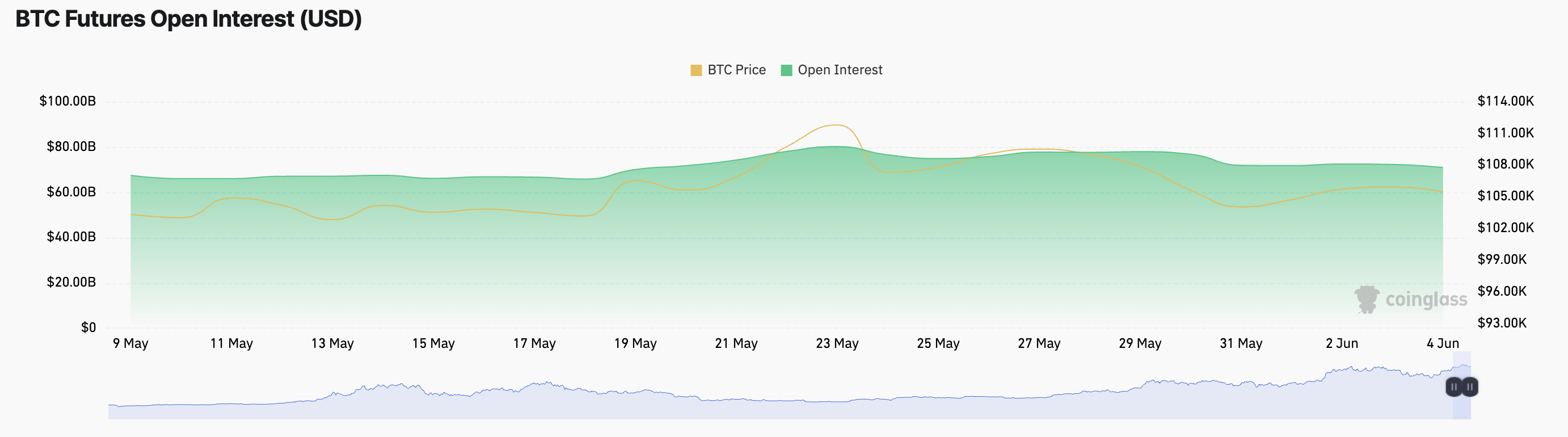

Today, the open interest in BTC futures is in retreat, like a bashful suitor avoiding the dance floor. It has declined to $70.89 billion, dropping 3% in the past 24 hours. The traders, evidently unsure whether to charge forward or stay silent, are closing their positions—perhaps whispering “Meh, let’s see what tomorrow brings”. 🤨

Open interest, that curious measure of active contracts awaiting their destiny, signals traders’ hesitations. When it falls while prices remain stagnant, it’s as if the market is holding its breath, waiting for something dramatic — or perhaps just tired of the routine. Not exactly a magnetic environment for breakout dreams. 😴

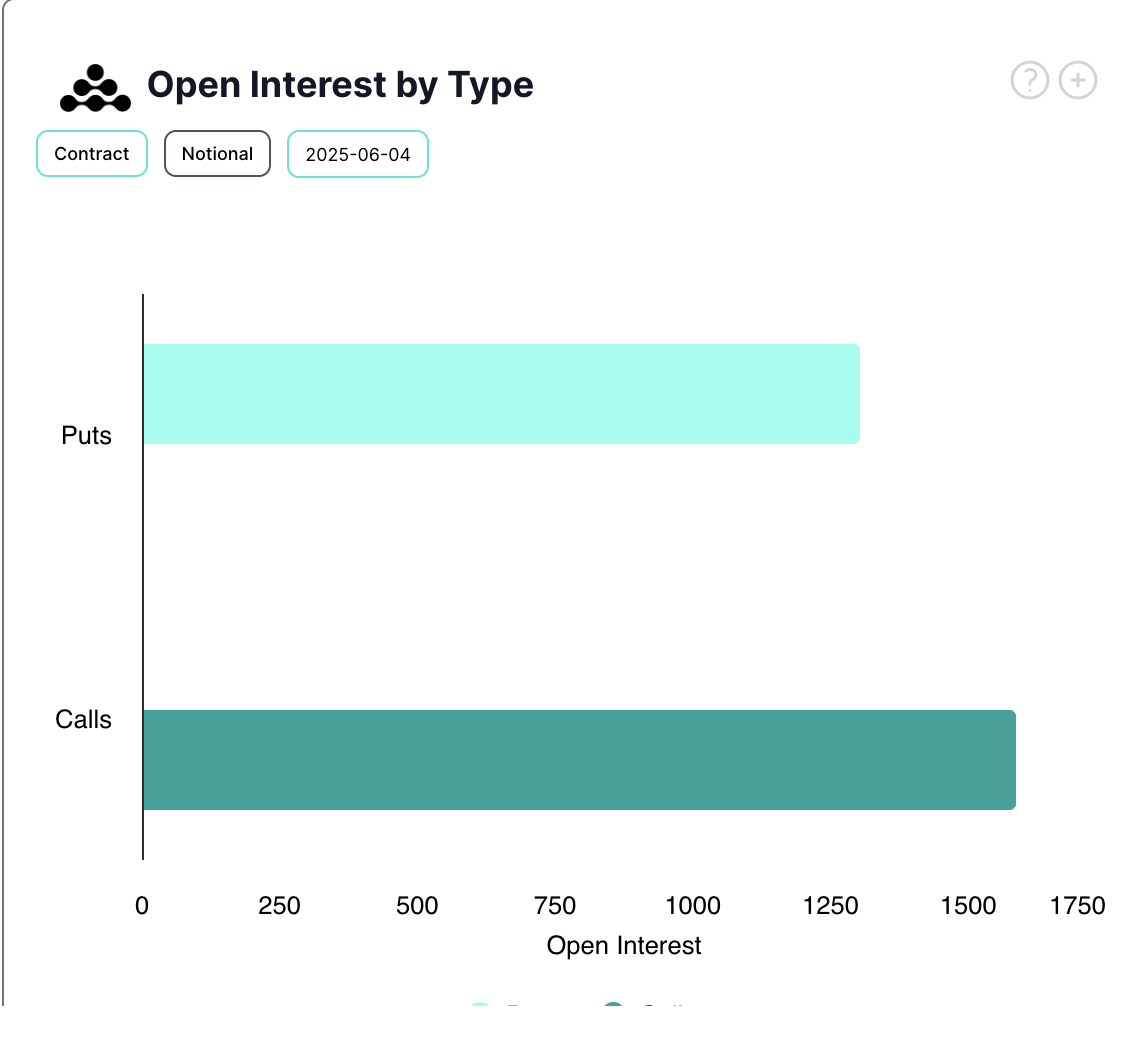

Yet, amid this cautious hum, the demand for call options—the subtle whisper of hope for upward action—has surged. Traders are hedging their bets and perhaps dreaming of a breakout, or at least a good story. When calls outnumber puts, it’s a sign that optimism, however fragile, still flickers in the night. 🌙✨

In this curious market, beneath the cautious veneer, lurks a seed of bullish sentiment. If the gods of finance smile kindly, this undercurrent might swell into a storm of recovery — or at least a decent party with some profits! Cheers to that! 🍾🥂

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Gold Rate Forecast

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Every Minecraft update ranked from worst to best

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2025-06-04 12:07