As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of economic cycles and their impact on various asset classes. Today’s Bitcoin price drop, coupled with the broader cryptocurrency market slump, appears to be another instance where macroeconomic factors are playing a significant role.

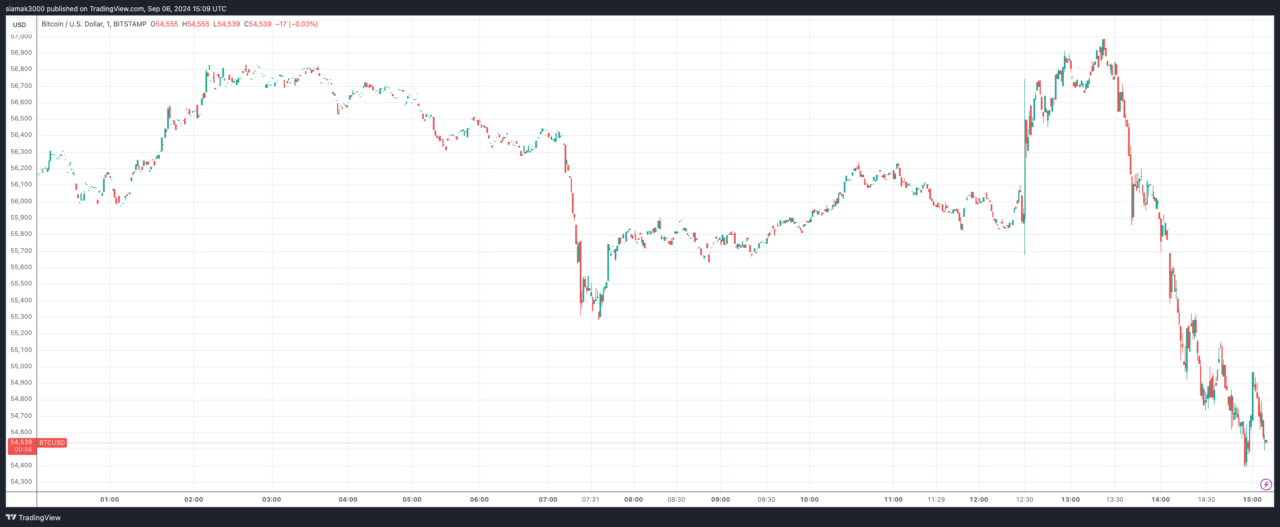

At precisely 2:50 p.m. on September 6th, 2024 (UTC), Bitcoin was being traded at $54,746, representing a 3.4% decrease over the previous 24 hours. This substantial drop in Bitcoin’s value appears to be linked with the underwhelming U.S. jobs report for August 2024, which was made public earlier that day. It seems that the overall cryptocurrency market, which often mimics Bitcoin’s trends, has also been influenced negatively by these same economic factors.

The U.S. Department of Labor Statistics’ recent press release indicates that August saw an employment growth of 142,000 jobs, which is less than anticipated. Contrary to earlier forecasts suggesting robust expansion, this data points towards a decelerating job market, causing worries about the current state of the U.S. economy. Interestingly, the unemployment rate stayed at 4.2%, meaning there were 7.1 million unemployed people, a higher figure compared to the same time last year when the unemployment rate was 3.8% and there were 6.3 million jobless individuals.

The analysis brought attention to significant job growth in areas like construction and healthcare during August. Construction jobs went up by 34,000, and healthcare employment saw a boost of 31,000. Unfortunately, other industries displayed minimal progress or no change at all. The manufacturing sector lost approximately 24,000 positions, primarily due to a drop in durable goods production, while retail trade, transportation, financial activities, and government sectors remained largely unchanged throughout the month.

While a softening job market might suggest to investors the possibility of a future interest rate reduction, which could positively impact assets like Bitcoin, this report has instead fueled worries about a potential U.S. economic recession. The fear that a weakening labor market could signal broader economic troubles has overshadowed the anticipation of Federal Reserve action during the upcoming FOMC meeting.

news reports show that the stock market responded negatively to recent events, causing further pessimism. For instance, CNBC reported a 1.4% decrease in the S&P 500, a 2.1% drop in the Nasdaq, and a 0.7% fall in the Dow Jones Industrial Average. Mega-cap technology companies were among those hit hardest, with Amazon, Alphabet, Microsoft, and Meta all experiencing losses exceeding 2%. Broadcom saw an even larger decline of 10%, following its announcement of in-line guidance for its fourth-quarter revenue. Other semiconductor companies like Nvidia, AMD, and Broadcom also suffered significant losses.

The disappointing job figures in August further fueled concerns, leading to a widespread sell-off of risky investments. Since Bitcoin is often considered a high-risk asset like tech stocks with rapid growth, its value was also affected by this market-wide selling. With investors becoming more cautious due to increasing economic contraction fears, the demand for risk has diminished, intensifying the downward trend in Bitcoin and the cryptocurrency market.

Read More

- Elder Scrolls Oblivion: Best Battlemage Build

- 30 Best Couple/Wife Swap Movies You Need to See

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Snowbreak: Containment Zone Katya – Frostcap Guide

- Are Lady Gaga’s Ever-Changing Wedding Plans Suiting Fiancé Dizzy? Here’s What’s Happening

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- ALEO PREDICTION. ALEO cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

2024-09-06 18:25