- Whale selling is like a bad breakup, while $3.3B inflows and long-term holders are the rebound. 💔💰

- NVT spikes, new address growth slows, and liquidation zones are like a rollercoaster ride—hold on tight! 🎢

On June 11th, Bitcoin [BTC] accumulation wallets had a day to remember, absorbing 30,784 BTC worth a whopping $3.3 billion. Talk about a shopping spree! 🛍️

These wallets, the introverts of the crypto world, are not linked to exchanges and now hold a collective 2.91 million BTC. Who knew hoarding could be so lucrative? 😏

Meanwhile, Bitcoin was trading around $104,719, reflecting a 2.41% daily drop. It’s like watching your favorite show get canceled—so much potential, yet so disappointing! 📉

Despite the short-term drama, the size and conviction of these inflows suggest a long-term bullish bias. It’s like the tortoise and the hare, but with more volatility! 🐢🐇

Whales vs. LTHs: The Ultimate Showdown

A prominent whale wallet recently decided to play the market by depositing 1,000 BTC worth $106 million to Binance. It’s like they’re trying to make a dramatic exit from a party! 🎉

So far, this wallet has offloaded 6,500 BTC, clearly signaling a strong intent to cash in as prices flirt with key resistance. But wait, they still hold 3,500 BTC—talk about mixed signals! 😅

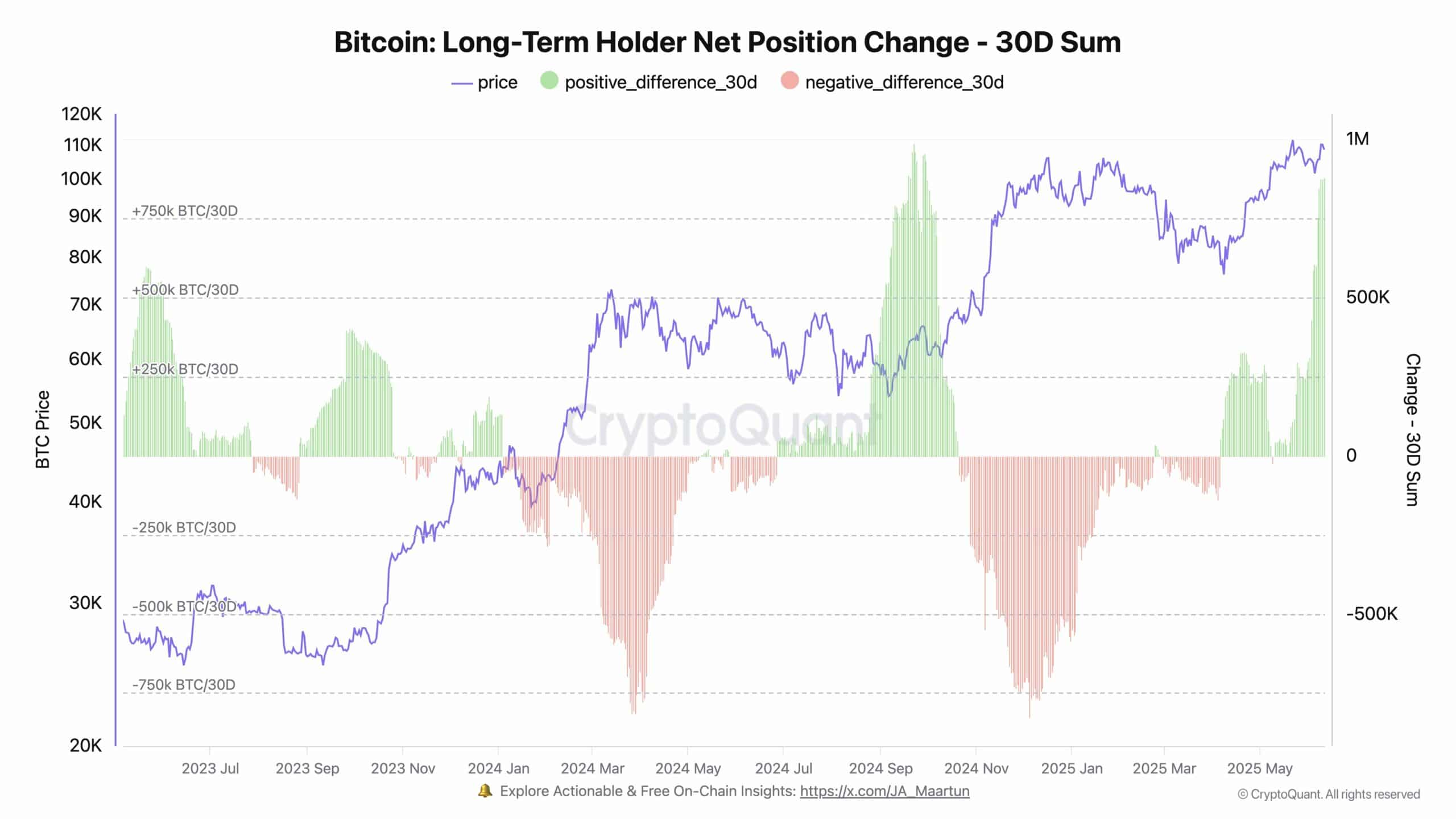

In contrast, long-term holders have added a staggering 881,578 BTC in the past 30 days. It’s like they’re saying, “We believe in you, Bitcoin!” even as the whales swim away. 🐋

Can Bulls Conquer the $112K Supply Wall?

Bitcoin’s price has tried and failed multiple times to breach the $112K resistance. It’s like that one friend who keeps trying to get into the VIP section but just can’t! 🚫

The market structure still leans bullish thanks to rising trendline support. But the Relative Strength Index (RSI) dipped below 50, which is like a warning sign saying, “Caution: Low momentum ahead!” ⚠️

Unless buyers reclaim the $106K zone soon, we might see another pullback toward $101K. It’s like a game of musical chairs, and the music is about to stop! 🎶

Nevertheless, bulls could trap late shorters if they manage to push prices above this congestion zone. Market indecision around this level is likely to define BTC’s next move. It’s all very dramatic! 🎭

Is BTC’s Valuation Outpacing Its Utility?

The Network Value to Transaction (NVT) ratio surged 15.21% to 36.49, reflecting a growing divergence between market cap and on-chain transfer volume. It’s like Bitcoin is getting all dressed up with nowhere to go! 💃

Such spikes have historically indicated speculative overvaluation. So, this metric now suggests that Bitcoin’s price may be rising faster than actual demand for transactional use. It’s a classic case of “all hat and no cattle.” 🤠

If this trend persists, it could precede a local top. But high NVTs can also occur during early stages of long-term uptrends, especially when holders prefer accumulation to spending. It’s a fine line to walk! ⚖️

What’s Keeping BTC Active?

Over the past week, active addresses rose by 1.69%, while new addresses fell by 2.36%. This suggests current users are like loyal fans at a concert, even as new fans trickle in. 🎤

The market is likely running on internal momentum rather than attracting fresh capital. It’s like a party where everyone knows each other, but no new guests are showing up! 🎉

While this dynamic can support short-term rallies, long-term sustainability usually requires expanding the user base. But hey, at least the committed holders are still participating, stabilizing the network during uncertain conditions. Go team! 🏆

Liquidation Clusters Aim at Volatility

The 24-hour Binance liquidation heatmap highlights dense long liquidations around $105K and $102K. Price movements into these zones may trigger cascading stop-losses. It’s like a game of Jenga—one wrong move and it all comes crashing down! 🏗️

This setup increases volatility risk if bears push below these thresholds. But if BTC holds above $104K, it may trap short positions and initiate a relief bounce. It’s a classic case of “the bigger they are, the harder they fall!” 🐻

These clustered zones often act as inflection points, amplifying whichever side gains momentum. So, traders should monitor these levels for sharp moves in either direction. It’s a wild ride! 🎢

Will Long-Term Holders Fuel the Next Breakout?

Despite price rejection near $112K and short-term whale selling, long-term accumulation and record inflows into HODL wallets reflect strong conviction. It’s like the loyal fans who keep cheering even when the team is losing! 📣

Network fundamentals appear mixed, with weakening user growth but steady activity from current participants. Elevated valuation metrics suggest caution, but buyer behavior implies confidence in long-term upside. It’s a rollercoaster of emotions! 🎢

Therefore, if Bitcoin can reclaim $106K and defend key support, the next leg toward new highs could be underway. Fingers crossed! 🤞

Read More

2025-06-14 01:20